How to Start Investing: Simple Steps for Beginners and Beyond

When you’re ready to how to start investing, it’s not about picking the hottest stock or timing the market. It’s about building a system that works for your life. Investment Policy Statement, a clear plan that defines your goals, risk tolerance, and rules for buying and selling. Also known as an IPS, it’s the foundation every serious investor uses—whether they manage $10,000 or $10 million. Without it, you’re just reacting to headlines, and that’s how people lose money.

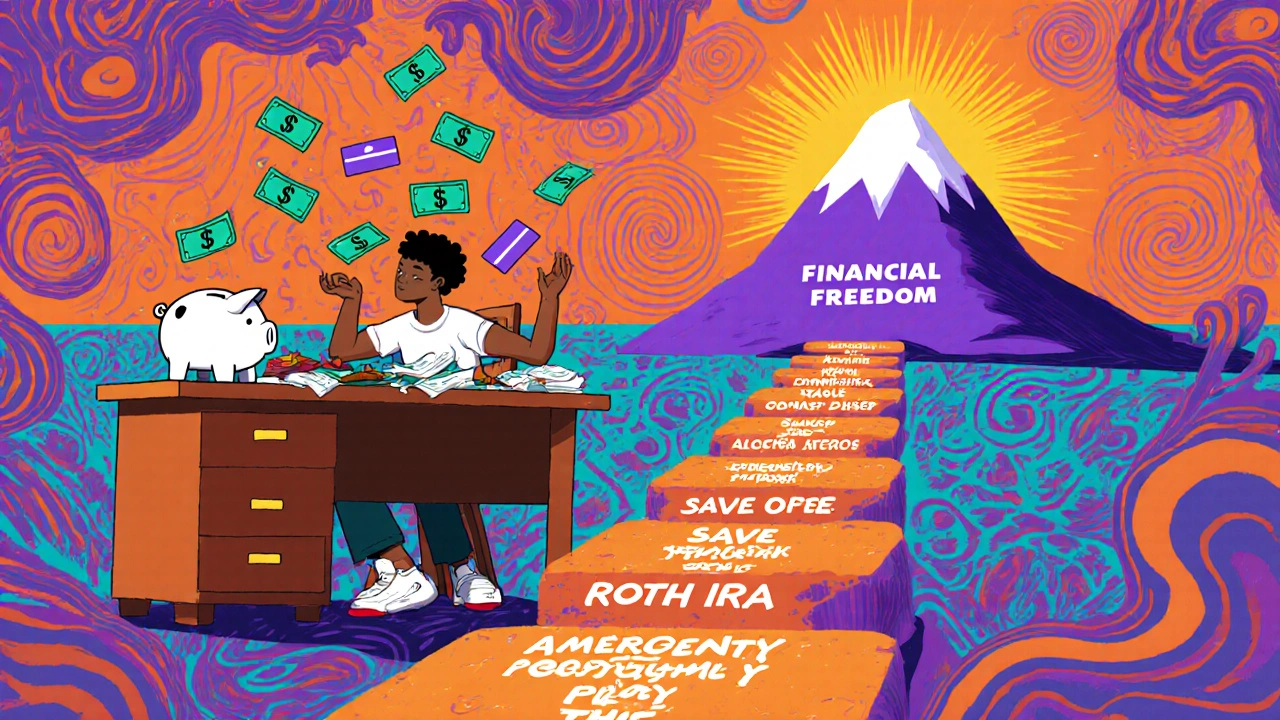

Before you buy your first stock or ETF, you need a safe place to keep your cash. That’s where high-yield savings account, an online savings account that pays significantly more interest than traditional banks. Also known as HYSA, it’s not glamorous, but it’s the smart first step. Most people skip this and try to jump straight into stocks. But if you don’t have an emergency fund, a liquid stash of cash you can access quickly if something goes wrong. Also known as rainy day fund, it’s the buffer that keeps you from selling investments at a loss during a market dip. Aim for three to six months of living expenses. Keep it in a high-yield account so it earns while it waits.

Once your emergency fund is in place, you’re ready to think about growth. portfolio diversification, spreading your money across different types of assets to reduce risk. Also known as asset allocation, it’s not about putting money in ten different stocks—it’s about owning the right mix of stocks, bonds, and cash based on your timeline. Some of your money should be for short-term goals (like a car in two years), some for mid-term (a down payment in five), and some for long-term (retirement in 20). The posts below show you exactly how to split it up without overcomplicating things.

You’ll find real examples here: how to use a bucket strategy for retirement, why international exposure matters, how to avoid value traps in dividend stocks, and why momentum investing works better than you think. You’ll see how people actually set up their accounts using tools like Chime, YNAB, or Zelle—not theory, but what’s working right now in 2025. There’s no fluff about compound interest magic or ‘buy and hold forever’ clichés. Just clear steps: where to open an account, what fees to watch for, how to read a fund’s prospectus, and when to ignore the noise.

What you won’t find are get-rich-quick schemes or advice from people who’ve never lost money. This collection is for anyone who’s tired of being talked down to by finance influencers. Whether you’re starting with $100 or $10,000, the rules are the same: protect your cash first, invest with a plan, and stay consistent. The rest follows.