WeChat Pay International Fee Calculator

How It Works

Based on 2025 WeChat Pay Global 2.0 pricing: 3.0% transaction fee for foreign cards (Visa/Mastercard) with no Chinese phone number required. Includes currency conversion at market rate.

Results

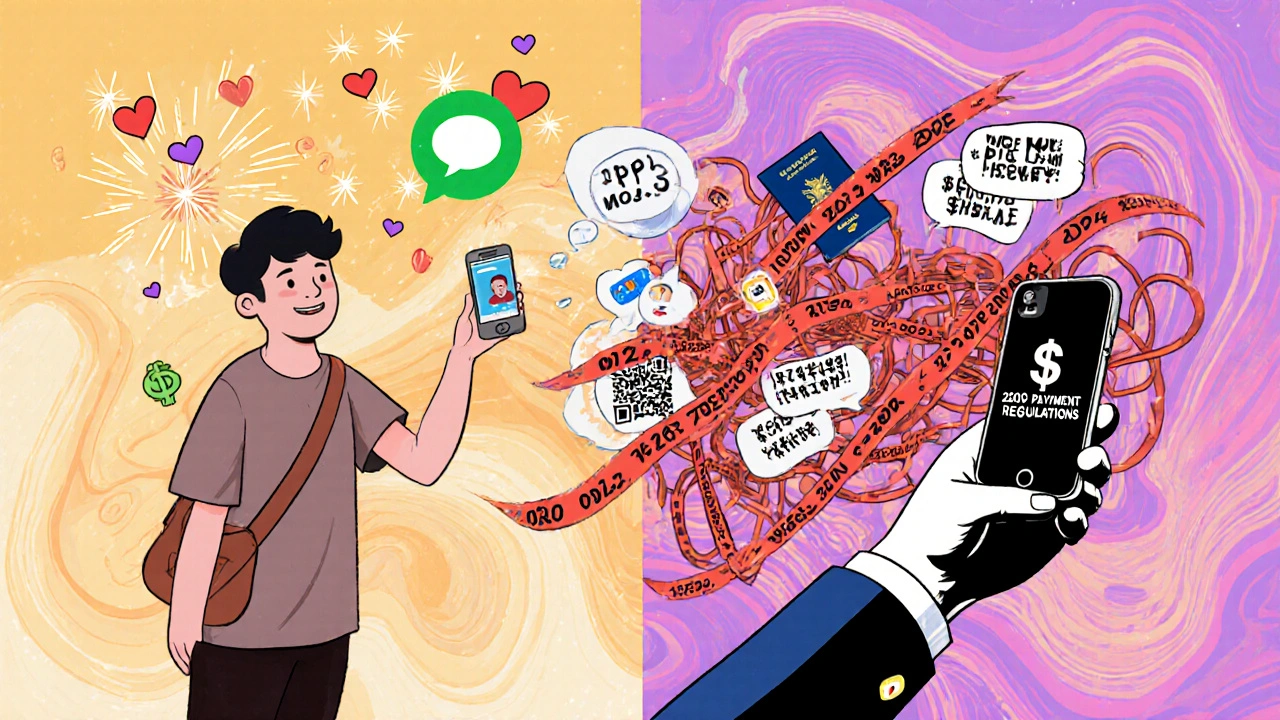

When you think of mobile payments, you probably imagine tapping your phone at a checkout or scanning a QR code. But in China, payments don’t just happen at registers-they happen in group chats, during Lunar New Year, and while ordering street food from a vendor who doesn’t even have a cash register. That’s the power of WeChat Pay.

It’s Not Just a Wallet. It’s a Social Platform With Money Built In

WeChat Pay isn’t a standalone app. It’s a feature inside WeChat, the messaging app used by over 1.26 billion people monthly. And that’s the secret sauce. Unlike Alipay, which started as an e-commerce payment tool, WeChat Pay grew out of everyday social habits. Sending money to a friend? Just tap a button in a chat. Splitting dinner? Send a digital red envelope. Paying for a bus ride? Scan a QR code without opening another app. Everything happens in one place. This integration turned financial transactions into social rituals. During the 2024 Lunar New Year, users sent 8.23 billion digital red envelopes through WeChat Pay. That’s not just payments-it’s tradition, digitized. And it worked. By 2023, WeChat Pay had 1.133 billion active users, making it the largest digital wallet in the world by user count, even ahead of Alipay.How It Actually Works Behind the Scenes

The magic isn’t just in the design-it’s in the tech. When you scan a QR code at a street stall, the system doesn’t just transfer money. It encrypts your transaction with AES-256 and TLS 1.3, then checks your balance, verifies your identity, and approves the payment-all in under 300 milliseconds. You don’t see it, but your phone is doing fingerprint or facial recognition (with 99.2% accuracy) to make sure it’s really you. WeChat Pay uses tokenization: your real card number is replaced with a unique code so even if hackers intercept the data, they can’t steal your info. It’s PCI DSS Level 1 certified-the highest security standard for payment systems. And unlike older systems, the QR codes refresh every 30 seconds to stop replay attacks. Even offline payments are secure. During peak times like Singles’ Day, the system handles up to 120,000 transactions per second with 99.99% uptime. That’s not just fast-it’s industrial-grade reliability.WeChat Pay vs. Alipay: Who Wins?

Alipay still processes more total transactions-421 billion in 2023 versus WeChat Pay’s 387 billion. But WeChat Pay wins in user growth and social reach. Why? Because it’s tied to the app people use every day to talk to friends, watch videos, and order food. Here’s the real difference:- WeChat Pay: Best for social payments, small businesses, and mini-programs. 87% of street vendors in China accept it. It’s the go-to for casual, everyday spending.

- Alipay: Better for financial services. It offers 177 investment products, insurance, and credit scoring. It’s the bank you use when you want to save or invest.

Foreigners Struggle-Here’s Why

If you’ve tried using WeChat Pay as a tourist, you know it’s not easy. Over 68% of negative reviews from international users mention one thing: linking a foreign card is a nightmare. Here’s what you need:- A Chinese phone number (required for SMS verification)

- A passport scan

- Proof of address

- And even then, the app often fails to verify you

The Hidden Risk: Your Social Life Is Your Financial History

WeChat Pay’s biggest strength is also its biggest weakness. Every payment you make, every red envelope you send, every mini-program you use-it’s all tracked. Your spending habits, your friends, your family, your travel patterns-all tied together in one data profile. Cybersecurity expert Dr. Mei Chen from Tsinghua University says WeChat Pay collects 27 more data points than GDPR allows. That’s not just inconvenient-it’s a privacy risk. In China, financial data and social data aren’t separated. That’s why regulators are pushing for change. China’s 2024 Payment Business Regulations now require platforms to split payment systems from their social apps. If enforced, WeChat Pay could lose its biggest advantage: the seamless blend of chat and cash.

What’s Next? A Big Bet on Going Global

Domestic growth is slowing. WeChat Pay’s user base is growing just 1.2% per quarter-down from nearly 5% in 2020. So Tencent is betting big on overseas markets. In 2025, they launched WeChat Pay Global 2.0: lower fees (now 3.0% for foreign cards), support for 18 more currencies, and integration with Hong Kong’s Faster Payment System. They’re also partnering with Thailand’s PromptPay to let users transfer money directly between Thai bank accounts and WeChat Pay wallets. The biggest move? A $2.1 billion investment to build a standalone payment app-separate from WeChat. This is a direct response to criticism that people who don’t use WeChat for social reasons see no value in the payment tool. If you’re not chatting or watching videos on WeChat, why would you use its wallet? By 2026, they plan to roll out biometric payments via smartwatches and blockchain-based cross-border settlements to cut international transaction times by half.Is WeChat Pay the Future?

It already is-for over a billion people in China. But its future outside China is uncertain. It’s not just about technology. It’s about culture. WeChat Pay works because it fits into how Chinese people live: connected, social, and always online. In the U.S. or Europe, people want privacy, simplicity, and independence. Apple Pay, Google Pay, and even Venmo offer those things without tying your spending to your social feed. WeChat Pay’s model might not translate. Still, in Southeast Asia-where mobile penetration is high and social apps dominate-it’s gaining 5.3 million new users every month. If Tencent can make the standalone app work, and if regulators don’t break up its social-financial link, WeChat Pay could become the first truly global social payment system. For now, it remains a marvel: a payment system that didn’t try to replace cash. It just made money feel like a conversation.Can I use WeChat Pay outside China?

Yes, but only in select countries like Thailand, Hong Kong, Japan, and parts of Southeast Asia where merchants have integrated it. You can also use it to pay at some international airports and tourist spots. To make payments, you need to link a foreign credit card (Visa, Mastercard, or UnionPay International), but you’ll pay a 3.0% transaction fee. Full functionality still requires a Chinese phone number for verification.

Why do I need a Chinese phone number to use WeChat Pay?

WeChat Pay requires a Chinese phone number for SMS-based identity verification and security. This is part of China’s financial regulations, which demand strict KYC (Know Your Customer) rules. Without a local number, you can’t complete full verification, and features like transferring money to friends or paying bills won’t work. Some foreigners use virtual Chinese numbers, but these often fail during verification and aren’t officially supported.

Is WeChat Pay safer than Apple Pay or Google Pay?

Technically, yes-it uses the same encryption standards (AES-256, TLS 1.3) and tokenization as Apple Pay. It also adds biometric checks like facial recognition with 99.2% accuracy. But security isn’t just about tech. WeChat Pay ties your payment data directly to your social profile, which means your spending habits are tracked and stored by Tencent. Apple and Google keep payment data separate from personal data, making them more private by design.

How do I stop WeChat Pay from charging me automatically?

Go to Me > Pay > Settings > Auto-Debit. Turn off all subscriptions listed there. Many foreign users get charged for services like video streaming, cloud storage, or membership clubs they didn’t realize they signed up for. These subscriptions often appear after you use a mini-program or pay for a service once. Disable auto-debit immediately after setting up your account.

Can I use WeChat Pay without a Chinese bank account?

Yes. Since late 2023, WeChat Pay allows you to link international credit cards (Visa, Mastercard, UnionPay International) directly. You don’t need a Chinese bank account. But you still need to verify your identity with a passport and a Chinese phone number. Funds from your foreign card are held in a WeChat wallet and converted to CNY at the time of payment. The 3.0% foreign transaction fee applies.

Astha Mishra

November 6, 2025 AT 19:41It's fascinating how WeChat Pay transformed financial interaction into something almost spiritual-a digital red envelope isn't just money, it's a gesture of care, a whisper of connection across generations. In India, we have UPI, which is fast and efficient, but it lacks this emotional texture. We send cash in envelopes during Diwali, folded by hand, sometimes with a note. WeChat didn't digitize payment; it digitized intimacy. And yet, I wonder: when every transaction is logged, when your social graph becomes your credit score, are we trading warmth for surveillance? The tech is brilliant, but the soul of the gesture… does it survive in algorithmic form?

Kenny McMiller

November 7, 2025 AT 19:53Let’s be real-WeChat Pay’s architecture is a masterclass in vertical integration. The tokenization stack, AES-256 + TLS 1.3, real-time biometric auth at the edge-it’s not just PCI DSS Level 1, it’s *industrial-grade* system design. Alipay’s got the transaction volume, sure, but WeChat’s UX is a frictionless behavioral nudge engine. QR codes refreshing every 30 seconds? That’s not UX, that’s crypto-grade anti-replay defense baked into a chat app. And the 120K TPS on Singles’ Day? That’s not scalability-it’s a distributed systems symphony. Meanwhile, Apple Pay still treats payments like an afterthought in a walled garden. WeChat didn’t build a wallet. It built a financial OS.

Dave McPherson

November 8, 2025 AT 22:27Oh wow, another tech bro fawning over WeChat Pay like it’s the second coming of Christ wrapped in a QR code. Let me grab my monocle and monocle cleaner. Sure, it’s ‘seamless’-until you realize you’ve been subscribed to a $19.99/month ‘VIP Reading Club’ you never clicked on because Tencent’s default settings are basically a digital pickpocket. And don’t get me started on the 37% failure rate for foreigners-this isn’t innovation, it’s exclusion disguised as convenience. You don’t need a Chinese phone number to be a human being, but apparently you do if you want to pay for dumplings in Bangkok. Meanwhile, Apple Pay just works. No surveillance. No auto-billing traps. No existential dread every time you open your wallet app. WeChat Pay isn’t the future-it’s a dystopian IKEA assembly manual for your financial life.

RAHUL KUSHWAHA

November 10, 2025 AT 20:04Thanks for this. I used WeChat Pay in Bangkok last year. Worked fine at street stalls. But I almost cried when I got charged $12 for a newsletter I didn’t know I signed up for. Turned off auto-debit right away. Still, I’m amazed how it feels like paying a friend. Not a bank. Not a merchant. Just… a person. 😊

Julia Czinna

November 10, 2025 AT 21:10What’s interesting is how WeChat Pay’s dominance in China reflects a cultural willingness to trade privacy for integration. In the U.S., we treat payments and social life as separate spheres-because we’re terrified of being tracked. But in China, the social fabric is so tightly woven that money becomes another thread. The real question isn’t whether it’s secure or efficient-it’s whether a society that accepts this trade-off can ever truly reverse it. Regulators are right to push for separation. Not because the tech is dangerous, but because the normalization of surveillance is irreversible once it’s embedded in daily ritual. I hope WeChat Pay Global 2.0 learns from this. Not just as a product, but as a cultural artifact.