Joint Budget Calculator

Create Your Financial Team Plan

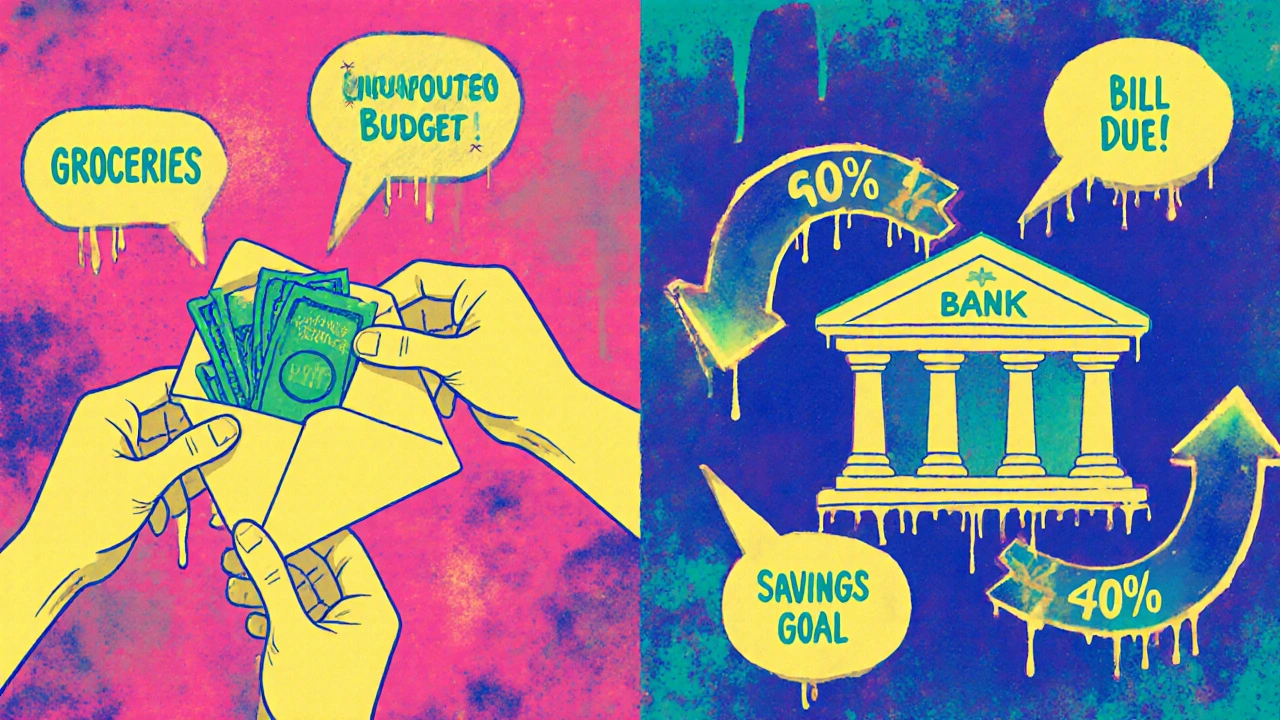

Calculate how to balance joint expenses and personal spending based on your income and lifestyle.

Money fights aren’t about money - they’re about trust

Over 38% of divorced couples say financial problems were a major reason their relationship ended. That’s not because one person spent too much on coffee or the other saved too little. It’s because money became a silent wedge - a source of resentment, secrecy, and misunderstanding. The problem isn’t income. It’s alignment.

Modern couples aren’t just sharing a home or a Netflix account anymore. They’re sharing bank accounts, bills, savings goals, and even how they think about spending. And for the first time, tools exist to make that collaboration easier - not harder. Shared wallets and joint budgets aren’t about losing independence. They’re about building a financial team.

How couples actually manage money today

There’s no one-size-fits-all approach. But if you look at real data from 5,000 households, a clear pattern emerges. The most popular system? The blended approach. About 57% of couples keep a joint account for shared expenses - rent, groceries, utilities - and maintain separate accounts for personal spending. This gives both people freedom to spend on hobbies, gifts, or coffee without asking permission, while still covering the basics together.

Another 28% pool everything. All income goes into one account. All expenses come out of it. It’s simple, but it only works if both partners are on the same page about spending habits. The remaining 15% keep everything completely separate. That’s usually because of past financial trauma, large income gaps, or deep distrust. But it often leads to more conflict down the line.

Here’s what works: autonomy within structure. Most successful couples set aside 15-25% of each person’s income as their own “no-questions-asked” money. That’s not a reward. It’s a boundary. It prevents small purchases from turning into power struggles.

Why traditional joint accounts fail

Most banks still treat joint accounts like legal contracts, not relationship tools. You open one, deposit money, and hope for the best. No alerts. No spending categories. No way to see who paid for what. OneUnited Bank calls this “more legal than it is useful.” And they’re right.

Imagine your partner buys a new guitar. You don’t know about it until the bank statement arrives. Or worse - you see it, assume it’s a luxury, and get upset. But maybe they’ve been saving for it for six months. Or maybe it’s for a side gig they’re starting. Without context, money becomes a mystery. And mystery breeds suspicion.

Modern apps fix this. They show real-time spending, send alerts when bills are due, and let you tag transactions so both people know why something was bought. It’s not about surveillance. It’s about awareness.

The top apps for couples - and what they actually do

There are dozens of apps out there. But only a few stand out because they solve real problems - not just make pretty charts.

- Honeydue: Best for beginners. It syncs with over 14,000 banks, sends bill reminders to both partners, and lets you split expenses manually. It’s free, simple, and has a 4.7/5 rating from nearly 20,000 users. Couples who used it say arguments dropped from 15 a month to just 2.

- YNAB (You Need A Budget): Best for serious budgeters. It uses zero-based budgeting - every dollar gets a job. It’s not cheap ($99/year), but 92% of users say it changed how they think about money. The shared budget feature lets two people edit the same plan, though syncing can glitch if both edit at once.

- Goodbudget: Best for talkers. It’s a digital version of the envelope system. You allocate cash to categories like “groceries” or “entertainment.” To spend, you move money between envelopes. It’s manual - which forces conversation. One user said, “Entering every purchase made us talk about why we were spending. It was awkward at first. Now it’s our favorite weekly ritual.”

- Lumio: Best for automators. It automatically splits bills based on income share - so if you make 70% of the household income, you pay 70% of the rent. It launched in the UK and expands to the US in early 2025. But some users hated that it didn’t let them customize splits. One said, “It felt unfair. I earn more, but I didn’t want to pay 70% of the Netflix bill.”

- Zeta Money Manager: Best for investors. It links to brokerage accounts, so you can track joint investments alongside daily spending. But the interface is clunky, and users give it only 3.8/5.

None of these apps are magic. They don’t fix bad communication. But they remove the noise. They turn “Why did you spend that?” into “Let’s look at this together.”

How to start - without making it a disaster

Don’t just download an app and call it a day. That’s how couples end up in therapy talking about transaction logs.

Follow this four-step process:

- Financial disclosure (3-7 days): Sit down and list everything - debts, savings, credit cards, pay stubs. No hiding. This is hard. But if you skip this, you’re setting yourself up for shock later.

- Choose your system (1-2 weeks): Try two apps. Use them side by side for a week. See which one feels less like work and more like help. Honeydue is easiest to start with. YNAB is best if you’re ready to change how you think about money.

- Set the rules (1 day): Decide together: What’s a joint expense? What’s personal? What’s the spending limit that needs a conversation? ($50? $100? $200?) What’s the personal allowance? (15-25% of income is the sweet spot.)

- Weekly check-ins (15 minutes): Every Sunday night, spend 15 minutes looking at the app together. Not to criticize. To celebrate. “We hit our savings goal!” “I didn’t touch my personal fund this week - I saved $80!”

That’s it. No spreadsheets. No lectures. Just two people checking in.

The hidden benefit: Less stress, more intimacy

Dr. Sonya Britt from Kansas State University found that couples using shared tools have 32% fewer money arguments. Why? Because transparency kills assumptions. When you can see where every dollar went, you stop guessing. You stop resenting. You start understanding.

Goodbudget users report 81% better money conversations. Not because the app talks for them - but because it gives them something real to talk about. “I didn’t know you were saving for that trip,” one partner said. “I didn’t know you were paying off your student loan,” said the other. That’s connection.

And it’s not just about avoiding fights. Couples using these tools are 72% more likely to reach joint goals - buying a house, paying off debt, retiring early. Because they’re working together, not against each other.

When apps make things worse

Not everyone wins. Some couples get stuck in automation traps.

Lumio’s automatic splitting confused people who earned uneven incomes. YNAB’s shared file conflicts took 45 minutes to fix. One couple said, “We spent more time fixing the app than talking about money.”

And then there’s the privacy fear. Thirty-two percent of users worry about data breaches. That’s real. Make sure any app you use is encrypted, follows GDPR or GLBA rules, and doesn’t sell your data.

But the biggest risk? Thinking the app replaces conversation. Certified Financial Planner Michael Stein says, “Over-automation can mask deeper issues.” If you’re using an app to avoid talking about why you’re mad about a $40 dinner, the app isn’t helping - it’s hiding the problem.

Tools should open doors, not lock them.

What to do if it’s not working

It’s okay to quit. If the app feels like a chore, if it’s causing more stress than relief, stop. Try a different system. Or go back to a simple spreadsheet. Or just talk.

Common reasons couples fail:

- They skip the disclosure phase and hide debts.

- They set rules but never review them.

- They use automation to avoid talking.

- They pick an app that doesn’t match their style - like forcing a manual system on someone who hates typing.

Success isn’t about using the fanciest app. It’s about showing up - consistently, honestly, and without judgment.

Where this is headed

The market for couple-focused financial tools is exploding. It was worth $4.2 billion in 2023. By 2026, it’ll be nearly $10 billion. Gartner predicts 65% of couples will use these tools by 2027 - up from 28% today.

Why? Because money stress is the #1 source of anxiety in relationships. And people are tired of fighting over it. They want tools that help them connect - not compete.

Companies are listening. Honeydue added investment tracking in late 2024. YNAB is building AI that predicts when spending patterns might cause conflict. Lumio is updating its algorithm to let users set custom income splits.

This isn’t just tech. It’s a cultural shift. Money isn’t a secret anymore. It’s a shared story.

Julia Czinna

October 31, 2025 AT 12:57Laura W

November 1, 2025 AT 19:32Astha Mishra

November 2, 2025 AT 11:31