Step-by-Step Investment Guide: Build Your Portfolio with Confidence

When you start investing, you don’t need a finance degree—you need a step-by-step investment guide, a clear, actionable path to grow your money without guesswork or hype. Also known as a personal investment roadmap, it’s what separates people who watch their money sit still from those who make it work for them. This isn’t about picking hot stocks or timing the market. It’s about building habits, choosing the right tools, and knowing what to do next—no matter your income or experience.

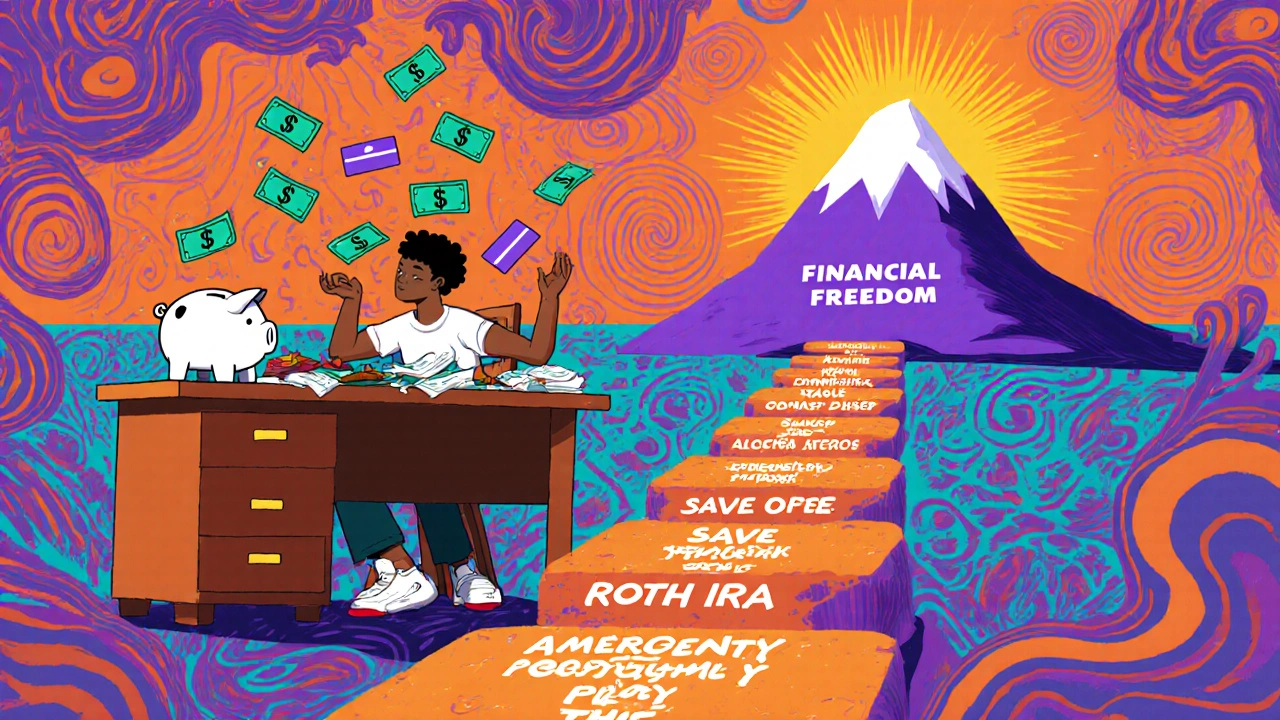

A good investment strategy, a plan that matches your goals, risk level, and timeline. Also known as financial plan, it starts with knowing why you’re investing. Are you saving for retirement? A house? Your kid’s education? Each goal needs a different approach. Then comes portfolio building, how you spread your money across different assets like stocks, bonds, and savings accounts. Also known as asset allocation, it isn’t about putting everything in one place. It’s about balance. If you’re young, you can take more risk. If you’re closer to retirement, you need safety. That’s why high-yield savings accounts, Roth IRAs, and corporate cards for business owners all fit into different parts of the same puzzle.

You’ll also need to know when to pay off debt versus when to invest. That 6% rule? It’s not a myth—it’s a real number that tells you which choice saves you more money. And when your broker’s app crashes during a market dip? You need backup plans, not panic. These aren’t abstract ideas. They’re the same topics covered in posts about emergency funds, fee-only advisors, and the 4% rule for retirement. You’ll find real examples: how couples use shared wallets to avoid money fights, how fintech lenders approve loans in minutes, and why cloud computing powers the apps you rely on.

There’s no magic formula. But there is a clear sequence: know your goal, choose your tools, protect your money, and stick with it. The posts below walk you through each step—no fluff, no jargon, no sales pitches. Whether you’re just opening your first account or you’re tweaking your retirement mix, you’ll find what works right now in 2025. No theory. Just what to do, when to do it, and why it matters.