Emergency Fund Calculator

Your Essential Expenses

Enter your monthly essential expenses based on the categories from the article

Life Circumstances

Select all that apply to your situation

Results

Enter your essential expenses and select your circumstances to see your personalized target

Why Your Emergency Fund Isn’t One-Size-Fits-All

The standard advice says to save 3 to 6 months of expenses. But if you’re a single parent working two jobs, or a freelancer with fluctuating income, that number might leave you exposed. Or worse - it might feel impossible to reach. The truth is, your emergency fund should match your life, not a textbook rule.

According to the Consumer Financial Protection Bureau, an emergency fund is cash you can access quickly for unexpected costs - like a broken water heater, a sudden medical bill, or losing your job. It’s not for vacations, new phones, or holiday gifts. It’s your financial buffer against chaos. And if you’re not tailoring it to your situation, you’re leaving yourself vulnerable.

What Counts as an Essential Expense?

Before you pick a number, you need to know what you’re actually saving for. Not your Netflix subscription. Not your coffee runs. Not the gym membership you never use. Only what you need to survive.

The U.S. Census Bureau and Bureau of Labor Statistics break essential expenses into six categories:

- Housing: Rent or mortgage, property taxes, utilities. Average: $2,062/month

- Food: Basic groceries only. Average: $462/month for one person

- Transportation: Car payments, gas, insurance, maintenance. Average: $700/month

- Healthcare: Insurance premiums and out-of-pocket costs. Average: $575/month

- Childcare: Daycare, babysitters, after-school programs. Average: $972/month

- Debt payments: Minimums on credit cards, student loans, child support.

Here’s the key: your essential expenses might be totally different from someone else’s. Someone in San Francisco paying $3,500 in rent needs a much bigger fund than someone in rural Alabama paying $1,200. Both are correct - as long as they’re using their real numbers.

Life Circumstances That Change Your Target

Here’s where the 3-6 month rule falls apart - and what you should do instead.

Single Income vs. Dual Income

If you’re the only person bringing money into the household, you have no backup. One missed paycheck means real trouble. NerdWallet recommends 6 to 8 months of expenses for single-income families. Dual-income households with stable jobs can stick closer to 3-6 months - but only if both incomes are reliable.

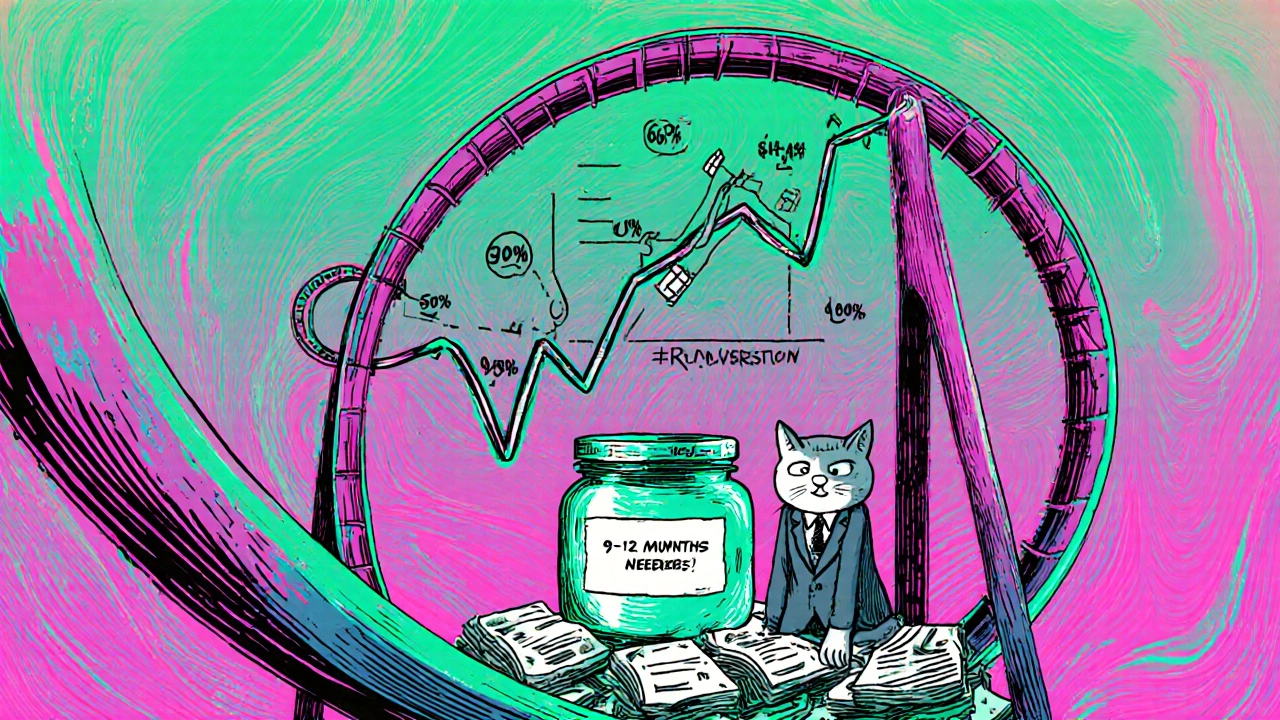

Self-Employed or Gig Workers

Income isn’t predictable. One slow month can wipe out your savings. JPMorgan Chase Institute data shows gig workers see 50% month-to-month income swings. That’s why certified financial planner Robert Pagliarini says 9 to 12 months is the new baseline. If your income varies by more than 20% from month to month, aim higher.

Chronic Health Conditions

If you or a family member has a long-term medical issue, unexpected costs are common. Kaiser Family Foundation data shows 23% of Americans with chronic conditions face medical bills over $1,000 a year - and those aren’t always covered by insurance. Add 6 to 9 months of expenses to your target. Don’t wait until you’re in crisis to realize you’re underprepared.

Parents of Young Children

Childcare emergencies happen. A sick kid, a daycare closure, a last-minute babysitter - they add up. Child Care Aware of America reports parents spend $2,500 a year on unplanned childcare costs. If you rely on daycare, add 1 to 2 extra months of childcare expenses to your fund. That’s not optional - it’s necessary.

Homeowners vs. Renters

Homeowners face bigger, more expensive surprises. The Joint Center for Housing Studies found 48% of homeowners dealt with unexpected repairs in 2023 - averaging $1,200 each. Renters? Only 29% faced repairs, and those averaged $450. If you own your home, bump your emergency fund up by at least 1-2 months to cover roof leaks, broken HVAC systems, or appliance failures.

Job Security Matters

Are you in a high-turnover industry? Retail, hospitality, or construction? The Bureau of Labor Statistics shows unemployment rates above 5% in those fields. Fidelity recommends 7.2 months of expenses if your job is unstable. Even if you feel secure, ask yourself: Could you find another job in 6 months? If the answer isn’t a confident yes, save more.

How to Start - Even If You’re Broke

You don’t need $10,000 to start. You just need to start.

Fidelity and Duke University both recommend a $500 to $1,000 starter goal. That’s not enough to cover a full emergency - but it’s enough to keep you from going into debt for a $400 car repair.

Here’s how to get there:

- Track your spending for 30 days. Write down every dollar you spend. You’ll find leaks - maybe $20 on takeout three times a week, or $15 on a subscription you forgot about.

- Automate $25 to $50 per paycheck. Set up a transfer to a separate savings account the day after you get paid. Out of sight, out of mind.

- Use windfalls wisely. Tax refunds, bonuses, birthday money - put at least half of it into your emergency fund.

- Try side gigs. Freelance work on Upwork pays an average of $22/hour. Even 5 hours a week adds $440 a month. That’s your next $1,000 in less than 3 months.

One Reddit user saved $15,000 on a $45,000 salary by automating $150 every two weeks and adding $200/month from a side job. It took 2.3 years - but they got there. You can too.

Where to Keep Your Emergency Fund

Don’t leave it in a checking account. Don’t lock it in a CD. Don’t gamble it in stocks.

Put it in a high-yield savings account that’s FDIC-insured. As of October 2024, the average APY is 4.25%. That means $5,000 earns you $212 a year - free money. Compare that to a traditional savings account at 0.47% APY, which earns just $23.50 on the same amount.

Make sure the account is separate from your checking. That way, you can’t accidentally spend it. Use a bank like Ally, Marcus, or Capital One - they offer easy transfers and no fees.

If you have more than $250,000 saved, split it across two banks. FDIC insurance only covers $250,000 per depositor per institution.

What to Do When You Use It

Life happens. You’ll need to use your fund. Maybe your car breaks down. Maybe you lose your job. That’s okay.

But here’s the catch: you have to rebuild it. Federal Reserve data shows 62% of people who dip into their emergency fund take over 6 months to refill it. The median time? 8.2 months.

Don’t wait until you’re back on your feet to start saving again. As soon as you have even $50 extra, put it back in. Treat rebuilding your fund like paying off a debt - it’s urgent. Set a new goal: “I will restore my fund to 3 months of expenses by [date].”

Update Your Fund Every Year

Your expenses change. Your income changes. Your life changes.

The Bureau of Labor Statistics reports essential expenses rose 6.8% year-over-year in 2024. If you saved for $3,000/month in 2023, that’s now $3,204. Your fund is already behind.

Set a calendar reminder: Every January, recalculate your essential expenses. Add new costs (like a new car payment or increased rent). Remove old ones (like a paid-off loan). Adjust your target accordingly.

Some startups like EmergencyFund.AI now use AI to track your spending and predict future needs. You don’t need fancy tech - just a spreadsheet and 15 minutes once a year.

Final Reality Check

78 million Americans have less than $100 in emergency savings. That’s not because they’re bad with money. It’s because they were told to save 3-6 months of expenses - without being told how to adjust that number for their life.

You don’t need to be rich to have an emergency fund. You just need to be realistic.

If you’re single, self-employed, or a parent - save more. If you’re in a stable job with a partner - you can aim lower. If your rent is high or your car is old - add extra. Your emergency fund isn’t a number on a chart. It’s your peace of mind. And it’s yours to shape.

Dave McPherson

October 31, 2025 AT 13:14Oh sweet mercy, another ‘3–6 months’ cultist peddling financial dogma like it’s scripture. Let me guess-you also think everyone should buy index funds and meditate to reduce stress? Newsflash: if you’re making $18/hour and your kid’s daycare costs more than your rent, ‘6 months’ is a fantasy written by trust fund babies who’ve never seen a pay stub with overtime. I’ve been saving $20 a week for two years and still only have $1,200. Meanwhile, my landlord raised rent 18% and my car’s transmission is singing its swan song. The real emergency isn’t the fund-it’s the system that tells you to save more while wages stagnate and inflation laughs in your face.

RAHUL KUSHWAHA

October 31, 2025 AT 22:32Thank you for this. 🙏 I am from India, working freelance in IT, and my income swings between $800–$2,200/month. I used to feel ashamed for not having 6 months saved. Now I know 9 months is my baseline. I started with $500 last year, and now I have $3,100. Slow, but steady. I keep it in a high-yield account-Ally, like you said. Small wins matter. 💪

Julia Czinna

November 2, 2025 AT 01:06One thing this article doesn’t emphasize enough is the psychological weight of having even a small buffer. I used to panic every time my fridge broke or my dog needed an emergency vet visit. Then I saved $800-just $800-and suddenly, I could breathe. It wasn’t about covering a job loss or a roof leak. It was about knowing I wouldn’t have to beg for help or max out a credit card. That peace of mind? Priceless. And yes, I recalculate my target every January. Life isn’t static. Neither should your safety net.

Laura W

November 2, 2025 AT 23:08Okay but let’s be real-$1,000 starter fund? That’s cute. If you’re a single mom in Ohio with a 2-year-old and a 2008 Corolla that’s held together by duct tape and hope, $1,000 gets you a new tire and a hospital copay. You need 8 months. Period. I went from $0 to $12k in 18 months by cutting Netflix (RIP), selling my unused designer stuff on Poshmark, and doing $15/hr virtual assistant gigs on nights I wasn’t nursing a sick kid. And yeah, I keep it in Marcus. No fees, no drama. If you’re not automating, you’re not serious. Also-stop comparing your Chapter 1 to someone else’s Chapter 10. Your emergency fund is YOURS. Build it like your life depends on it… because it does.