Financial Advisor Fee Comparison Calculator

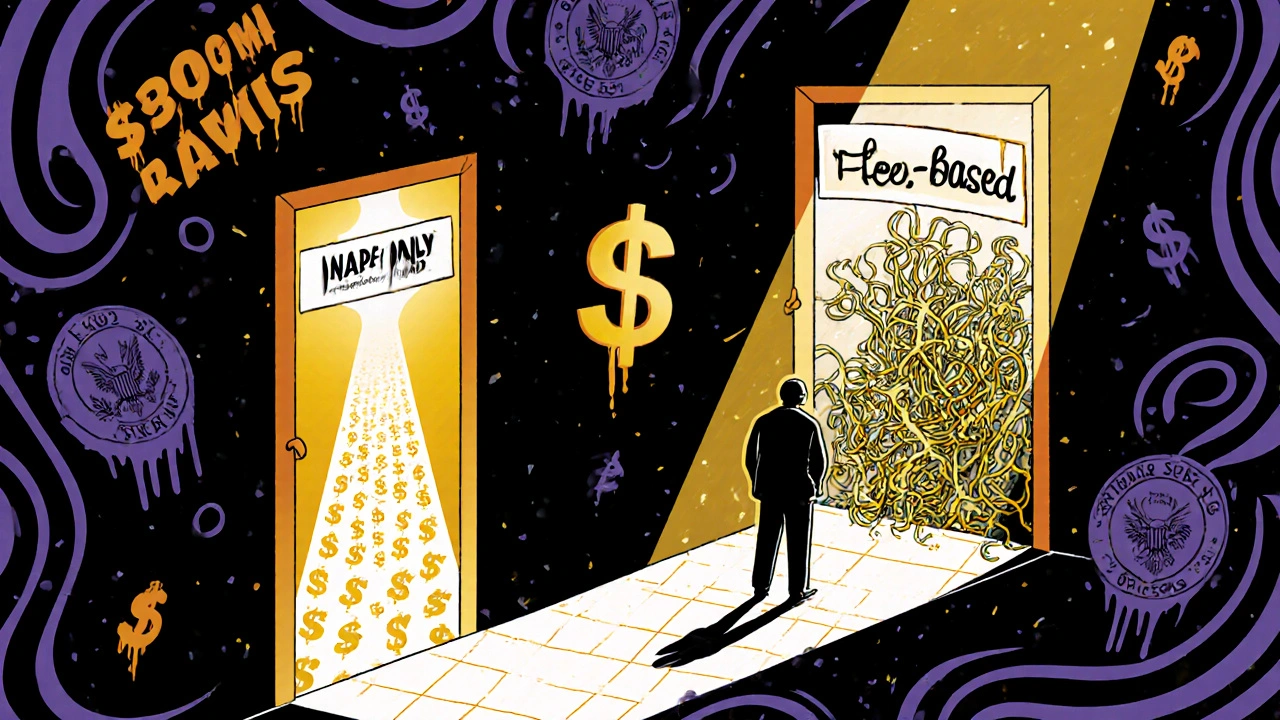

Compare the long-term costs of fee-only versus fee-based advisors based on your investment size, fees, and time horizon.

Why this matters: Fee-based advisors often include hidden commissions that can significantly reduce your returns over time. This calculator shows how these costs add up.

Fee-Only Advisor

Total Fees: $0.00

Annual Fee: $0.00

Fee-Based Advisor

Total Fees: $0.00

Annual Fee: $0.00

Cost Difference

Over 1 years, you'll pay $0.00 more with fee-based advisors.

This represents the difference in fees due to hidden commissions in fee-based models.

The article states: "A 0.35% annual fee gap can cost you over $100,000 in lost growth on a $500,000 portfolio." Your results may vary based on your specific inputs.

When you hire a financial advisor, you’re trusting them with your money, your future, and sometimes your family’s security. But not all advisors are built the same. Two common models-fee-only and fee-based-sound similar, but they’re worlds apart in how they’re paid, what they’re legally required to do, and how much they might be pushing products that benefit them instead of you.

What Does ‘Fee-Only’ Really Mean?

A fee-only financial advisor gets paid one way: directly from you. No commissions. No kickbacks. No hidden payments from mutual fund companies, insurance providers, or brokerage firms. Their income comes from clear, upfront fees-whether that’s a percentage of your assets under management (usually 0.25% to 1% per year), an hourly rate ($150-$300/hour), or a flat fee for a complete financial plan ($1,500-$5,000). This model was created in the 1980s by the National Association of Personal Financial Advisors (NAPFA) to fix a broken system. Before then, many advisors earned money by selling you products-like annuities or mutual funds with high fees-whether they were right for you or not. Fee-only advisors swear off that entirely. NAPFA’s rules are strict: members must sign a fiduciary oath and prove they receive no compensation from anyone but the client. That’s not just a nice policy. It’s a legal standard. Fee-only advisors are typically Registered Investment Advisors (RIAs), regulated under the Investment Advisers Act of 1940. That means they’re legally required to act as a fiduciary. In plain terms: they must put your interests above their own. If they recommend a stock, a fund, or a retirement strategy, it has to be the best choice for you-not the one that pays them the most.How Fee-Based Advisors Get Paid (And Why It Matters)

Fee-based advisors mix two payment streams: they charge you a fee for advice, but they also earn commissions from selling financial products. Think of it like a doctor who charges you for a consultation but also gets paid every time they prescribe a specific brand of medicine. This dual structure creates a conflict of interest. When they’re giving you advice as an advisor, they’re supposed to be a fiduciary. But when they’re selling you an insurance policy or a mutual fund, they switch to the “suitability standard.” That’s a much lower bar. Under suitability, they only have to prove the product is “appropriate” for you-not necessarily the best or cheapest option. For example, a fee-based advisor might recommend a mutual fund with a 5% upfront sales charge (a load) because their firm pays them a commission for it. A fee-only advisor wouldn’t even consider that fund, because they can’t accept that commission. According to a 2021 Vanguard study, clients working with fee-based advisors paid, on average, 0.35% more per year in hidden fees because of these embedded commissions. The SEC’s Regulation Best Interest (Reg BI), which took effect in 2020, tried to clean this up. But it didn’t eliminate the conflict. Fee-based advisors can still operate under two standards depending on the task. That’s why you need to ask: “When you’re recommending this product, are you acting as a fiduciary-or as a broker?”Fiduciary Duty: The Core Difference

Fiduciary duty isn’t a buzzword. It’s a legal obligation. If someone is your fiduciary, they’re required by law to act in your best interest. That means avoiding conflicts, disclosing everything, and choosing options that help you-even if they make less money. Fee-only advisors are always fiduciaries. Full stop. No exceptions. Fee-based advisors? Only sometimes. When they’re giving advice for a fee, they’re fiduciaries. But when they’re selling you a product that pays them a commission, they’re not. And most clients don’t realize they’ve switched gears. The CFP Board made all Certified Financial Planners fiduciaries starting January 1, 2020. But that doesn’t change how they’re paid. A CFP can still be fee-based-and still earn commissions on insurance or annuities. So certification alone doesn’t guarantee pure fiduciary behavior. You have to look at the compensation model. A 2022 CFP Board study found that 87% of financial planners believe fee-only advisors give more objective advice. Why? Because their income doesn’t depend on what you buy.Transparency and Disclosure: What to Look For

You can’t trust a handshake. You need paperwork. Every advisor-whether fee-only or fee-based-must file Form ADV with the SEC or their state regulator. Part 2A of this form is where they describe how they’re paid. Look for Section 7: “Compensation.” If it says “We receive fees only from clients,” you’re likely dealing with a true fee-only advisor. If it says “We receive advisory fees and commissions from product sales,” you’re dealing with a fee-based advisor. Don’t just take their word for it. Go to the SEC’s Investment Adviser Public Disclosure (IAPD) website and pull up their Form ADV. Type in their name or CRD number. Read it yourself. If you see phrases like “referral fees,” “revenue sharing,” or “12b-1 fees,” walk away. Those are red flags. NAPFA has a public directory of fee-only advisors who’ve passed a third-party audit to prove they don’t take any commissions. You can find them at FeeOnlyNetwork.com. That’s the gold standard.

Who Should Choose Which Model?

There’s no one-size-fits-all answer, but here’s how to think about it:- Choose fee-only if: You want pure, conflict-free advice. You’re focused on long-term investing, retirement planning, or tax efficiency. You value transparency over convenience. You have $100,000 or more to invest. Fee-only advisors typically serve clients with $500,000+ in assets, and their fees scale with your wealth-so you pay less as you grow.

- Consider fee-based if: You need integrated services like life insurance, long-term care coverage, or annuities bundled with investment advice. You have less than $100,000 in investable assets and can’t afford a fee-only advisor’s minimums. You’re okay with paying a little more for convenience-and you’ve verified they disclose every commission clearly.

The Hidden Costs of Fee-Based Models

Most people don’t realize how much they’re paying in hidden fees. A mutual fund with a 5% sales load means you lose $5,000 on a $100,000 investment before it even starts earning. Trailing commissions-annual payments of 0.25% to 1%-keep flowing to the advisor every year you hold the fund, even if it underperforms. A fee-only advisor might charge you 0.5% per year on that same $100,000. That’s $500. No hidden loads. No trailing commissions. No surprise bills. Over 20 years, that difference compounds. A 0.35% annual fee gap can cost you over $100,000 in lost growth on a $500,000 portfolio, according to a simple compound interest calculation. That’s not theoretical. It’s math.What Experts Are Saying

Harold Pollack, a professor at the University of Chicago and author of The Index Card, says: “The only way to ensure your advisor is truly working for you is to verify they are both fee-only and a fiduciary-anything else creates potential conflicts that can erode your returns over time.” Michael Kitces, a top financial planning researcher, adds nuance: “A skilled fee-based advisor who minimizes commissions and discloses everything can still serve clients well.” But he also admits: “Fee-only is the ideal model because it removes the temptation entirely.” The SEC agrees. Their 2023 Examination Priorities list “potential conflicts in dual-registrant firms” as a top enforcement area. That means regulators are watching fee-based advisors closely-and cracking down on those who hide commissions or misrepresent their duties.

How to Protect Yourself

Here’s what to do right now:- Ask: “Are you a fiduciary at all times, no matter what service you’re providing?”

- Ask: “Do you ever earn commissions from products you recommend?”

- Ask: “Can I see your Form ADV Part 2A?”

- Check the SEC’s IAPD website to verify their registration and disclosures.

- Look for NAPFA membership or FeeOnlyNetwork.com verification.

- If they hesitate, avoid them.

Graeme C

October 31, 2025 AT 14:22Let’s be real-this is the most important financial decision most people never think about until it’s too late. I used to work with a ‘fee-based’ guy who swore he had my best interests at heart. Then I found out he was pushing me into a mutual fund with a 5.75% load because it gave him a $7,500 kickback. I didn’t even know what a ‘load’ was. That’s not advice. That’s exploitation dressed up as finance. Fee-only isn’t just preferable-it’s non-negotiable. If your advisor can’t show you their Form ADV and explain every line without hesitation, fire them. Today. No exceptions.

And stop trusting titles like ‘CFP’ or ‘Wealth Manager.’ Those are marketing buzzwords. What matters is whether they get paid by you-or by the company selling the product. The system is rigged. Don’t be the sucker who lets it work on you.

I’m not mad. I’m just done being naive.

Astha Mishra

November 1, 2025 AT 11:40While I appreciate the clarity of this post, I find myself reflecting on the deeper philosophical implications of trust in financial systems. In a world where incentives are so deeply embedded in professional conduct, can any model truly eliminate moral hazard? The fee-only model appears ideal, yet even here, one might question: what if the advisor becomes too reliant on asset-under-management fees and thus subtly discourages clients from withdrawing funds-even when it’s financially prudent?

And what of the individual who earns less than $100,000 annually? Are they condemned to the murky waters of fee-based advisors simply because the fee-only model is economically inaccessible to them? Is this not a systemic failure of financial democratization?

Moreover, the notion that fiduciary duty is a legal shield feels somewhat illusory when enforcement remains inconsistent and litigation prohibitively expensive for the average person. Perhaps what we truly need is not just better models, but a cultural shift-where financial advice is treated not as a commodity, but as a public good, akin to education or healthcare.

I do not mean to diminish the value of this post; on the contrary, it is a vital step. But we must ask: who benefits when the solution is individual vigilance rather than structural reform? The system rewards those who can navigate its complexities. The rest are left to guess.

Still, I thank you for illuminating the path. Even if the road is long, at least now I know which direction to walk.

Kenny McMiller

November 2, 2025 AT 04:49Bro. This is 100% spot on. Fee-based is just a fancy way of saying ‘I get paid when you buy stuff.’ It’s like a car salesman who also owns the dealership. You think they’re giving you honest advice about the Camry vs. the Accord? Nah. They’re pushing the one with the biggest commission.

And yeah, Reg BI? Total loophole. ‘Suitability’ is the legal version of ‘eh, close enough.’ Meanwhile, fee-only advisors? They don’t care if you buy a fund or not-they care if your portfolio grows. Their income is tied to your success. That’s alignment. That’s integrity.

Also, stop trusting CFPs unless they’re NAPFA. I’ve seen CFPs selling annuities with 7% commissions and calling it ‘retirement security.’ Bullshit. You’re locking your money up for 10 years so they can cash in. Read Form ADV. If it says ‘revenue sharing’ or ‘12b-1,’ run. Don’t even ask. Just go to FeeOnlyNetwork.com. It’s free. It’s verified. It’s your only real shot at not getting screwed.

And if you’re under $100k? Start with a robo-advisor. Better than a fee-based human who’s just trying to hit quota.