Dividend Safety Analyzer

Assess Your Dividend Stock

Check if your dividend stock is a value trap or quality investment by entering key financial metrics.

Tip: Based on data from the article, a payout ratio above 80%, free cash flow coverage below 1.2x, or debt-to-equity above 50% are strong warning signs.

How much of earnings goes to dividends (e.g., 75 = 75%)

>80% = High risk

Free cash flow divided by dividend payments (e.g., 1.2 = 1.2x)

< 1.2 = High risk

Total debt divided by shareholder equity (e.g., 0.5 = 50%)

>50% = High risk

Enter your metrics and click Analyze to see if your stock is a value trap or quality investment.

When you see a stock paying 7% dividends, it’s tempting. That’s more than double what the S&P 500 offers. But what if that high yield isn’t a reward-it’s a warning? Every year, investors get burned chasing big payouts, only to watch their dividends get cut or their stock price collapse. The truth is, not all high-yielding stocks are created equal. Some are solid businesses. Others are value traps-companies that look cheap but are actually falling apart. The difference between making money and losing it comes down to one question: Are you chasing yield… or quality?

What Is a Value Trap in Dividend Investing?

A value trap is a stock that looks like a bargain because it’s cheap and pays a big dividend, but the underlying business is weakening. The company might be losing customers, drowning in debt, or seeing profits shrink. The high yield isn’t a sign of strength-it’s a sign of desperation. When a company can’t grow its earnings anymore, it often raises its dividend to keep investors interested. But if earnings keep falling, the dividend becomes unsustainable. Eventually, the company has no choice but to cut it. And when that happens, the stock price usually drops even further. In 2020, during the pandemic, nearly 18% of dividend-paying S&P 500 companies cut or suspended their payouts. Many of them were high-yield stocks. Investors who bought them for the income got slapped with a double hit: lower income and lower stock value. That’s the hallmark of a value trap.High Yield Dividends: The Allure and the Risk

High yield dividend strategies focus on stocks with the highest current payouts. Funds like the iShares Select Dividend ETF (DVY) or the WisdomTree U.S. High Dividend Index target companies with yields above 4%, sometimes even 5% or 6%. These are often found in sectors like utilities, real estate (REITs), energy, and telecoms-industries that generate steady cash flow but don’t grow quickly. On paper, this looks great. A 5% yield means you get $500 a year for every $10,000 invested. That’s better than most savings accounts. But here’s the catch: these stocks often trade at low prices because the market knows something’s wrong. Maybe the company’s revenue is declining. Maybe it’s borrowing heavily to pay the dividend. Or maybe its industry is being disrupted-like brick-and-mortar retail or traditional cable TV. Between 2013 and 2023, the WisdomTree U.S. High Dividend Index had an average yield of 4.5% to 5%. But it also had the lowest total returns of any major dividend index over that period. Why? Because the stock prices fell. The high yield didn’t make up for the losses in value. The market was punishing these companies for their weak fundamentals.High Quality Dividends: The Quiet Winner

Now consider companies like Visa, Microsoft, or Coca-Cola. These aren’t the highest yielders. Visa paid just 0.2% in dividends back in 2008. But here’s what happened: over the next 16 years, it raised its dividend every single year. By 2023, the yield on your original investment-called yield on cost-was over 12%. That’s not because the stock price went up. It’s because the company kept paying more. These are dividend growth stocks. They’re part of the S&P 500 Dividend Aristocrats Index, which tracks companies that have increased dividends for at least 25 consecutive years. As of 2024, only 65 out of 500 S&P 500 companies made the cut. That’s how hard it is to stay consistent. The beauty of this approach is that it rewards patience. You don’t get a big payout right away. But over time, your income grows. And because these companies have strong balance sheets, solid earnings, and low debt, they rarely cut dividends-even in recessions. During the 2020 crisis, dividend aristocrats cut payouts at less than half the rate of broader high-yield indices.

Why Quality Beats Yield Over Time

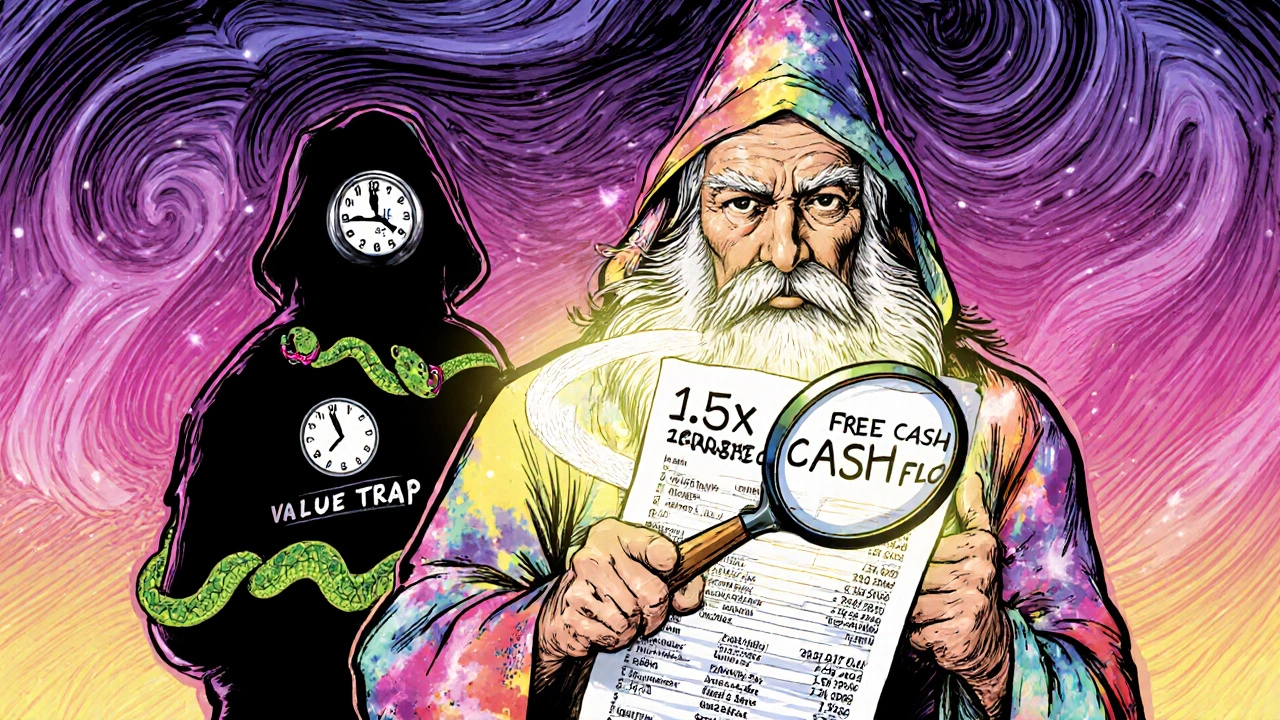

Let’s compare two real companies: Verizon and Visa. In March 2008, Verizon paid a 5.6% dividend. Visa paid 0.2%. If you invested $10,000 in each, you’d get $560 a year from Verizon and just $20 from Visa. At first glance, Verizon wins. Fast forward to 2023. Verizon’s dividend is still around $2.50 per share. It hasn’t grown much. Its yield on cost is now about 7.8%. Visa, on the other hand, raised its dividend every year. By 2023, it paid $3.24 per share. Your original $10,000 investment now generates $1,200 a year in dividends-that’s a 12% yield on cost. And Visa’s stock price? It’s up over 1,000% since 2008. That’s the power of quality. You don’t just get income-you get capital appreciation. And because these companies are profitable and growing, their dividends are safer. According to S&P Global, dividend aristocrats have lower debt-to-equity ratios and higher return on equity than high-yield stocks. They’re simply better-run businesses.How to Spot a Value Trap Before It’s Too Late

You don’t need to be a financial analyst to avoid value traps. Just check three things:- Payout ratio: This is how much of a company’s earnings go to dividends. If it’s over 80%, that’s a red flag. For most industries, a ratio under 60% is safe. If a utility company is paying out 90% of its profits as dividends, it’s barely keeping the lights on.

- Free cash flow coverage: Earnings can be manipulated. Cash flow can’t. Look at how much free cash flow the company generates compared to its dividend payments. If it’s less than 1.2x, the dividend is at risk. A ratio of 1.5x or higher is ideal.

- Debt levels: High debt + low earnings growth = trouble. Check the debt-to-equity ratio. If it’s above 50%, especially in a cyclical industry, be cautious. S&P’s data shows high-yield stocks have an average debt-to-equity of 49.6%. Dividend aristocrats are at 40.4%-a big difference.

When High Yield Might Make Sense

This isn’t to say high yield is always bad. There are times it works. If you’re retired and need income right now, a high-yield stock or ETF can help cover bills. If interest rates are falling and you believe the economy is stabilizing, value stocks often rebound. Some value investors, like Tweedy, Browne, argue that high-yield stocks are trading at 22% discounts to their 10-year averages-making them attractive for patient buyers. But here’s the catch: you need to know what you’re buying. Don’t just pick the highest yielder. Look for companies with stable cash flows, low debt, and a clear path to recovery. Think of it like buying a house in a bad neighborhood-it might be cheap, but you better know if the neighborhood is getting better.How to Build a Dividend Portfolio That Lasts

If you want to avoid value traps and build lasting income, here’s what to do:- Start with dividend growth: Focus on companies with 10+ years of consecutive dividend increases. Look at the S&P 500 Dividend Aristocrats list.

- Use relative yield: Don’t just look at today’s yield. Compare it to the stock’s historical average. If a stock’s yield is 30% higher than its 10-year average, it might be undervalued-not just risky.

- Reinvest dividends: That’s where the real magic happens. A $10,000 investment in the S&P 500 in 1993 grew to $182,000 with dividend reinvestment. Without it? Just $102,000. That’s $80,000 extra from compounding.

- Diversify across sectors: Don’t pile into just REITs or utilities. Spread your holdings across healthcare, tech, consumer staples, and industrials.

- Be patient: Dividend growth takes time. Visa didn’t turn into a 12% yield-on-cost stock overnight. It took 16 years. But the returns were worth the wait.

The Bottom Line

Chasing high yields is like chasing a fast car-you think you’re winning until you hit a pothole. And in dividend investing, the pothole is a dividend cut. High quality dividend growth stocks don’t flash bright lights. They don’t scream for attention. But they quietly build wealth. They raise your income year after year. They survive recessions. And over time, they outperform. In 2024, investors poured $18.7 billion into dividend growth ETFs and just $2.3 billion into high yield funds. That’s not an accident. It’s a vote of confidence from smart money. The market is waking up: yield without quality is a trap. Quality with growth is a treasure.Don’t look for the highest yield. Look for the most sustainable one. Because in dividend investing, the best returns don’t come from what you earn today-they come from what you’ll earn tomorrow.

What’s the difference between high yield and high quality dividends?

High yield dividends focus on stocks with the highest current payout percentages, often above 4-5%. These are usually from mature or struggling companies. High quality dividends come from companies with a long history of increasing payouts-often 25+ years-and prioritize sustainable earnings growth over immediate income. Quality stocks typically have lower yields (2-3%) but grow their dividends annually, leading to higher long-term income and lower risk of cuts.

How do I know if a high-yield stock is a value trap?

Check three things: First, look at the payout ratio-anything over 80% is risky. Second, examine free cash flow coverage-if it’s less than 1.2x the dividend, the payout isn’t secure. Third, review debt levels. A debt-to-equity ratio above 50% combined with flat or falling earnings is a warning sign. Also, ask why the yield is high. If the stock price dropped because the business is declining, it’s likely a trap.

Can high yield dividends be part of a good portfolio?

Yes, but only if used carefully. High yield stocks can provide immediate income, which helps retirees or those needing cash flow now. But they should be a small part of your portfolio and only include companies with stable cash flows, low debt, and clear business models. Avoid REITs or energy firms with high yields if they’re in declining industries. Always pair them with dividend growth stocks for balance.

Why do dividend growth stocks outperform over time?

Because they’re better-run companies. They have strong balance sheets, consistent earnings growth, and low debt. Their ability to raise dividends year after year signals confidence in future profits. This leads to higher stock prices over time. Plus, reinvesting growing dividends compounds returns dramatically. A $10,000 investment in Visa in 2008 grew to over $180,000 by 2023-not just because of price gains, but because the dividend income kept rising.

Should I reinvest my dividends?

Absolutely. Reinvesting dividends is the single biggest factor in long-term wealth building for dividend investors. From 1993 to 2023, reinvesting dividends turned a $10,000 S&P 500 investment into $182,000. Without reinvestment, it would have been just $102,000. That’s an extra $80,000 from compounding. Even small, growing dividends add up fast when reinvested over decades.

What ETFs should I consider for dividend growth?

Look at the ProShares S&P 500 Dividend Aristocrats ETF (NOBL), which tracks companies with 25+ years of dividend increases. The WisdomTree U.S. Quality Dividend Growth Index ETF is another solid option, focusing on high-quality firms with growing dividends and moderate yields. Avoid funds labeled as "high yield" unless you’ve done deep research on their holdings. Stick to ETFs that emphasize consistency, not just current payout.

Dave McPherson

November 7, 2025 AT 08:57Let’s be real-chasing 7% yields is the financial equivalent of dating someone who’s great in bed but ghosted you after three weeks. You’re not investing, you’re gambling with grandma’s retirement fund. I’ve seen this movie before: ‘Oh look, a 9% dividend from a coal company that’s being buried by renewables!’ Spoiler: the dividend gets cut, the stock becomes a pumpkin, and you’re left holding the bag while the CEO buys a yacht. Dividend aristocrats? Now that’s a long-term relationship. Visa didn’t give me $1,200 a year because it was desperate-it gave it to me because it’s a cash-printing machine with a conscience. Yield without quality is just a trap with a nice logo.

RAHUL KUSHWAHA

November 7, 2025 AT 12:27Thank you for this. 😊 I live in India where many people think high dividend = good investment. But after reading this, I checked my portfolio-two stocks had payout ratios over 90%. I sold one last week. Still learning, but this helped me avoid a mistake. 🙏

Julia Czinna

November 7, 2025 AT 15:35There’s something quietly powerful about dividend growth investing that doesn’t get enough attention-it’s not about the money you make today, it’s about the dignity of consistency. Companies that raise dividends annually aren’t just profitable; they’re disciplined. They’re not gaming the system with debt-fueled payouts. They’re building something that outlasts market cycles. And yes, it takes patience. But patience isn’t passive-it’s strategic. Reinvesting dividends over 15 years isn’t ‘waiting for luck’-it’s compound interest doing the heavy lifting while you sleep. The real win? Knowing your income won’t vanish when the next recession hits. That peace of mind? Priceless.