Mobile Banking: What It Is, How It Works, and What You Can Do With It

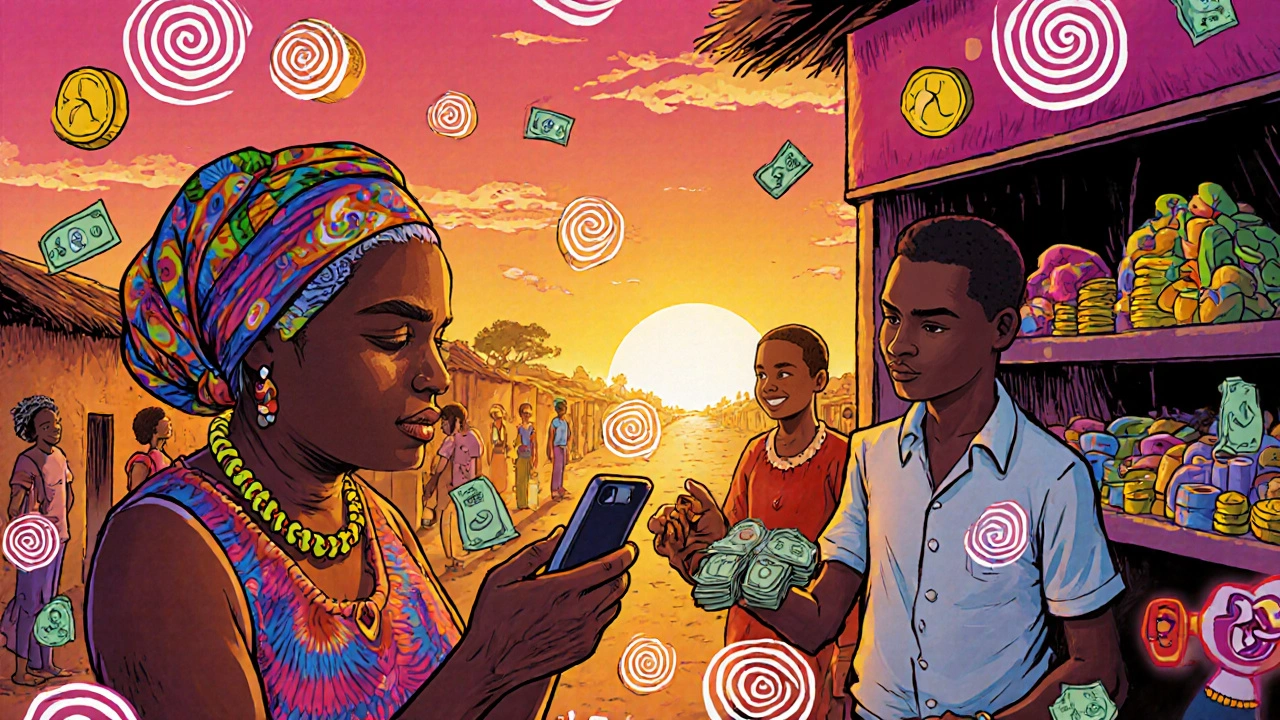

When you use mobile banking, a way to manage your money through a smartphone app instead of visiting a branch or using a computer. Also known as app-based banking, it lets you do everything from checking your balance to sending money to a friend—all without stepping into a bank. This isn’t just convenience. It’s a shift in how people control their money, especially for those who don’t trust big banks or want to save smarter without extra fees.

Mobile banking high-yield savings apps, digital tools that offer better interest rates than traditional banks are one of the biggest reasons people switch. Apps like Ally, Marcus, or Chime now pay up to 5% APY—way more than the 0.01% most brick-and-mortar banks offer. These apps also let you set up automatic transfers, track spending in real time, and even get paid two days early through earned wage access features. And they’re not just for saving. fintech apps, software platforms that use technology to improve financial services now handle loans, budgeting, joint accounts, and even emergency fund management—all inside one app. You can split rent with your roommate, automate your emergency savings, or get a business card for your side hustle without ever talking to a teller.

But mobile banking isn’t perfect. Outages happen. Apps crash during market swings. Some charge hidden fees for instant transfers or ATM use. And if you’re not careful, you might end up with multiple accounts you forgot about—each with its own login, rules, and alerts. That’s why knowing what to look for matters: no monthly fees, FDIC insurance, real-time notifications, and easy customer support. The best apps don’t just move money—they help you make smarter decisions without the noise.

Below, you’ll find real reviews and comparisons of the tools people actually use. From apps that help couples track joint spending to platforms that let you earn interest while you sleep—these aren’t theory pieces. They’re what works today, in 2025, for real people managing money on their phones.