First Investment Strategy: Start Smart with Proven Approaches

When you’re building your first investment strategy, a clear, practical plan to grow money over time based on your goals, risk tolerance, and financial situation. Also known as beginner investing plan, it’s not about picking hot stocks or timing the market—it’s about setting up systems that work even when you’re not watching. Most people get this wrong. They think they need a big balance, a fancy app, or a financial advisor to begin. But the truth? Your first investment strategy starts long before you buy your first share.

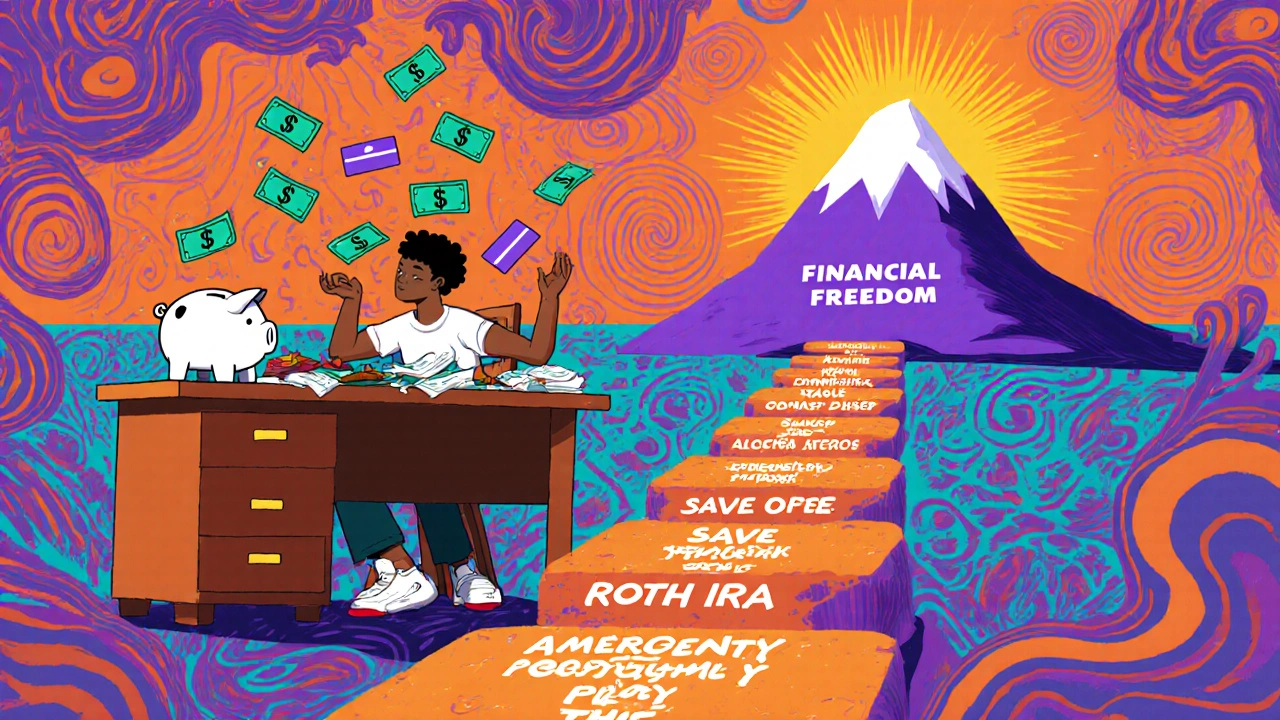

It begins with emergency fund, a cash buffer you can access quickly to cover unexpected expenses without touching investments. Also known as liquid savings, this isn’t optional—it’s the foundation. Without it, any market dip or job loss can force you to sell investments at a loss. That’s why nearly every post in this collection ties back to building safety first: whether it’s choosing the best high-yield savings, a bank account that pays significantly more interest than traditional savings accounts, often through online-only platforms. Also known as app-based HYSA, and is the most common place to hold emergency cash, or understanding why debt payoff, the act of eliminating high-interest obligations like credit cards or personal loans before investing. Also known as pay off debt or invest, it’s the critical decision that shapes your entire financial path comes before investing. You don’t invest in a vacuum. You invest from a position of strength.

What you’ll find here isn’t theory. These are real strategies used by people who started with nothing and built something. You’ll see how the 4% rule adapts to today’s markets, how fintech loans can free up cash to invest, and why shared wallets and joint budgets help couples invest together without conflict. You’ll learn how to avoid broker outages, use trust accounts for long-term goals, and even how to legally boost retirement savings with a Backdoor Roth IRA if you earn too much for a regular one. There’s no fluff. No jargon. Just what actually moves the needle when you’re starting out.

Some of these posts are about tools—like Ramp’s corporate card or app-based savings accounts. Others are about rules—like the 6% rule for debt vs. investing. But they all connect back to one thing: your first investment strategy isn’t a single decision. It’s a chain of smart, simple choices. The right emergency fund. The right debt plan. The right account. The right timing. And if you get those right, everything else falls into place. What follows isn’t a list of articles. It’s your roadmap.