Beginner Investing: Simple Steps to Start Building Wealth Without Stress

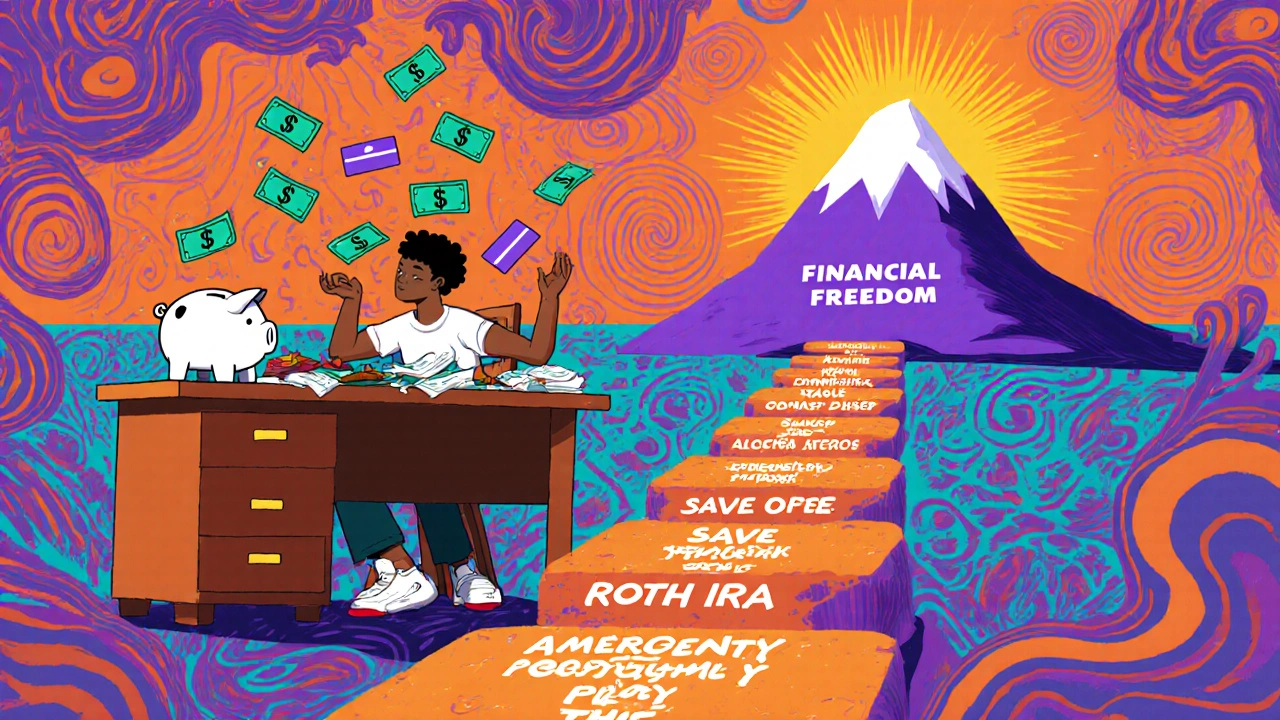

When you start beginner investing, the first steps in building long-term wealth through smart, low-risk financial habits. Also known as starting with basic money moves, it’s not about picking stocks or timing the market—it’s about setting up systems that work while you focus on life.

Most people think you need a lot of money to begin, but that’s not true. What you really need is a high-yield savings account, an online account that pays significantly more interest than traditional banks, often over 4% APY for your emergency fund. That’s your safety net. Without it, any market dip feels like a crisis. Then comes the decision: investing vs debt, choosing whether to put money into stocks or pay off credit cards and loans first. If your debt has a rate higher than 6%, paying it off usually wins. But if you have a 401(k) match, take that free money first—it’s an instant 100% return.

You don’t need a fancy advisor to get started. In fact, many financial pros make more money by selling you products than by helping you. That’s why fee-only advisor, a professional who gets paid only by you, not commissions from banks or brokers matters. They’re legally required to put your interests first. Most beginners don’t need one yet, but knowing the difference helps you avoid costly mistakes.

What you’ll find below isn’t theory. These are real, tested steps from people who started with $50 a month and built real security. You’ll see how to pick the right savings app, how to set your emergency fund goal based on your job and family, and how to avoid the traps that make new investors quit. There’s no magic formula—just clear choices, simple tools, and habits that stick. Whether you’re scared of the stock market or confused by fees, the posts here cut through the noise. You don’t need to be an expert to start. You just need to begin.