Portfolio Diversification: How to Spread Risk and Build Stable Returns

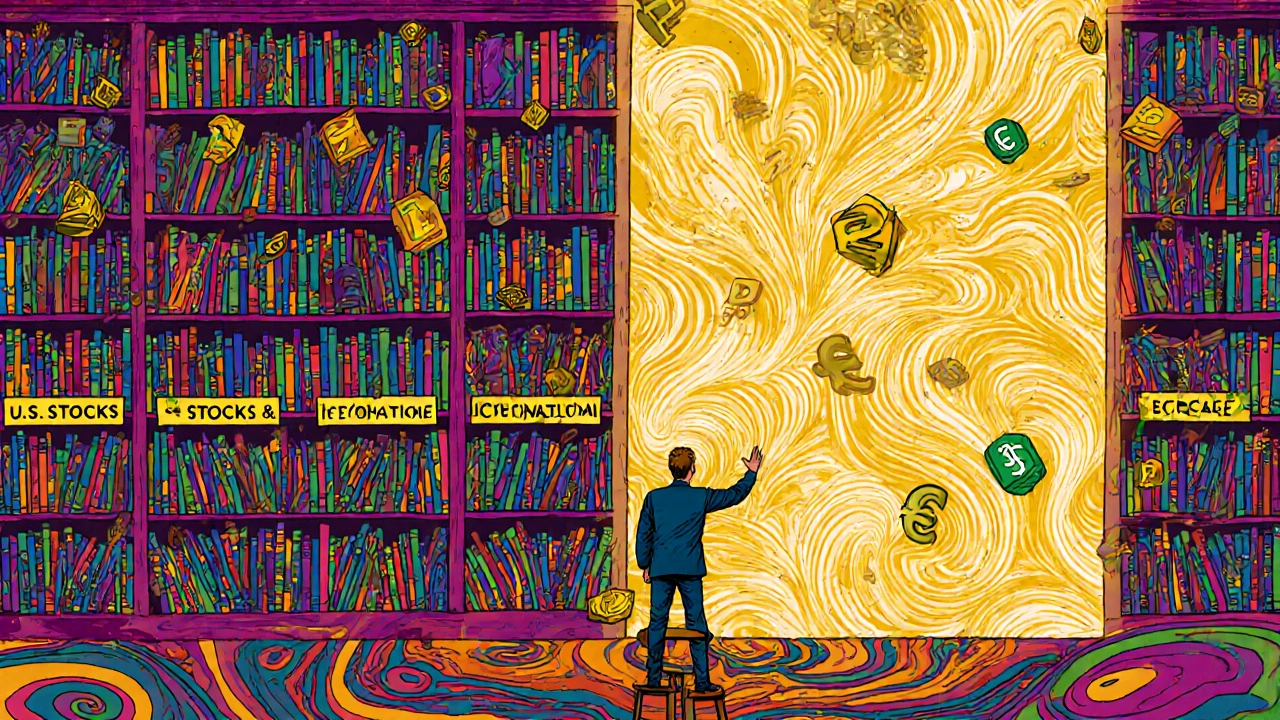

When you build a portfolio diversification, the practice of spreading investments across different assets to reduce risk. Also known as asset allocation, it’s not about putting money in lots of things—it’s about putting money in the right kinds of things so one bad move doesn’t wreck your whole plan. Most people think diversification means owning 20 different stocks. But that’s not enough. If all those stocks are in tech, and tech crashes, you’re still exposed. True diversification means mixing stocks, bonds, cash, real estate, and even international assets so losses in one area don’t drag down everything else.

It’s not just about asset allocation, how you divide your money among different types of investments. It also means spreading your bets across time horizons, when you plan to use your money. Need cash next year? Keep it safe and liquid. Saving for retirement in 20 years? You can afford to take more risk. That’s why the bucket strategy and time horizon diversification work—they match your money to your goals, not just your risk tolerance. And when you add in risk management, the process of identifying, measuring, and reducing financial threats, you’re not just investing—you’re building a system that holds up when markets get wild.

Look at the posts below. You’ll find real examples of how people use diversification to avoid big losses. Some use money market funds to keep cash safe while earning more than a regular savings account. Others hedge international bonds to block currency swings. A few split their retirement savings into buckets so they never have to sell stocks during a crash. There’s even advice on how to pick dividend stocks that won’t turn into value traps—because high yield doesn’t mean high safety. Every post here is a piece of the puzzle: how to protect your money, reduce stress, and make your portfolio work harder without taking dumb risks.

Portfolio diversification isn’t a one-time setup. It’s a habit. You check it. You adjust it. You don’t ignore it when markets are calm—because that’s when you prepare for when they’re not. The tools, strategies, and real-world examples below aren’t theory. They’re what actual investors use to stay calm, stay invested, and stay ahead. No fluff. No hype. Just what works.