Mobile Money: How Digital Wallets and Apps Are Changing How We Handle Cash

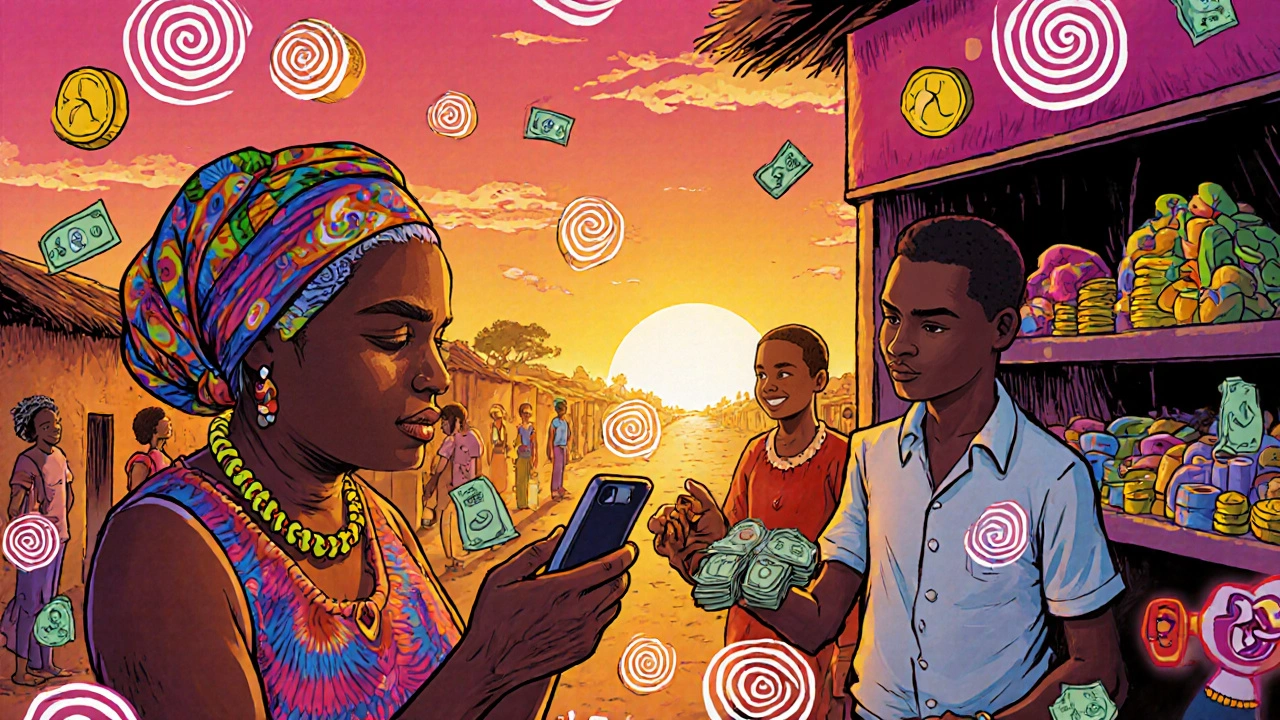

When you think of mobile money, a system that lets people send, receive, and store money using a mobile phone without needing a traditional bank account. Also known as digital wallets, it's not just for developing countries anymore—it's becoming the default way millions in the U.S. and Europe manage everyday cash. You don’t need a bank branch to pay a friend, split rent, or save for groceries. All you need is a phone and an app. This isn’t science fiction. It’s what people in Kenya, Nigeria, and India have been doing for over a decade—and now it’s here, in your pocket, too.

Behind mobile money are three key tools: digital wallets, apps that hold money securely and let you pay, send, or receive funds instantly. Also known as mobile payment apps, they’re the front door to modern finance. Then there’s fintech apps, platforms that combine banking, budgeting, and payments into one streamlined experience. Also known as neobanks, they’re built for people who want control without the bureaucracy. And finally, cashless payments, the broader shift away from physical bills and coins toward taps, scans, and transfers. Also known as contactless transactions, they’re why your phone can now replace your wallet at the grocery store. These aren’t separate trends—they’re layers of the same change. Mobile money enables digital wallets. Digital wallets run on fintech apps. And together, they make cashless payments the new normal.

You might think this is just for tech-savvy millennials, but it’s not. Single parents using Cash App to get paid early. Small business owners skipping PayPal fees with Venmo. Retirees avoiding bank lines with Zelle. These aren’t edge cases—they’re the new baseline. The apps that make this possible don’t just move money. They give people control. No more waiting for checks. No more overdraft fees from banks that don’t understand your pay schedule. No more hiding cash under the mattress because you don’t trust the system.

That’s why the posts below focus on real tools and real decisions. You’ll find comparisons of the best app-based savings accounts that earn real interest, guides on how to use shared wallets to avoid money fights with your partner, and breakdowns of how fintech lenders approve loans in minutes instead of weeks. You’ll see how cloud-powered platforms keep your money safe, and how emergency funds now live in apps—not CDs. This isn’t about chasing trends. It’s about understanding the system you’re already using—and using it better.