Emerging Markets: Where Growth Happens and How to Invest Smart

When we talk about emerging markets, economies transitioning from low-income to middle-income status with rapid industrialization and expanding consumer bases. Also known as developing economies, they include countries like India, Vietnam, Brazil, and Nigeria—places where infrastructure is being built, middle classes are growing, and businesses are scaling fast. These aren’t just distant countries on a map. They’re where the next wave of global companies will emerge, and where smart investors look for returns that mature markets can’t match.

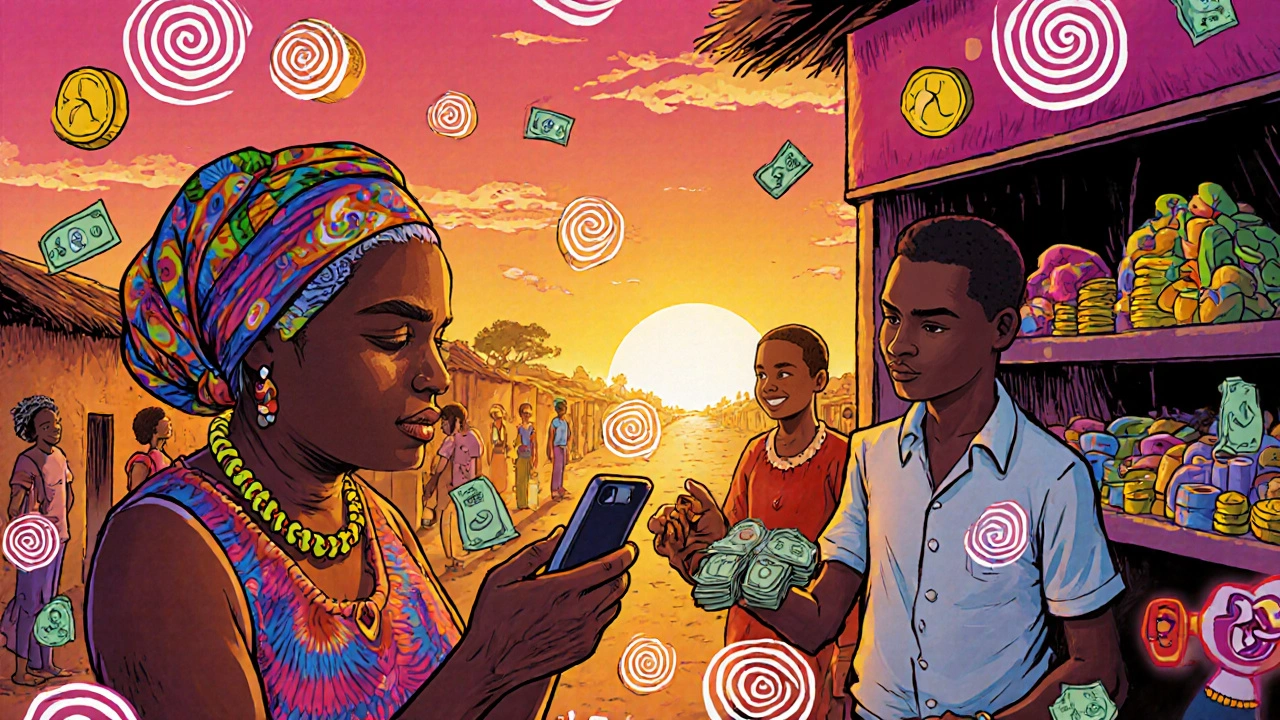

But emerging markets aren’t a single thing. They include frontier markets, smaller, less liquid economies like Bangladesh, Kenya, or Vietnam that are earlier in development, and foreign investment, the flow of capital from investors in the U.S., Europe, or Asia into these economies through stocks, bonds, or funds. You can’t treat them like U.S. tech stocks. Political shifts, currency swings, and weak regulation can hit hard. But so can explosive growth. A company in Indonesia selling mobile payment apps might grow 300% in two years—while a similar one in Germany grows 8%. That’s the trade-off.

What ties the posts below together is a simple truth: you don’t need to guess. Whether you’re looking at how to access these markets through ETFs, understanding currency risks, or seeing how global supply chains are shifting toward Southeast Asia, the goal is the same—invest with eyes open. These aren’t speculative bets. They’re strategic moves for portfolios that want more than just S&P 500 returns. The posts here cut through the noise. You’ll find real comparisons, practical checklists, and clear explanations of fees, risks, and timing—not hype.