Investment Plan: Build a Strategy That Actually Works

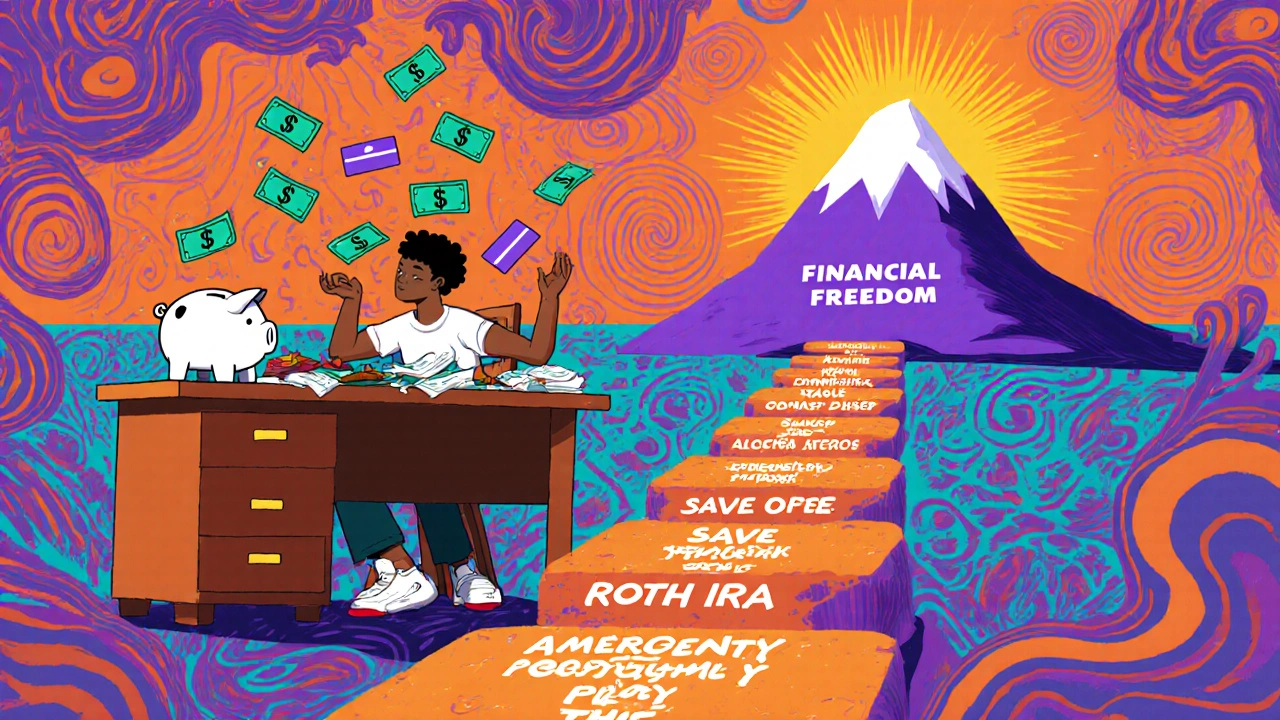

When you hear investment plan, a clear roadmap for growing and protecting your money over time. Also known as a financial plan, it’s not about picking stocks or chasing trends—it’s about making your money work for you, no matter your income or experience level. Most people think an investment plan means buying mutual funds or opening a Roth IRA, but that’s just one piece. A real investment plan ties together your emergency fund, your debt, your income, and your long-term goals into one system that adapts as your life changes.

Without a solid emergency fund, a cash buffer you can access quickly when unexpected costs hit. Also known as a safety net, it’s the foundation every investment plan needs. If you don’t have three to six months of living expenses saved, any market dip can force you to sell investments at a loss. That’s why high-yield savings accounts and money market funds show up so often in these guides—they’re not glamorous, but they keep your plan from falling apart. Then there’s debt payoff, the process of eliminating high-interest obligations before or alongside investing. Also known as debt management, it’s the silent partner to investing. Paying off a credit card at 20% interest gives you a guaranteed 20% return—better than most stocks. And if your employer offers a 401(k) match, that’s free money you can’t afford to skip.

Your asset allocation, how you divide your money across different types of investments like stocks, bonds, and cash. Also known as portfolio mix, it’s the core of your long-term strategy. It’s not about being aggressive or conservative—it’s about matching your risk level to your timeline. Someone in their 20s can handle more stocks. Someone nearing retirement needs more stability. And your investment plan should reflect that, not a random recommendation from a YouTube video.

What you’ll find below aren’t generic tips. These are real, tested approaches from people who’ve been there: how to adjust your emergency fund when you’re self-employed, why the 4% rule might be outdated in 2025, how to use a Backdoor Roth IRA if you earn too much, and when to choose paying off debt over investing. Every post here answers a specific question real investors face—not theory, not fluff. This isn’t about getting rich quick. It’s about building a plan that holds up when life gets messy.