Unbanked Populations: How Fintech Is Reaching Those Left Out of the Financial System

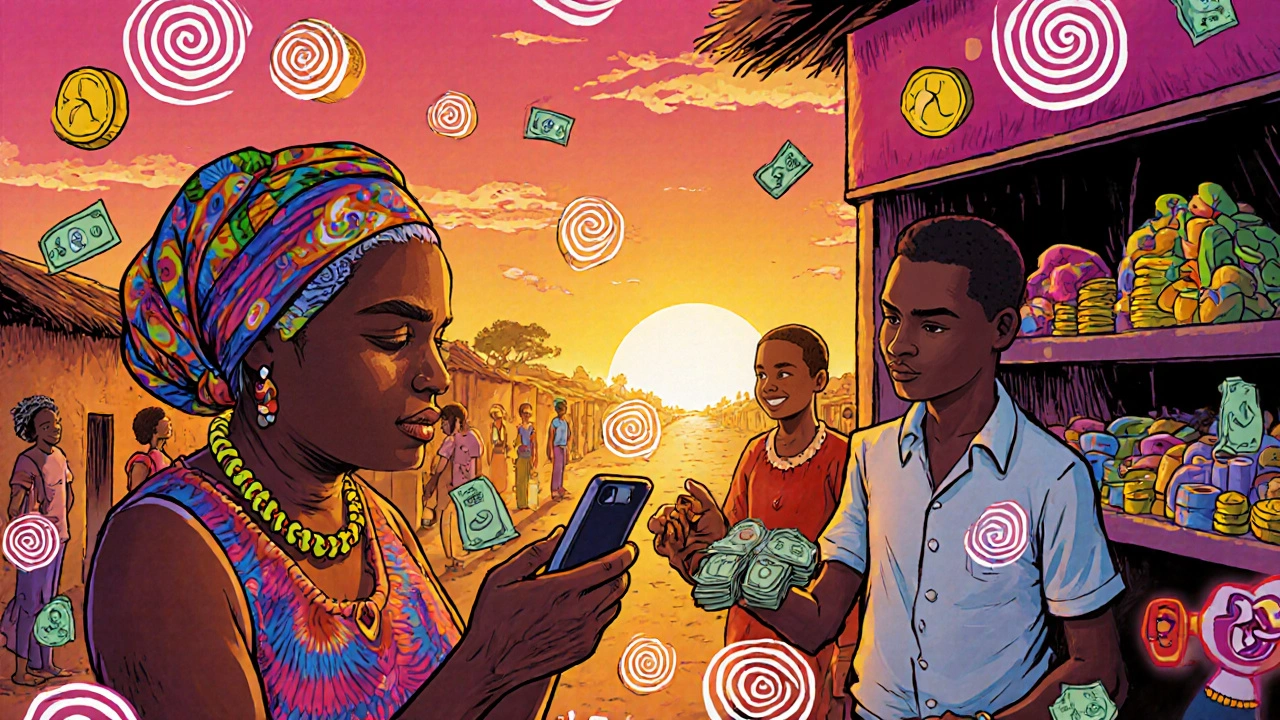

When we talk about unbanked populations, people who don’t have access to traditional banking services like checking or savings accounts. Also known as the financially excluded, it’s not just about lacking a bank branch nearby—it’s about being locked out of basic financial tools that most people take for granted. These aren’t just people in remote villages. Millions live in cities across the U.S. and globally, working hourly jobs, sending remittances, or paying rent in cash because no bank will take them on—or they can’t afford the fees.

That’s where fintech, technology-driven financial services that bypass traditional banks. Also known as digital finance, it’s the fastest way to bring financial access to people who’ve been ignored for decades. Think mobile apps that let you deposit paychecks without a bank account, or platforms that give you a debit card tied to your earned wages before payday. These tools don’t require credit scores, minimum balances, or in-person visits. They work with just a phone number and a government ID. And they’re not just helping the poor—they’re helping gig workers, immigrants, single parents, and anyone who’s been turned away by banks that see them as too risky or too expensive to serve.

It’s not magic. It’s built on real systems: earned wage access, programs that let workers get paid as they earn, instead of waiting two weeks. Also known as EWA, it’s a game-changer for people living paycheck to paycheck. Companies like those offering EWA funding models are partnering with employers to give employees their money faster—no fees, no debt. Meanwhile, high-yield savings accounts, app-based accounts that pay real interest with no hidden fees. Also known as mobile savings, they’re now accessible to anyone with a smartphone, even if they’ve never had a bank account before. These aren’t luxury tools. They’re survival tools. And they’re working. People who used to pay $30 to cash a check now save $150 a month by using a digital wallet. Families who once relied on payday loans are now building emergency funds with automated micro-deposits.

The shift isn’t just about technology—it’s about trust. Banks built systems to protect themselves, not to serve people. Fintech is flipping that. It’s not asking if you have a credit history. It’s asking if you have a job. If you have a phone. If you show up. And for the first time, that’s enough.

Below, you’ll find real examples of how these tools are changing lives—not through theory, but through actual platforms, models, and choices people are using right now. Whether it’s how a corporate card helps a small business owner avoid predatory lenders, or how cloud-powered lending cuts approval time from weeks to minutes, the thread is the same: financial access is no longer a privilege. It’s a product. And it’s finally reaching the people who need it most.