Money Market Account: What It Is and How It Compares to Savings and CDs

When you need more than a regular savings account but aren’t ready to lock money away for years, a money market account, a type of interest-bearing bank account that offers higher returns than standard savings and limited check-writing access. Also known as MMA, it sits between a savings account and a certificate of deposit in terms of flexibility and yield. Unlike a regular savings account, a money market account often lets you write a few checks or use a debit card each month—making it useful for emergency funds you might need to tap occasionally. And unlike a CD, your money isn’t locked in; you can withdraw it without penalty, as long as you stay under the federal limit of six withdrawals per month.

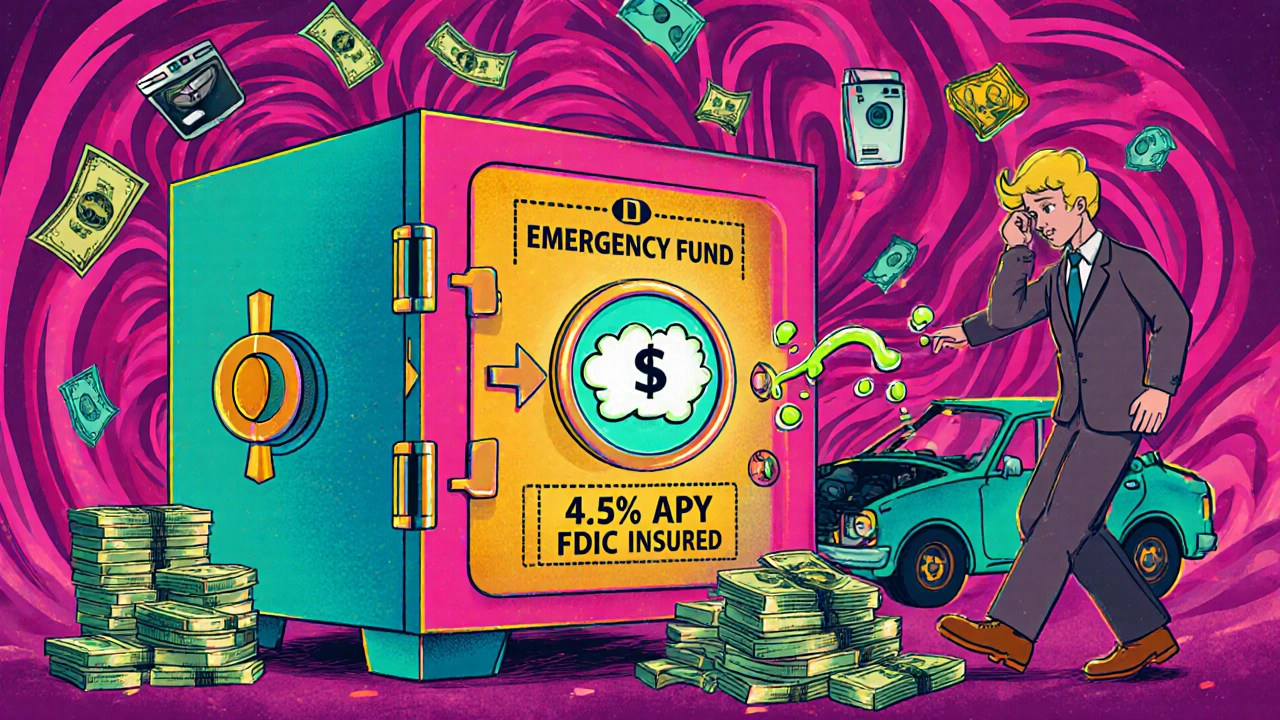

What makes a money market account stand out is how it balances interest rates, the percentage of your balance the bank pays you annually with liquidity, how quickly and easily you can access your cash. In 2025, top money market accounts pay over 4.5% APY—close to what you’d get from the best high-yield savings accounts, online-only savings accounts that typically offer higher rates than traditional banks. But unlike HYSA, many MMAs give you check-writing privileges or debit card access, which can be handy if you’re saving for a near-term goal like a car down payment or home repairs.

Still, it’s not always the best choice. If you don’t need to touch your money for a year or more, a CD, a time-bound deposit that pays a fixed interest rate in exchange for locking up your cash might earn you more. But if your job is unstable, your income is irregular, or you’re building an emergency fund, the flexibility of a money market account matters more than a half-percent higher rate. Many people use MMAs as a holding ground: park cash there while saving up for investments, then move it to a brokerage when ready.

Some banks charge monthly fees unless you maintain a minimum balance—often $2,500 or more. That’s something to watch for. Also, remember that MMAs are FDIC-insured up to $250,000 per depositor, so your money is safe, but the returns are still just interest—no market risk, no growth potential like stocks. It’s cash, just earning more of it.

What you’ll find in these posts isn’t just definitions. You’ll see real comparisons between money market accounts and other options, like how they stack up against apps like Ally or Marcus, what fees to watch for, and when to skip them entirely. There’s also advice on using them as part of a broader strategy—like pairing one with an emergency fund goal or using it as a bridge before investing. No fluff. Just what works.