Financial Inclusion: How Technology Is Bringing Banking to the Unbanked

When we talk about financial inclusion, the process of ensuring all individuals and businesses have access to useful and affordable financial products and services. Also known as economic inclusion, it’s not just about having a bank account—it’s about being able to save, borrow, pay bills, and build security without being locked out by fees, distance, or discrimination. Right now, over 1.4 billion adults worldwide still don’t have a bank account. Many live in rural areas, work gig jobs, or earn too little to qualify for traditional services. But something’s changing fast.

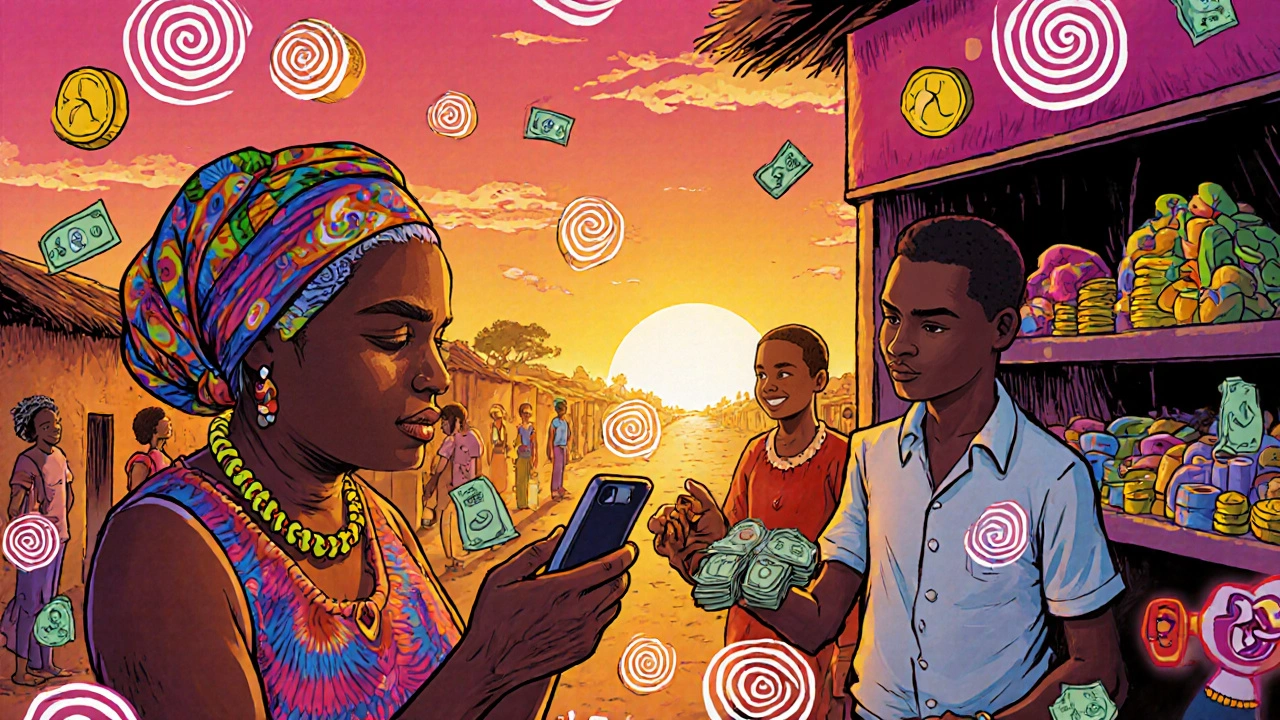

fintech, technology-driven financial services that improve access and efficiency is turning that around. Mobile apps, digital wallets, and AI-powered lending are reaching people who banks ignored. Think of someone in Kenya sending money to family via phone, or a small business owner in Mexico getting a loan based on their sales history—not their credit score. These aren’t futuristic ideas. They’re happening now. And digital banking, banking services delivered through smartphones and online platforms without physical branches is the engine behind it. You don’t need a branch nearby if your phone can do it all.

Financial inclusion isn’t just charity—it’s smart economics. When people can save safely, they spend more locally. When they can access credit, they grow businesses. When they can pay bills digitally, they avoid predatory lenders. That’s why tools like access to credit, the ability to obtain loans or financing without excessive barriers or interest rates are so powerful. Platforms offering instant small loans based on transaction history, not collateral, are giving people control over their money for the first time. This isn’t about handouts. It’s about giving people the same tools the rest of us take for granted.

Look at the posts below. You’ll see how earned wage access helps workers get paid without payday loans, how corporate cards let small businesses manage cash flow without traditional bank approvals, and how app-based savings accounts offer 5% interest to people who never had a high-yield option before. These aren’t random tech trends. They’re pieces of a bigger shift—making finance work for everyone, not just the privileged few. Whether you’re trying to help someone build an emergency fund, start a business, or just avoid overdraft fees, understanding financial inclusion means understanding where the system is finally getting better. And that’s where the real opportunity lies.