Winning Stock Calculator

See Your Hidden Losses

How much are you leaving on the table by selling winners too early? Calculate the difference between your current exit strategy and letting winners run.

Your Results

| Your current exit: | $0.00 |

| Held until peak: | $0.00 |

| Missed opportunity: | $0.00 |

The disposition effect costs you more than bad stock picks.

Example: Selling at 5% means you turn a 20% gain into a 5% gain. That's 75% less profit from your winning trades.

Most investors think they’re good at picking stocks. But here’s the uncomfortable truth: selling winners too early is probably killing your returns more than any bad pick ever could. You buy a stock. It goes up 5%. You sell. Two weeks later, it doubles. You kick yourself. Sound familiar? You’re not alone. This isn’t bad luck. It’s a deeply wired psychological trap called the disposition effect.

Back in 2009, researchers from Yale School of Management studied millions of real investor trades. What they found was shocking: about 80% of retail investors consistently sell their winning stocks too soon - often at just 5% to 10% gains - while holding onto losing stocks for months, sometimes years, hoping they’ll bounce back. Meanwhile, professional traders do the exact opposite. They let winners run and cut losses fast. And it’s not because they’re smarter. It’s because they’ve built systems to fight their own brains.

Why Your Brain Sabotages Your Profits

Your brain doesn’t care about portfolio returns. It cares about feeling right. When a stock you bought goes up, your brain lights up with a hit of dopamine. Selling at a profit feels like winning. It’s instant validation: I made a good call. But when a stock drops? That’s different. Holding onto it means you haven’t admitted you were wrong. Selling it feels like failure - like confessing you made a mistake. So you hold on, hoping the price will recover just enough to let you break even. That’s not investing. That’s ego management.

Psychologists call this loss aversion. The pain of losing $100 feels twice as strong as the joy of gaining $100. So you’ll do almost anything to avoid locking in a loss. But here’s the math you’re ignoring: by selling winners too early, you’re trading big potential gains for tiny, guaranteed ones. You’re turning a 50% winner into a 7% win. And you’re letting a 30% loser become a 50% loser. Over time, that kills compounding.

How Professionals Handle Winners Differently

Professional traders don’t rely on gut feelings. They rely on rules. Here’s what they do:

- They set exit targets before they buy. Before putting money into a stock, they ask: “What’s my target? What’s my stop?” If they can’t answer that, they don’t trade. This removes emotion from the decision.

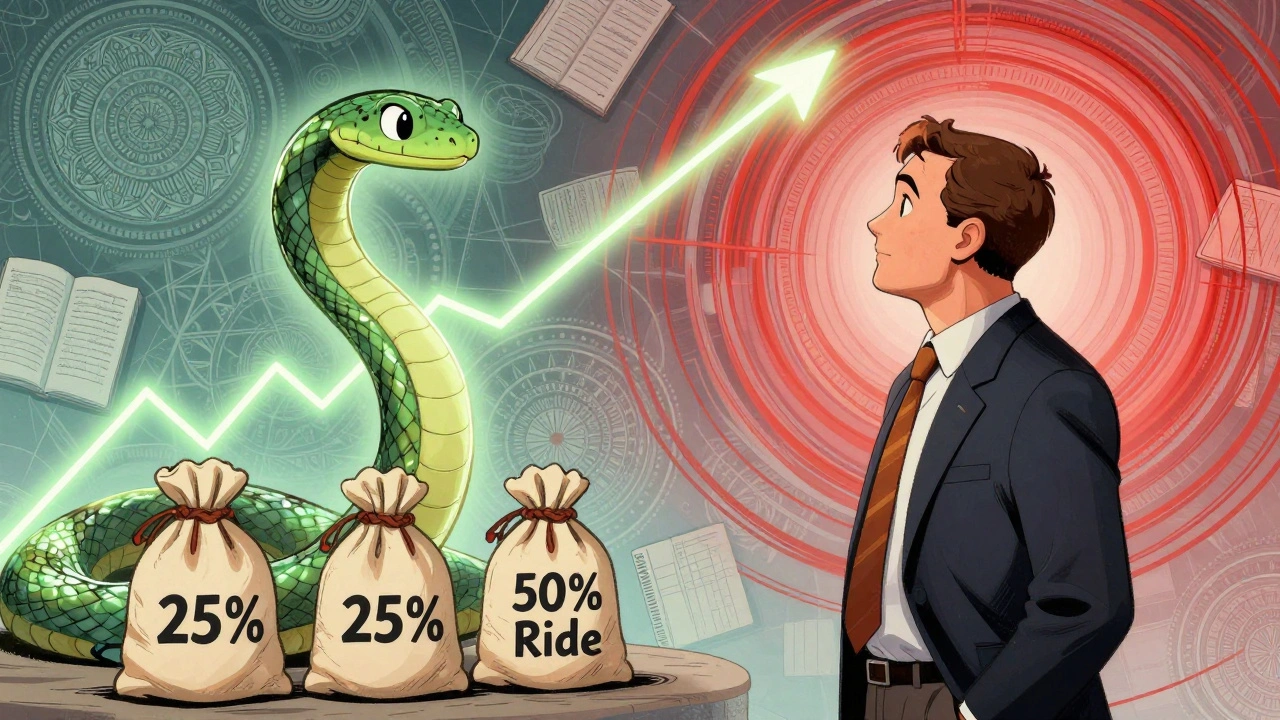

- They take partial profits. Instead of selling everything at 10%, they sell 25% at 10%, 25% at 20%, and let the rest ride with a trailing stop. That way, they lock in gains but still participate in big moves.

- They use trailing stops. A 20% trailing stop means if a stock rises from $50 to $70, their stop moves up from $40 to $56. If it drops back to $56, they’re out - but they kept $6 of the $20 gain. No panic. No second-guessing.

- They track their trades. Every time they sell a winner early, they write it down: “Why did I sell? Was it fear? A news headline? A random spike?” After 30 days, patterns emerge. And patterns can be fixed.

One trader on Reddit had a $25,000 account. He had a 62% win rate - meaning he won more trades than he lost. But he was still down $8,450 over six months. Why? He sold winners at 5-7% and held losers down 30-40%. His average win was $120. His average loss was $480. Even with more wins, he lost money because his losers were 4 times bigger than his winners.

Four Proven Ways to Stop Selling Winners Too Early

Here’s how to fix this - without needing a finance degree or a trading desk.

1. Define Your Sell Rules Before You Buy

Don’t wait until the stock moves. Before you even click “buy,” write down:

- Target price (what you expect to make)

- Maximum loss you’ll accept

- Trailing stop percentage (20% is a good start for most stocks)

Example: You buy XYZ at $40. Your target is $60. Your stop is $36. Your trailing stop is 20%. Now, when XYZ hits $50, your trailing stop moves to $40. If it drops to $40, you’re out - but you still made $10. No emotion. Just execution.

2. Scale Out, Don’t Sell All at Once

Instead of selling 100% of your position at your target, sell in chunks:

- Sell 25% at 10% gain

- Sell 25% at 20% gain

- Let the remaining 50% ride with a trailing stop

This way, you lock in profit and still have skin in the game. You won’t be screaming when the stock keeps going up - because you didn’t sell everything. And if it reverses, you already captured gains.

3. Reduce Position Size When You Feel Anxious

Here’s a simple trick: if you feel nervous holding a winner, reduce your position by 30-50%. Smaller positions = less emotional pressure. You’re less likely to panic-sell at 5% if you only risked $500 instead of $2,000. Traders who do this report holding winners 2.3 times longer.

4. Journal Every Premature Exit

For 30 days, write down every time you sell a winner too early. Ask yourself:

- What was the stock’s gain when I sold?

- What was I thinking right before I sold?

- Did I feel fear? Guilt? Excitement?

- Did a news headline or a friend’s comment influence me?

After a month, you’ll see the same triggers over and over. Maybe it’s always when the stock hits $100. Or when it goes up 15% in one day. Once you spot the pattern, you can build a rule to stop it.

The Real Enemy Isn’t the Market - It’s Your Mind

Most people blame the market for their losses. But the real problem is internal. The market doesn’t care if you’re right or wrong. It doesn’t reward you for being “right” on a trade. It rewards you for keeping your gains and letting them grow.

Consider this: in 2023, retail investors captured only 42% of the potential gains from their winning trades. Professionals captured 78%. The difference? Not skill. Not information. It’s discipline. The ability to sit through the fear, the doubt, the FOMO - and stick to the plan.

Even if you’re right 70% of the time, if you’re cutting winners at 5% and letting losers run to 30%, you’re still losing money. The math doesn’t lie.

What Happens When You Stop Selling Winners Too Early

One trader on TradingView started using a 20% trailing stop after years of premature exits. His average winner jumped from 6.2% to 14.7%. His win rate didn’t change. His losses didn’t get worse. He just stopped cutting his winners short. His annual return went from 8% to 21%.

Another investor, after journaling his trades for 90 days, realized he sold 87% of his winners before they reached 10%. He started using partial profit-taking and trailing stops. In the next year, his portfolio grew by 34% - not because he picked better stocks, but because he stopped sabotaging his best ones.

It’s not about predicting the next big move. It’s about not ruining the ones you already have.

Final Thought: Let Winners Run - But With Rules

You don’t need to be a genius to beat the market. You just need to stop letting your emotions run the show. The disposition effect is powerful. It’s been proven in labs, in brokerage data, and in thousands of real trader journals. But it’s also beatable.

Set your rules. Stick to them. Track your mistakes. Scale out. Use trailing stops. Reduce position size when you feel shaky. Over time, your brain will adapt. The fear won’t disappear - but you’ll learn to act anyway.

The market will keep giving you winners. Don’t let your own mind take them away.

Why do I keep selling my winning stocks too soon?

You’re likely falling for the disposition effect - a psychological bias where selling a winning stock feels like a win, while holding a losing stock feels like avoiding failure. Your brain craves quick validation, so it locks in small gains to feel successful. But this behavior ignores long-term compounding. Professionals avoid this by setting predefined exit rules before buying, not reacting after the price moves.

Is it ever smart to sell a winner early?

Yes - but only if it’s part of a plan, not a reaction. If you set a target price before buying and the stock hits it, selling is smart. Taking partial profits (e.g., selling 25% at 10%, 25% at 20%) is also a disciplined strategy. The problem isn’t selling winners - it’s selling them too early because you’re scared, impatient, or emotionally triggered.

What’s a trailing stop and how does it help?

A trailing stop is an automatic sell order that follows the stock price upward but stays fixed if the price drops. For example, a 20% trailing stop on a stock rising from $50 to $70 moves your sell trigger from $40 to $56. If the stock then falls to $56, you sell - locking in a $16 profit. It lets winners run while protecting gains without needing to watch the market constantly.

How long does it take to overcome the disposition effect?

It takes consistent practice. Most traders who track their trades and follow rules for 18-24 months see major behavioral shifts. You’ll notice progress after 30-90 days of journaling and using trailing stops. The key isn’t perfection - it’s awareness. Every time you catch yourself selling early out of fear, you’re rewiring your brain.

Do professional investors ever sell winners too early?

Rarely - and when they do, it’s intentional. Professionals have predefined exit criteria based on fundamentals, technicals, or portfolio rebalancing. They don’t sell because a stock went up 10%. They sell because the business outlook changed, the valuation became excessive, or a better opportunity emerged. Their decisions are system-driven, not emotion-driven.

Astha Mishra

December 5, 2025 AT 23:09The disposition effect isn’t just a trading flaw-it’s a mirror of how we relate to failure in all areas of life. We treat investments like moral exams: if the stock rises, we’re virtuous; if it falls, we’re guilty. But markets don’t operate on ethics. They operate on probability and time. The real discipline isn’t in picking winners-it’s in resisting the urge to baptize every small gain as divine intervention. I’ve watched friends sell Tesla at $300, then watch it hit $1,000, and they’ll say, ‘Well, I got mine!’ as if that somehow absolves them of the opportunity cost. It doesn’t. Compounding doesn’t care about your ego. It only rewards patience. And patience, unlike luck, is a muscle you build by showing up even when your heart is screaming to bail.

Graeme C

December 7, 2025 AT 05:28This is the most accurate breakdown of retail investor self-sabotage I’ve ever read. The 80% statistic? Not surprising. I’ve seen it firsthand in my own portfolio before I got serious. Selling winners at 5% is the financial equivalent of cutting your own throat with a butter knife. The trailing stop strategy alone is worth its weight in gold. I use 25% at 10%, 25% at 20%, and the rest with a 20% trailing stop-no exceptions. No emotion. No ‘what ifs.’ I’ve increased my annual returns by 17% in 18 months just by sticking to this. If you’re still selling early, you’re not investing-you’re gambling with a handicap.

Laura W

December 7, 2025 AT 18:59Y’all need to stop treating the market like a dating app. You swipe right on a stock, it matches you with a 5% pop, and you’re like ‘OMG HE’S INTO ME’ and you ghost it. Meanwhile, the real alpha is out there waiting for you to chill the F out and let it run. Trailing stops = your emotional safety net. Partial profit-taking = your ‘I’m still in this’ vibe. Journaling your dumb sells? That’s your accountability partner. I went from ‘I sold too early AGAIN’ to ‘I let it ride and made 3x’ in 3 months. It’s not magic. It’s mechanics. Stop chasing dopamine. Start chasing compounding. You got this 💪📈

Kenny McMiller

December 7, 2025 AT 20:19One sentence: you’re not a bad investor-you’re just a human with a brain wired for survival, not wealth. The disposition effect is evolution’s glitch. Your ancestors didn’t survive by holding onto risky bets-they survived by grabbing the berry and running. So your brain screams ‘TAKE THE WIN!’ when a stock goes up. But markets aren’t forests. They’re fractals. The real edge isn’t in being right-it’s in not being wrong for too long. Use the rules. Automate the exits. Let the math win. Your future self will thank you.