Spending Limit Calculator

How Your Spending Should Be Controlled

Different spending types need different controls. This tool helps you set appropriate limits based on your team size and spending category.

Strategic Spend

Large planned purchases

Operational Spend

Daily business costs

Small Expenses

Scattered purchases

Your Team Size

Spending Type

Most companies don’t lose money because they spend too much on big projects. They lose it because dozens of small, untracked purchases add up - a $120 subscription no one remembers, a $300 team lunch paid with a personal card, a $750 software license bought without approval. These aren’t scandals. They’re symptoms of a broken system. Without clear spending controls, even well-run teams drift into financial chaos.

Why Spending Controls Matter More Than Ever

In 2025, companies that still rely on paper receipts, manual approvals, and Excel sheets to track spending are leaving money on the table - and risking compliance violations. Organizations with strong spending controls cut unnecessary expenses by 15-25% in their first year, according to Tipalti. That’s not theoretical. It’s real cash back into the bank.

But it’s not just about saving money. It’s about control. When every purchase has a rule, there’s less guesswork. No more arguments over whether a $400 conference ticket was approved. No more CFOs scrambling to explain why $12,000 was spent on random SaaS tools. Spending controls bring clarity. They turn finance from a reactive cleanup job into a proactive strategy.

And it’s not just for big corporations. Mid-sized teams with 50-500 employees are adopting these systems fastest. Why? Because they’re growing fast - and without rules, growth becomes expensive.

The Three Types of Spending (and How to Control Each)

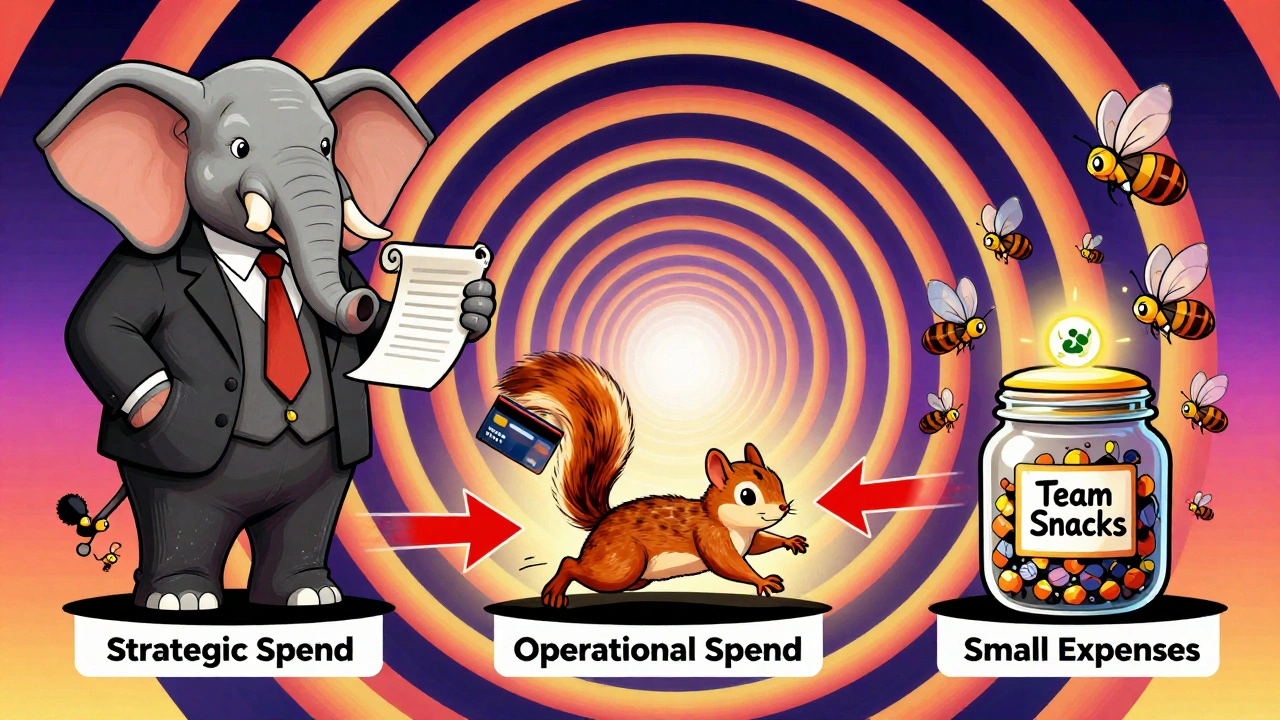

Not all spending is the same. Treating them all the same is why most policies fail. There are three distinct categories:

- Strategic spend: Large, planned purchases like software licenses, office leases, or equipment. These are usually handled through purchase orders and invoicing. Control here means requiring CFO or director-level approval before any contract is signed.

- Operational spend: The daily costs - travel, meals, office supplies, marketing ads, subscriptions. These happen constantly, often with corporate cards. This is where most leaks occur. Limits here need to be baked into the payment tool itself.

- Small, scattered expenses: Team perks, last-minute Uber rides, coffee runs, emergency repairs. These are the hardest to track. But they add up. A team of 20 people spending $25 each per week on snacks? That’s $2,600 a month. Without a policy, it’s invisible.

The key? Don’t use one rule for all. Strategic spend needs formal approvals. Operational spend needs automated limits. Small expenses need prepaid cards or pooled budgets with clear usage rules.

Smart Limits: The Game-Changer

Forget asking people to follow rules. Build the rules into the system.

That’s what “Smart Limits” do. They’re automated spending caps tied directly to cards, accounts, or apps. For example:

- Marketing team cards can’t exceed $500 per transaction without a second approval.

- Travel expenses over $1,200 trigger an alert to the finance manager.

- Subscription renewals above $200 require a 48-hour waiting period before auto-renewal.

One company with 300 employees cut policy violations by 43% after implementing Smart Limits. Why? Because the system stopped the violation before it happened. No one had to say no. The card just didn’t work.

Platforms like Spendesk, Volopa, and Zip let you set these limits by department, person, or category. You can even set time-based limits - like $1,000 per month for office supplies, reset on the first of each month.

Policy Without Enforcement Is Just a Document

Here’s the hard truth: 89% of companies have a written spend policy. Only 37% actually enforce it.

Why? Because policies are written by finance teams in isolation. Then they’re emailed to everyone and forgotten. No training. No reminders. No consequences.

Effective enforcement starts with involvement. Bring department heads into the policy design. Let them say, “We need $800 for client dinners” - then agree on the rules together. When people help make the rules, they follow them.

And leadership must model the behavior. If the CEO books a $3,000 flight without approval, the policy is dead. Enforcement only works when it’s consistent - from the intern to the founder.

Technology Is the Enabler - But Not the Solution

You don’t need the fanciest software. You need the right one.

Top platforms like Coupa, SAP Ariba, and Oracle handle enterprise needs with deep ERP integration. But for most teams, Spendesk or Volopa are better fits. They’re easier to set up, cheaper, and designed for real-world use.

Look for these features:

- Real-time spending visibility - can you see what’s being spent right now?

- Mobile app with receipt capture - no more lost receipts.

- Integration with your bank and accounting system - automatic syncing saves hours.

- Approval workflows - no more chasing signatures.

And make sure it connects to your existing tools. 92% of enterprise systems require SAP or Oracle compatibility. If your accounting software is QuickBooks or Xero, check if the platform supports it.

Don’t get fooled by flashy dashboards. The best tool is the one your team actually uses.

How to Roll It Out (Without Causing a Revolt)

Changing how people spend money is uncomfortable. People fear loss of freedom. You need a plan.

Here’s how to do it right:

- Start small. Pick one department - maybe marketing or sales - and pilot the system there. Show them the results.

- Train with real examples. Don’t read from a manual. Show them a receipt from last month that got rejected. Explain why. Then show how the new system would’ve handled it.

- Give a grace period. Let people use the old way for 2-3 weeks while the new system runs alongside. Then switch.

- Appreciate compliance. Publicly thank teams that follow the rules. Celebrate when someone says, “I didn’t buy that because the limit was too low.” That’s a win.

- Review quarterly. Adjust limits based on actual spending. If everyone’s hitting their $300 travel cap, raise it. If they’re always under, lower it. Policies should evolve.

Successful rollouts take 8-12 weeks. Rushing it causes resistance. Patience pays.

The Hidden Cost of Not Acting

What happens if you do nothing?

Expense processing costs $12.50 per invoice when done manually. With automation, it drops to $3.75. That’s $8.75 saved per transaction. Multiply that by 1,000 transactions a year? That’s $8,750 saved - just in labor.

And that’s not even counting fraud. According to Bill.com, 1 in 5 organizations experience internal financial fraud each year. Many start with small, unchecked expenses that grow.

Regulatory risks are real too. SOX compliance requires documented controls over spending. Auditors don’t care if you “didn’t know.” They care if you had a system - and ignored it.

By 2026, 85% of spend control systems will use AI to detect unusual spending patterns. If you’re not on that train, you’ll be left behind - not just financially, but operationally.

What Success Looks Like

Success isn’t about cutting every dollar. It’s about spending with intention.

When your team knows exactly what they can spend - and why - they make smarter choices. They stop asking, “Can I get away with this?” and start asking, “Is this the best use of our money?”

One manufacturing company with 1,200 employees cut unauthorized spending by 68% in six months. A tech firm with 450 employees slashed expense processing time by 72%. Both didn’t hire more staff. They just built rules into their tools.

That’s the goal. Not control for control’s sake. Control that frees people to do their jobs - without the fear, the chaos, or the receipts.

What’s the difference between spend control and budgeting?

Budgeting is about planning how much to spend in total - like setting a $50,000 annual marketing budget. Spend control is about enforcing how that money is spent - like blocking a $10,000 ad buy if it’s not approved, even if the budget isn’t full. Budgeting sets the goal; spend control ensures you don’t go off-track.

Can small businesses use spending controls?

Absolutely. In fact, small businesses benefit most. With fewer resources, every dollar counts. Tools like Volopa and Spendesk offer plans starting under $100/month. Even a simple rule - like “no purchases over $200 without manager approval” - used with a corporate card and receipt app, can cut waste by half.

How do I get leadership to buy in?

Show them the money. Run a 30-day audit of last quarter’s expenses. Highlight 5-10 unauthorized or duplicate purchases. Add up the cost. Then show how a spending control system would’ve prevented them. Finance leaders care about risk and efficiency - frame it that way.

What if employees hate the new system?

They probably don’t hate the system - they hate being treated like they can’t be trusted. Shift the message. Don’t say, “We’re locking you down.” Say, “We’re giving you freedom to spend without asking every time.” Show them how Smart Limits let them buy what they need instantly - without waiting for approval. Autonomy, not restriction, is the goal.

Do I need to replace my accounting software?

No. Most spend control tools integrate with QuickBooks, Xero, NetSuite, and Sage. Look for platforms that offer two-way sync - so every approved expense auto-posts to your books. Avoid tools that require manual data entry. That defeats the purpose.

How often should I update spending limits?

Review them every quarter. If a department consistently hits its cap, raise it. If they’re spending half of it, lower it. Limits should reflect actual needs, not guesses. Use real data - not gut feeling. Some platforms now auto-adjust limits based on spending trends, which makes this even easier.

Astha Mishra

December 4, 2025 AT 22:50It’s fascinating how we’ve come to treat financial discipline as a matter of compliance rather than cultural alignment. The real breakthrough isn’t in the software or the limits-it’s in the shift from fear-based control to trust-based autonomy. When people understand the ‘why’ behind the rules, they don’t see them as cages-they see them as guardrails that let them move faster. I’ve seen teams go from resenting expense reports to proudly sharing how they saved $200 by choosing a cheaper hotel because the system let them know upfront what was acceptable. That’s not policy enforcement. That’s empowerment. And it starts when leadership stops treating employees like children who need to be monitored and starts treating them like adults who want to do the right thing.

Graeme C

December 5, 2025 AT 12:43This is the most coherent, well-structured piece on spend control I’ve read in years. No fluff. No corporate buzzword bingo. Just cold, hard truth wrapped in actionable insight. The 89% vs 37% stat? That’s not a statistic-it’s a crime. Companies are literally burning cash because their finance teams are too lazy to enforce what they wrote down. And don’t even get me started on the ‘we’re not a big enough company’ excuse. My cousin runs a 42-person design studio in Manchester and they cut their monthly SaaS waste by 31% using Spendesk in two weeks. Stop using scale as an excuse. Start using systems. The tech is cheap. The willpower is what’s missing.

Laura W

December 6, 2025 AT 05:12Y’all are overcomplicating this. Smart Limits = game changer. Full stop. No more chasing receipts. No more ‘was this approved?’ drama. My team at the startup? We went from 17 pending approvals a week to 2. Why? Because the card just says NO if you’re over $500 on a vendor that isn’t pre-approved. No emails. No meetings. No guilt trips. And guess what? People still buy what they need-they just don’t waste $80 on expired Canva subscriptions anymore. This isn’t about control. It’s about removing friction so people can actually do their jobs. Also-yes, we use Volopa. And yes, it integrates with Xero. Stop overthinking it. Just implement it. Your finance team will cry tears of joy.

Kenny McMiller

December 8, 2025 AT 00:17Look, I get it-spending controls sound bureaucratic. But here’s the thing: the real bureaucracy isn’t the system. It’s the chaos. The 3 a.m. Slack messages asking if a $120 Zoom Pro license is okay. The CFO’s panic when the audit team shows up and finds 14 duplicate subscriptions. The intern who gets scolded for using their personal card because the company never gave them a better option. This isn’t about restricting freedom-it’s about removing the mental load of guessing. The best systems don’t say ‘no’-they say ‘here’s how you can say yes.’ And honestly? The fact that we’re even having this conversation in 2025 is wild. We automate everything else. Why is finance still stuck in 2008? Time to upgrade.