Investment Growth Calculator

Calculate Your Investment Growth

See how your regular investments grow over time with compound interest. The math in this article shows that $100/month at 7% return for 10 years yields $24,623 - over $12,600 more than just saving the same amount without investment.

Your Investment Growth Projection

This calculator shows that consistent investing is powerful. For example, $100/month for 10 years at 7% return grows to $24,623, which is $12,623 more than if you just saved the money without investing.

Why You Need a Written Investment Plan

Most people think investing is about picking stocks or timing the market. It’s not. It’s about showing up consistently, staying calm when prices drop, and letting time do the heavy lifting. Without a plan, you’re just guessing - and guessing leads to selling low and buying high. That’s how you lose money.

Investors with a written plan are 3.2 times more likely to reach their financial goals, according to Ameritas. Why? Because a plan turns vague dreams like "I want to be rich" into clear actions: "I will save $300 a month and put it in a low-cost index fund until I’m 65."

The math is simple. If you invest $100 every month for 10 years at a 7% annual return, you’ll end up with $24,623. Without compounding? Just $12,000. That extra $12,623? That’s your plan working.

Step 1: Pay Off High-Interest Debt First

Before you invest a dollar, ask yourself: Do I have any debt with an interest rate above 7%? Credit cards, personal loans, payday loans - these eat your future returns alive.

Let’s say you’re paying 18% on a credit card balance. Even if your investments earn 7%, you’re still losing 11% net. That’s like digging a hole while trying to climb out. Pay off that debt first. It’s the highest guaranteed return you’ll ever get.

Start with the smallest balance. Pay minimums on everything else. This builds momentum. Once you’re debt-free (except maybe a low-rate mortgage), you’re ready to move forward.

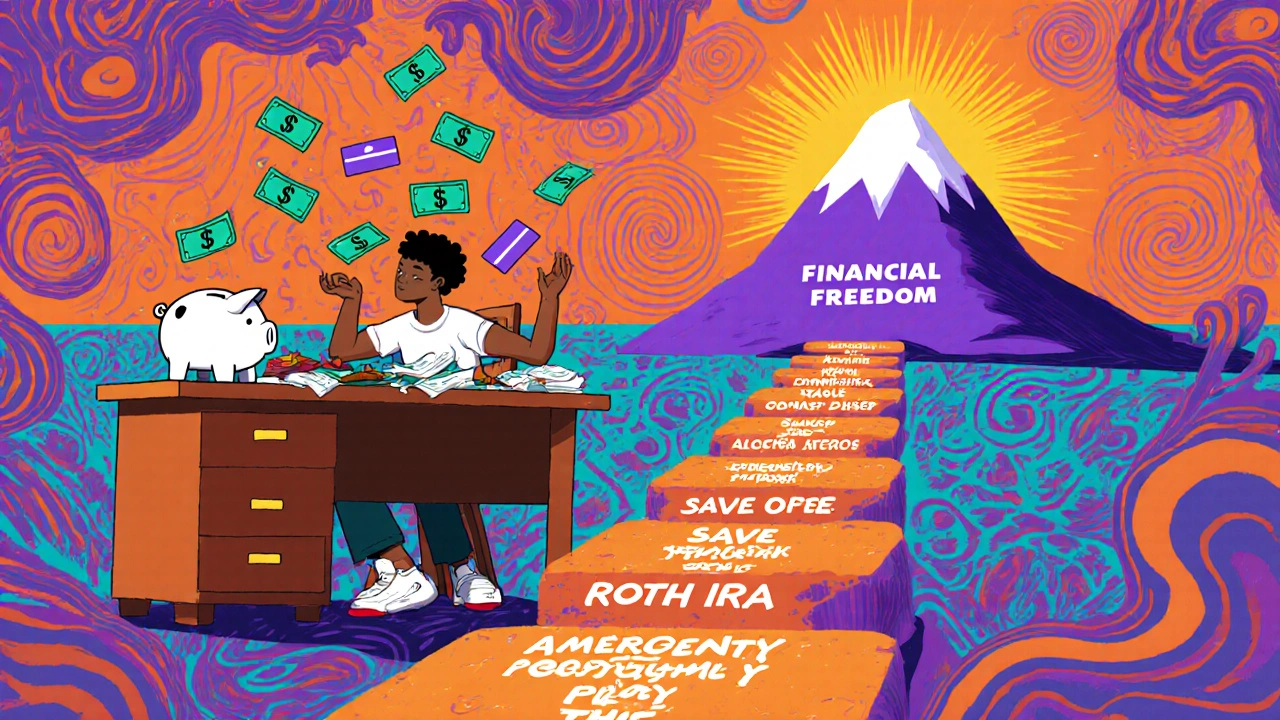

Step 2: Build Your Emergency Fund

You need cash you can touch right away - not in stocks, not in crypto, not in a CD that locks you in. You need an emergency fund.

How much? Three to six months of living expenses. If you spend $3,000 a month, save $9,000 to $18,000. Keep it in a high-yield savings account. As of October 2025, accounts at Marcus by Goldman Sachs and Ally Bank are paying 4.5% and 4.25% APY respectively. That’s far better than the 0.01% you get at big banks.

This isn’t optional. If your car breaks down, your fridge dies, or you lose your job, you won’t sell your investments at a loss. You’ll use your emergency fund - and your plan stays intact.

Step 3: Pick the Right Account Type

Where you put your money matters as much as how much you put in. For most beginners, there are two smart choices: a Roth IRA or a brokerage account.

Roth IRA: If you’re under 35 and expect your income to rise, this is your best bet. You pay taxes now, but all future growth and withdrawals are tax-free. The 2025 contribution limit is $7,000 per year. Fidelity and Vanguard let you open one with $0 minimum.

Brokerage Account: No contribution limits. No income caps. You pay taxes on dividends and capital gains, but you can pull money out anytime. Great if you want flexibility or are saving for a house in 5-7 years.

63% of beginners start with a Roth IRA because it’s simple, powerful, and built for long-term growth. Start there unless you have a specific short-term goal.

Step 4: Choose Your Core Investments

Forget picking individual stocks. You don’t need to. You don’t want to. Most people who try end up underperforming the market.

Instead, use low-cost index funds or ETFs. These are baskets of hundreds or thousands of companies. They track the whole market. They cost almost nothing. And they outperform 82% of actively managed funds over 15 years, according to S&P Dow Jones Indices.

Here’s what most beginners should own:

- Vanguard Total Stock Market ETF (VTI) - Covers every U.S. stock, big and small. Expense ratio: 0.03%.

- Vanguard Total International Stock ETF (VXUS) - Adds exposure to markets outside the U.S. Expense ratio: 0.07%.

- Vanguard Total Bond Market ETF (BND) - For stability. Expense ratio: 0.03%.

These three funds cover nearly everything you’ll ever need. 78% of robo-advisor portfolios hold VTI, according to MagnifyMoney. That’s not a coincidence.

Step 5: Set Your Asset Allocation

How much should you put in stocks vs. bonds? The old rule was "100 minus your age." So if you’re 30, put 70% in stocks, 30% in bonds.

But today, many experts recommend something simpler: if you’re under 40 and can handle swings, go 100% stocks in your Roth IRA. Why? Because you have decades to recover from downturns. The S&P 500 has always bounced back after a crash - it just takes time.

Use this guide:

- Under 30: 90-100% stocks

- 30-45: 80-90% stocks

- 46-60: 60-70% stocks

- 60+: 40-50% stocks

If you’re unsure, use a target-date fund like Vanguard Target Retirement 2060. It automatically adjusts your mix as you get older. Just pick the year closest to when you plan to retire. Expense ratio: 0.08%.

Step 6: Automate Everything

The biggest mistake people make? They wait until they "feel like it." Investing isn’t about motivation. It’s about systems.

Set up automatic transfers. Have $200, $500, or whatever you can afford, pulled from your paycheck or checking account every two weeks. Direct it straight into your Roth IRA or brokerage account.

Fidelity data shows people who automate save 37% more annually than those who don’t. Why? Because you’re not thinking about it. You’re not debating whether today’s the day. It just happens.

Set it and forget it. Your future self will thank you.

Step 7: Rebalance Once a Year

Markets move. Stocks go up. Bonds go down. Over time, your original mix changes. If stocks surge, you might end up with 95% stocks instead of 80%. That’s riskier than you planned.

Once a year, check your portfolio. Sell a little of what grew too big. Buy more of what fell behind. This is called rebalancing.

It sounds complicated. It’s not. Most brokerages let you do it with one click. BlackRock found that annual rebalancing reduces portfolio volatility by 22%. It’s the quiet hero of long-term investing.

Don’t do it more often. Don’t chase trends. Don’t panic when the market drops. Just do it once a year, like paying your taxes.

What to Avoid

Here’s what breaks most new investors:

- Chasing hot stocks - Tesla, Bitcoin, meme stocks. They’re gambling, not investing.

- Checking your balance daily - Schwab found investors who checked daily during the 2020 crash sold 12% more than those who checked quarterly.

- Buying too many funds - Holding 25+ funds doesn’t make you safer. It just raises fees and confuses you. Vanguard says it lowers returns by 0.4% a year.

- Listening to financial influencers - They’re selling clicks, not advice. Stick to the basics.

How Long Does It Take to Get Started?

You can build your entire plan in one afternoon. Here’s the timeline:

- Day 1: Open your Roth IRA at Fidelity or Vanguard (takes 10 minutes).

- Day 1: Set up automatic transfers ($100 or more).

- Day 1: Buy VTI and VXUS (or a target-date fund).

- Day 2: Confirm your emergency fund is funded.

- Day 3: Set a calendar reminder to rebalance next year.

That’s it. No complicated forms. No financial advisor meetings. No guesswork.

What Happens Next?

Nothing dramatic. That’s the point.

You’ll see your balance go up. You’ll see it dip. You’ll feel nervous. But you’ll keep adding money. You’ll keep rebalancing. You’ll keep ignoring the noise.

Five years from now, you’ll have $20,000-$30,000 saved. Ten years? $50,000-$80,000. Twenty years? Over $200,000 - all from $300 a month.

That’s not magic. That’s a plan.

Graeme C

October 31, 2025 AT 23:26Finally, someone gets it. Pay off debt first? Absolutely. I was paying 19% on a credit card while "investing" $50 a month in ETFs. The math didn’t lie-I was losing 14% net. Paid it off in 8 months, then went all-in on VTI. Now I’m up 47% in 18 months. No magic. Just math. And discipline. Stop overcomplicating it.

Astha Mishra

November 1, 2025 AT 09:24It is truly remarkable how the simplicity of this approach stands in such stark contrast to the cacophony of financial noise that inundates us daily-from TikTok gurus hyping Dogecoin to YouTube influencers selling "get rich quick" schemes. The core truth here-that compounding, consistency, and emotional regulation are the only real alchemists of wealth-is not new, yet it remains profoundly underappreciated. I have watched friends, brilliant in their professions, fritter away years chasing volatility, while the quiet investor who sets up automatic transfers and forgets about it for a decade emerges not merely solvent, but free. The emergency fund, the Roth IRA, the low-cost index funds-these are not investments, they are acts of self-respect. And the rebalancing? A ritual of humility, reminding us that we cannot predict, only prepare. May we all find the courage to be ordinary, and thus, extraordinary.

Kenny McMiller

November 1, 2025 AT 15:13