Emergency Fund: What It Is, Why You Need It, and How to Build One

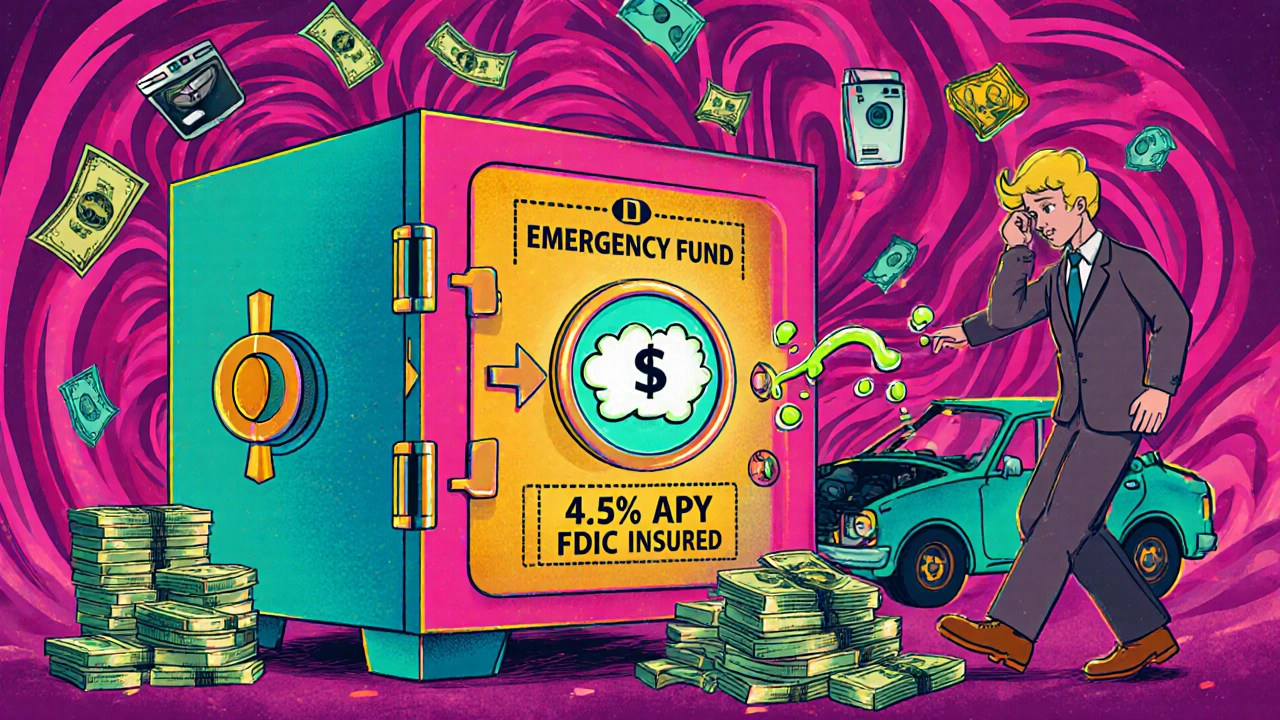

When life throws you a curveball—a car repair, a medical bill, or a sudden job loss—an emergency fund, a dedicated stash of cash for unexpected expenses. Also known as a financial safety net, it’s not a luxury—it’s the first step in taking control of your money. Without one, even small surprises can force you into debt, drain your credit cards, or make you skip rent. The emergency fund isn’t about getting rich. It’s about not going broke when things go wrong.

Most experts say you should aim for three to six months of living expenses. But if you’re just starting, even $500 makes a difference. That’s enough to cover a broken laptop, a missed paycheck, or an urgent vet visit. Where you keep it matters too. A regular checking account? Too easy to spend. A high-yield savings account? That’s better. High-yield savings account, an online savings account that pays significantly more interest than traditional banks. Also known as a HYSA, it lets your money grow while staying safe and accessible. Apps like Ally, Marcus, or Chime offer these accounts with no fees and instant access. You want your money earning interest, not sitting idle.

Building this fund doesn’t require a big salary. It’s about consistency. Set up automatic transfers—$25 a week, $100 a month—right after payday. Treat it like a bill you can’t skip. If you get a bonus, tax refund, or side gig payment, put half of it straight in. You don’t need to wait until you’re "ready." Start small, stay steady. And if you ever have to use it? That’s okay. Just refill it as soon as you can. This isn’t a one-time task. It’s a habit.

People often confuse this with retirement savings or a vacation fund. They’re not the same. Your emergency fund is for true surprises—not planned spending. If you’re using it for a new phone or a weekend trip, you’re missing the point. It’s your last line of defense. Once you have it, you’ll sleep better. You’ll stop stressing over every unexpected cost. And you’ll be in a much stronger position to invest, pay down debt, or even take a risk on a better job.

The posts below show you exactly how others have built theirs—using simple tools, smart apps, and real-world strategies. You’ll see how people with modest incomes created their safety nets, how they picked the right accounts, and what mistakes to avoid. Some used automated savings tools. Others started with cash envelopes. A few even turned side gigs into fund boosters. There’s no single right way. But there are plenty of wrong ones. Let’s get you on the right path.