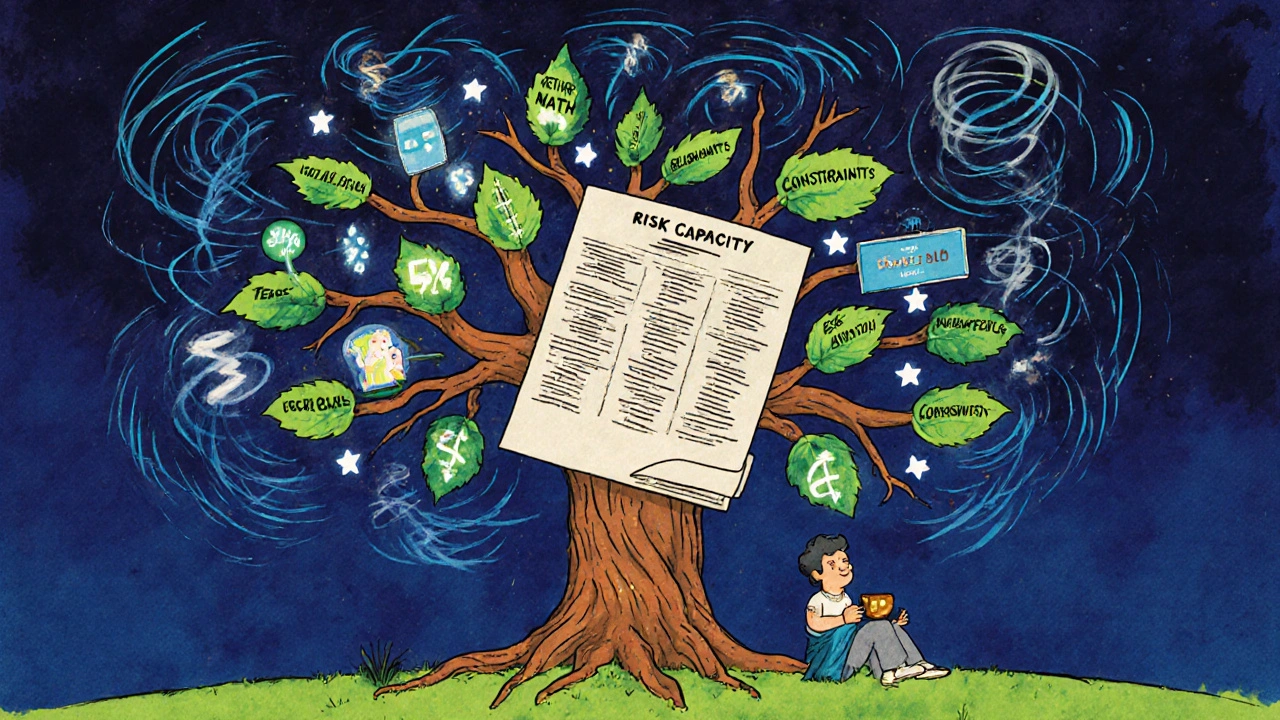

Risk Capacity Calculator

Risk Capacity Assessment

Calculate your financial ability to take investment risk based on your time horizon, income needs, and liquidity requirements.

Your Risk Capacity Score

This score reflects your financial ability to withstand market volatility, not your emotional comfort level.

Risk Level

Most people think an investment policy statement is just a fancy form that financial advisors hand them at the start of a relationship. But the truth? It’s the only thing standing between a client’s portfolio and emotional chaos during a market crash. Without a clear IPS, investors panic-sell in downturns, chase hot trends, or hold onto losers too long. With one? They stick to the plan-even when everything feels like it’s falling apart.

That’s why every registered investment advisor today builds an IPS-not as a box-ticking exercise, but as a living contract between discipline and desire. It’s not about what the client wants to hear. It’s about what their money actually needs to survive and grow over decades.

Start with Risk: Not What They Say, But What They Can Handle

When you ask a client, “How much risk are you comfortable with?” they’ll often say, “I can handle anything.” That’s not risk tolerance. That’s optimism. Real risk tolerance is measured by behavior under stress, not by survey answers.

Top advisors use tools like Riskalyze or FinaMetrica to generate a numeric risk capacity score between 1 and 100. These tools don’t just ask if you’d sleep at night-they simulate real market crashes. For example, a client might say they’re fine with 10% losses. But when shown a graph of what a 20% drawdown looked like in 2008 or 2020, many realize they’d have sold at the bottom.

There’s a difference between willingness to take risk and ability to take risk. A 65-year-old retiring next year has zero ability to ride out a 30% market drop, even if they say they’re “aggressive.” Their IPS must reflect that. Advisors who ignore this mismatch end up with clients who bail out at the worst possible time.

Return Objectives: Math, Not Magic

Everyone wants high returns. But high returns without a realistic path to get there are dangerous. A good IPS doesn’t say “aim for 8%.” It says, “You need 7.2% nominal return to fund your retirement at $65,000/year, accounting for 2.5% inflation, $1,200/year in fees, and a 1.5% real growth buffer.”

This formula comes straight from the Commonfund Institute: Spending Rate + Inflation + Real Growth + Fees = Required Nominal Return.

For a nonprofit endowment spending 5% annually, with 2% inflation, 1% real growth, and 1% fees, the required return is 9%. For a retiree spending 4% of their portfolio, with 2.5% inflation and 1% fees, the target is 7.5%. These aren’t guesses. They’re calculations rooted in actual cash flow needs.

Advisors who set arbitrary return goals-like “we’ll target 10%”-are setting clients up for failure. The market doesn’t owe anyone 10%. Historical data shows a 60/40 stock/bond portfolio returned 7.8% annually from 1926 to 2022-with 10.2% volatility. That’s the reality. The IPS must reflect it.

Constraints: The Hidden Rules That Keep Portfolios on Track

Constraints are the silent engines of portfolio discipline. They’re the rules that prevent drift, avoid tax traps, and protect against liquidity crises.

Here’s what a real constraint looks like:

- “Maintain at least 12 months of operating expenses in cash or cash equivalents.”

- “No individual stock position may exceed 5% of total portfolio.”

- “Rebalance quarterly if any asset class deviates more than ±5% from target allocation.”

- “Avoid investments in fossil fuel companies.”

Compare that to vague language like “maintain liquidity” or “diversify appropriately.” Those phrases mean nothing. They don’t guide action. They invite interpretation-and interpretation leads to deviation.

Institutional clients like foundations often have 12-15 constraints. Individuals typically have 5-8. But the key isn’t quantity-it’s precision. The CAIA Association found that 68% of institutional investors who defined liquidity quantitatively avoided cash crunches during 2020’s market stress. Those who didn’t? Many had to sell assets at fire-sale prices.

The Three-Horizon Framework: Aligning Time With Risk

Not all money has the same timeline. A client’s emergency fund, their child’s college fund, and their retirement nest egg all need different strategies. The best IPS separates these into three buckets:

- Short-term (1-3 years): Capital preservation. Cash, short-term bonds, CDs. No equities.

- Intermediate-term (3-10 years): Balanced growth. 40-60% stocks, 40-60% bonds. Moderate risk.

- Long-term (10+ years): Growth focus. 70-90% equities. Higher volatility, but time to recover.

This approach is used by 65% of top-performing advisors, according to the 2023 J.D. Power Financial Advisor Satisfaction Study. It works because it matches investment strategy to life goals-not just a single portfolio number.

For example, a 45-year-old with a 12-year-old child and a 30-year retirement horizon can allocate 10% to short-term (college fund), 30% to intermediate (paying for college), and 60% to long-term (retirement). Each bucket has its own risk profile, rebalancing rules, and performance benchmarks-all documented in the IPS.

Why Most IPS Documents Fail (And How to Avoid It)

Here’s the hard truth: 47% of IPS documents become outdated within six months of creation. Why? Because they’re static. They don’t adapt.

Common failures:

- No stress test: Only 31% of IPS documents specify maximum allowable drawdown during a crisis.

- Contradictory goals: 22% of IPS documents set return targets that are mathematically impossible given their stated risk level.

- No update schedule: 63% of small advisory firms never formally review their IPS after signing.

The fix? Build in review triggers:

- Annual review

- Major life event (job loss, divorce, inheritance)

- Regulatory change (like the 2023 SEC Marketing Rule)

- Market regime shift (e.g., sustained high inflation or interest rates)

And don’t just update it-document why. A 2024 Russell Investments study found that foundations updating their IPS annually outperformed static ones by 0.8% per year over a decade. That’s not magic. That’s discipline.

The New Rules: ESG, AI, and Regulation

The IPS isn’t frozen in 2010. It’s evolving.

Since 2023, the SEC requires advisors to tie return assumptions to historical data. You can’t claim “10% returns” without showing how that aligns with past performance of the assets you’re using. That’s forced a wave of template updates-78% of advisors revised their IPS in 2023 to comply.

ESG constraints are now standard. In 2024, 52% of institutional investors included environmental or social guidelines in their IPS. Not because it’s trendy-because clients demand it. Advisors who ignore this risk losing clients to firms that do.

And technology is changing how IPS are built. Platforms like Riskalyze, Orion, and Envestnet now auto-generate IPS drafts based on client inputs. AI tools are emerging to predict behavioral risk and flag contradictory parameters. By 2025, 38% of advisors plan to use AI-assisted IPS tools.

But tech doesn’t replace judgment. It enhances it. The best IPS still comes from a human who understands the client’s fears, hopes, and hidden assumptions.

What Happens When You Get It Right

A 2024 Vanguard study tracked 2,500 portfolios over 15 years. Those with a formal IPS and strict adherence delivered 1.2% higher annual returns than those without. Volatility was 15% lower. And clients? They stayed invested.

That’s the power of the IPS. It’s not a document. It’s a behavioral guardrail. It turns emotion into execution. It turns wishful thinking into a measurable plan.

When clients ask, “Why are we holding bonds when stocks are up?” the advisor doesn’t argue. They open the IPS. “Here’s what we agreed to. Here’s why. Here’s how we’ll adjust if needed.”

That’s not advice. That’s fiduciary responsibility.

What’s the difference between risk tolerance and risk capacity?

Risk tolerance is how comfortable someone feels with market swings-often emotional. Risk capacity is how much risk they can afford to take based on their financial situation, time horizon, and income needs. A young professional with a stable job may have high risk capacity even if they’re nervous about volatility. A retiree relying on portfolio income has low risk capacity, no matter how brave they sound.

Can an IPS guarantee better returns?

No. An IPS doesn’t guarantee returns. But it dramatically improves the chances of sticking to a strategy that delivers them over time. Vanguard’s 15-year study showed IPS-adherent portfolios outperformed by 1.2% annually-not because they were riskier, but because they avoided panic selling and emotional trading.

How often should an IPS be reviewed?

At least once a year. But also after major life events-job loss, divorce, inheritance, retirement-or major market shifts like sustained inflation or interest rate changes. The CFA Institute recommends formal reviews every 12 months, with informal check-ins quarterly.

Do I need an IPS if I’m not a high-net-worth client?

Yes. IPS aren’t just for millionaires. Anyone with a long-term financial goal-retirement, college, home purchase-benefits from a clear, written plan. The SEC’s Regulation Best Interest applies to all registered advisors, regardless of client wealth. An IPS protects you from yourself, no matter your account size.

What happens if my client disagrees with the IPS?

You don’t sign it until they understand it. Use visuals-charts showing historical drawdowns at different risk levels. Walk through worst-case scenarios. Show them what 7% returns look like over 20 years versus 10% fantasy returns. If they still insist on unrealistic goals, document their request and your warning in writing. Your fiduciary duty is to inform, not to enable.