Mobile Banking Cost Calculator

How much could you save?

Compare the cost of basic transactions using mobile banking versus traditional banking in developing countries. Based on data from the World Bank and mobile money providers.

Your Monthly Savings

At 75% of adults in emerging markets using mobile banking, this savings could fund 12 months of groceries or 5 school supplies for a child.

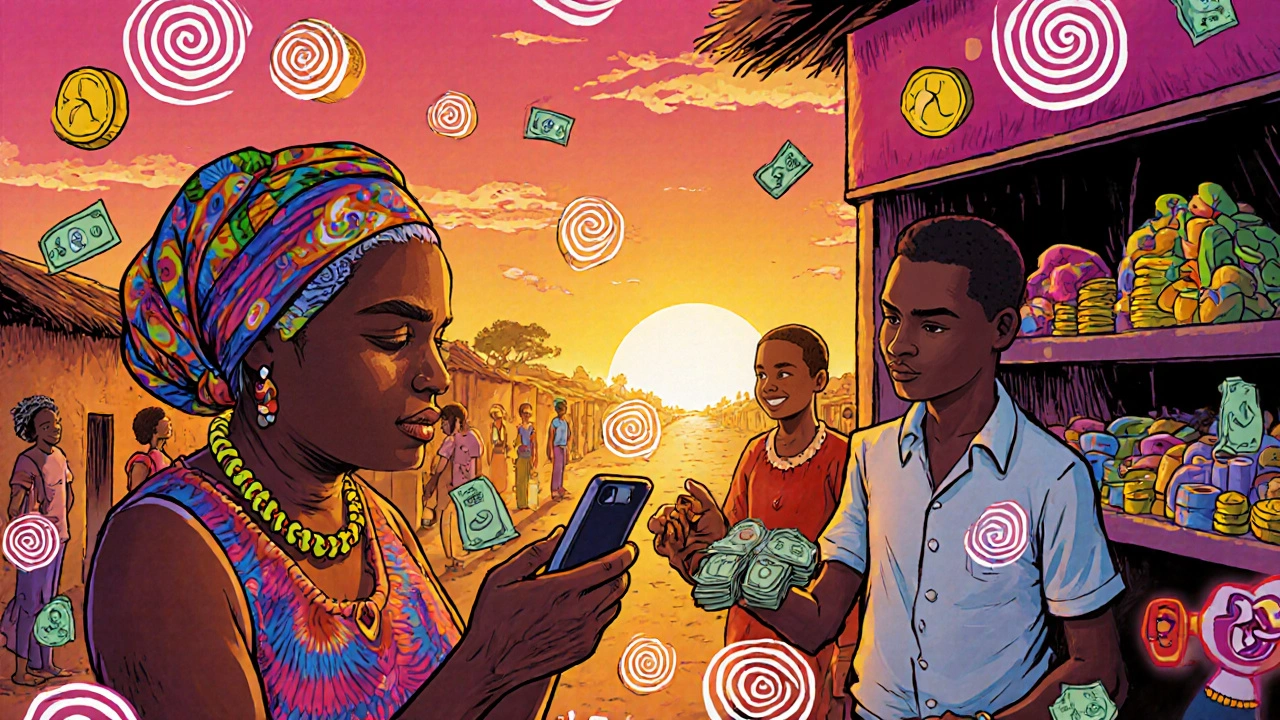

Why Mobile Banking Is Changing Lives in the Global South

More than 1.4 billion adults around the world still don’t have a bank account. They can’t save safely, get a loan to start a business, or pay bills without walking miles to the nearest branch-if one exists at all. But in places like Kenya, India, and Nigeria, something unexpected is happening: people without bank accounts are now using their phones to send money, pay for groceries, and even save for emergencies. Mobile banking isn’t just a convenience here-it’s the only way millions are finally getting access to financial services.

The Rise of Mobile Money: From M-PESA to Millions

The story really began in Kenya in 2007, when Safaricom launched M-PESA. It wasn’t fancy. No apps, no smartphones. Just text messages and local agents in villages who could turn cash into digital credit and back again. Within five years, half of Kenya’s adults were using it. Today, that model has spread across Africa, Asia, and Latin America. In 2025, over 2 billion consumer banking apps have been downloaded globally-most of them in countries where traditional banks barely reach.

What makes this work isn’t high-tech. It’s low-barrier. Even a basic feature phone with no internet can use USSD codes (*123#) to check balances, send money, or pay utility bills. In rural Nigeria or remote parts of the Philippines, this is the only banking option available. And it’s growing fast. Between 2021 and 2024, the number of adults in developing countries saving in formal accounts jumped by 16 percentage points. That’s the biggest leap in over a decade-and mobile banking is driving it.

How Mobile Banking Beats Traditional Banks in Cost and Reach

Opening a physical bank branch in a village with 50 people per square kilometer? It’s impossible. The cost of staffing, security, and infrastructure makes it unprofitable. Mobile banking changes that. By using existing mobile networks and agents in local shops, financial providers can serve customers at a fraction of the cost-up to 80% cheaper than traditional branches.

And the numbers show it. In Sub-Saharan Africa, 68% of all new financial accounts opened in 2024 were through mobile platforms. In Southeast Asia, it’s 52%. These aren’t just transaction tools. People are using them to save. Ten percent of adults in developing countries now use mobile money accounts specifically to set aside money-up from 5% just four years ago. For a farmer in Tanzania or a street vendor in Colombia, that’s life-changing. It means they can plan ahead, avoid loan sharks, and handle emergencies without selling their livestock or borrowing from relatives at ruinous rates.

What Mobile Banking Can-and Can’t-Do

Mobile banking excels at simple, everyday tasks: sending money to family, paying school fees, topping up airtime, or receiving government aid. In Mexico, remittance fees dropped from 9.2% in 2021 to 5.8% in 2024 because people stopped using expensive wire services and switched to mobile transfers. In India, the Unified Payments Interface (UPI) processes over 11 billion transactions a month-almost all of them under $10.

But it has limits. While 37% of adults in low-income countries now make or receive digital payments, only 18% can access credit through these platforms. Most mobile lenders cap loan sizes at $500. Want a mortgage? A business loan? A credit card? You’re still stuck. Traditional banks don’t serve these communities, and mobile platforms haven’t figured out how to assess risk for larger loans without physical collateral or formal income records.

That’s starting to change. AI is being used to analyze mobile usage patterns-how often someone tops up their phone, who they send money to, when they pay bills-to predict creditworthiness. By 2028, experts estimate this could open credit access to 200 million small business owners who’ve never had a bank account before. But right now, the system still favors small, short-term loans over long-term financial growth.

Who’s Left Behind-and Why

For all its progress, mobile banking isn’t reaching everyone equally. Women in low-income countries are 8 percentage points less likely than men to use mobile money. Why? Lack of phone ownership, social restrictions, and lower digital literacy. In rural Pakistan or parts of rural India, a woman might need her husband’s permission to buy a phone-or even to speak to a female agent.

Age is another barrier. About 41% of people over 45 in Sub-Saharan Africa don’t have the digital skills to use mobile banking apps. They know how to handle cash. They don’t know how to enter a PIN or navigate a menu. And if they make a mistake? Customer support is almost non-existent. In Southeast Asia, 63% of users report waiting more than 72 hours for help with a failed transaction. Chatbots handle most queries, but they can’t fix a wrong transfer or explain a fee.

Then there’s infrastructure. About 28% of rural populations in Sub-Saharan Africa still live outside reliable mobile network coverage. No signal? No mobile banking. Even if you have a phone, if the network drops during a transaction, your money can vanish-literally. Users in Nigeria and Ghana report transaction failures during peak hours, especially around payday or market days. These aren’t bugs. They’re systemic failures in network capacity.

How Countries Are Fixing the Gaps

Successful mobile banking ecosystems don’t happen by accident. They’re built over 18 to 24 months with three things: strong mobile networks, clear regulations, and user education.

India’s UPI is the gold standard. It’s a public platform that lets any bank, app, or telecom company connect to a single payment system. No more walled gardens. If you use Paytm, PhonePe, or your bank’s app, you can send money to anyone else on UPI. That’s why it handles 11 billion transactions a month.

Kenya and Tanzania have streamlined regulations that allow telecom companies to offer financial services without becoming full banks. That’s why M-PESA and Tigo Pesa grew so fast-they didn’t need to wait for years of licensing.

And then there’s digital ID. India’s Aadhaar system links every citizen to a unique biometric number. When you open a mobile bank account, your identity is instantly verified. Countries with similar systems see mobile banking adoption rates 22 percentage points higher than those without. The World Bank is now helping governments in Ghana, Indonesia, and Colombia roll out their own digital ID programs-because without knowing who you are, you can’t safely give you money.

The Future: AI, Integration, and the Last Mile

The next big wave isn’t just about sending money. It’s about connecting mobile banking to social programs. In 2025, the World Bank, Gates Foundation, and Mastercard Foundation launched a push to link government cash transfers-like food aid or pension payments-directly to mobile wallets. The goal? Reach 500 million more people by 2027.

AI is making fraud detection smarter. PwC predicts fraud in mobile banking will drop by half by 2025. That’s huge. People won’t trust a system if they think their savings can disappear overnight.

But the biggest challenge remains the last mile. Even if 75% of adults in emerging markets have mobile banking by 2030, the remaining 25% will be the hardest to reach: elderly people in remote villages, refugees, conflict zones, and those without phones or literacy. No app can fix that. It takes community agents, voice-based interfaces, and human trust.

Mobile banking didn’t solve financial inclusion. It just gave millions a door they never had before. Now the work begins: making sure no one gets left outside.

What is mobile banking in emerging markets?

Mobile banking in emerging markets refers to financial services delivered through mobile phones-especially to people without traditional bank accounts. It includes sending money, paying bills, saving, and sometimes borrowing, using apps or simple text-based systems like USSD. Unlike in developed countries, it often works on basic phones and relies on local agents instead of bank branches.

How is mobile banking different from traditional banking?

Traditional banking needs physical branches, paperwork, and formal income proof. Mobile banking skips all that. It uses mobile networks, digital IDs, and agent networks to offer basic services at a fraction of the cost. It’s faster, cheaper, and more accessible-but it doesn’t yet support complex services like mortgages or business loans.

Which countries lead in mobile banking adoption?

Kenya leads with 83% of adults using mobile money. Other top countries include Tanzania, Uganda, India, Nigeria, Colombia, and Mexico. In Sub-Saharan Africa, 54% of adults use mobile money; in Latin America, it’s 39%. India’s UPI system processes over 11 billion transactions monthly, making it the largest real-time payment platform in the world.

Why aren’t women using mobile banking as much as men?

Women are 8 percentage points less likely to use mobile money in low-income countries. Reasons include lower phone ownership, cultural restrictions, lack of financial literacy, and fewer opportunities to earn income independently. In some places, men control household finances and may not allow women to use mobile banking tools.

Can mobile banking help people get loans?

Yes-but only small ones. Most mobile lenders offer loans up to $500, based on mobile usage data like call history and payment patterns. AI is now being used to predict credit risk without traditional documents. This could expand access to 200 million small business owners by 2028. But larger loans, like for homes or businesses, still require physical collateral and formal records that most unbanked people don’t have.

What’s stopping mobile banking from reaching everyone?

Four main things: poor mobile network coverage in rural areas, low digital literacy (especially among older adults), gender inequality, and lack of interoperability between platforms. Also, customer support is weak-many users wait days for help. Without fixes to these issues, financial inclusion will stall for millions.

Graeme C

October 30, 2025 AT 14:46Let’s be real - this isn’t just about technology. It’s about power. M-PESA didn’t succeed because it was clever. It succeeded because it bypassed colonial-era banking structures that deliberately excluded the poor. When a woman in Kisumu can send money to her sister without asking her husband for permission, she’s not just transacting - she’s rebelling. And that’s why banks and governments are terrified of it. They don’t want decentralized financial autonomy. They want control. The fact that 68% of new accounts in Sub-Saharan Africa are mobile? That’s a revolution written in USSD codes.

Astha Mishra

October 31, 2025 AT 18:31It is truly heartening to witness how, in the quiet corners of rural India, where electricity flickers like a candle in the wind, a simple *99# code has become the lifeline for millions who were once invisible to the formal economy. I recall visiting a village in Odisha last year, where a grandmother, illiterate but sharp as a tack, showed me how she saved Rs. 50 every week through her mobile wallet - not for herself, but for her granddaughter’s school fees. She didn’t know what ‘financial inclusion’ meant in a policy paper, but she knew what it felt like: dignity. And yet, I wonder - if we are so focused on scaling AI-driven credit scoring, are we forgetting that trust is built not in algorithms, but in human faces? The agent at the corner shop who remembers her name? That is the real infrastructure.

Kenny McMiller

November 2, 2025 AT 03:48Bro, UPI is the real MVP. 11 billion transactions a month? That’s more than the entire US debit card network. And it’s open-source, interoperable, built on public infrastructure - no Silicon Valley VC nonsense. Meanwhile, in the US we’re still stuck with Zelle charging $1 to send money to your cousin. Mobile banking in emerging markets isn’t ‘innovative’ - it’s just not broken. We’re still using 1970s banking tech while they’re running on 5G. The future’s not coming - it’s already here, and it’s got a ₹10 note and a bad signal.

Dave McPherson

November 2, 2025 AT 07:04Oh wow, another feel-good tech utopia fantasy. Let me grab my monocle. Mobile banking? Sure, it’s great for sending ₹20 to your cousin for chai. But let’s not romanticize the fact that 82% of these ‘accounts’ are dormant after six months. People aren’t saving - they’re transacting. And that ‘AI credit scoring’? It’s just behavioral surveillance wrapped in buzzwords. Your phone knows you buy samosas on Fridays - congrats, you’re now ‘creditworthy’? Meanwhile, actual financial tools - like credit cards, mortgages, insurance - remain locked behind corporate moats. This isn’t inclusion. It’s financial gentrification with a smartphone.

RAHUL KUSHWAHA

November 3, 2025 AT 21:34Thank you for writing this. 😊