Time Horizon Portfolio Calculator

Investment Calculator

What's This For?

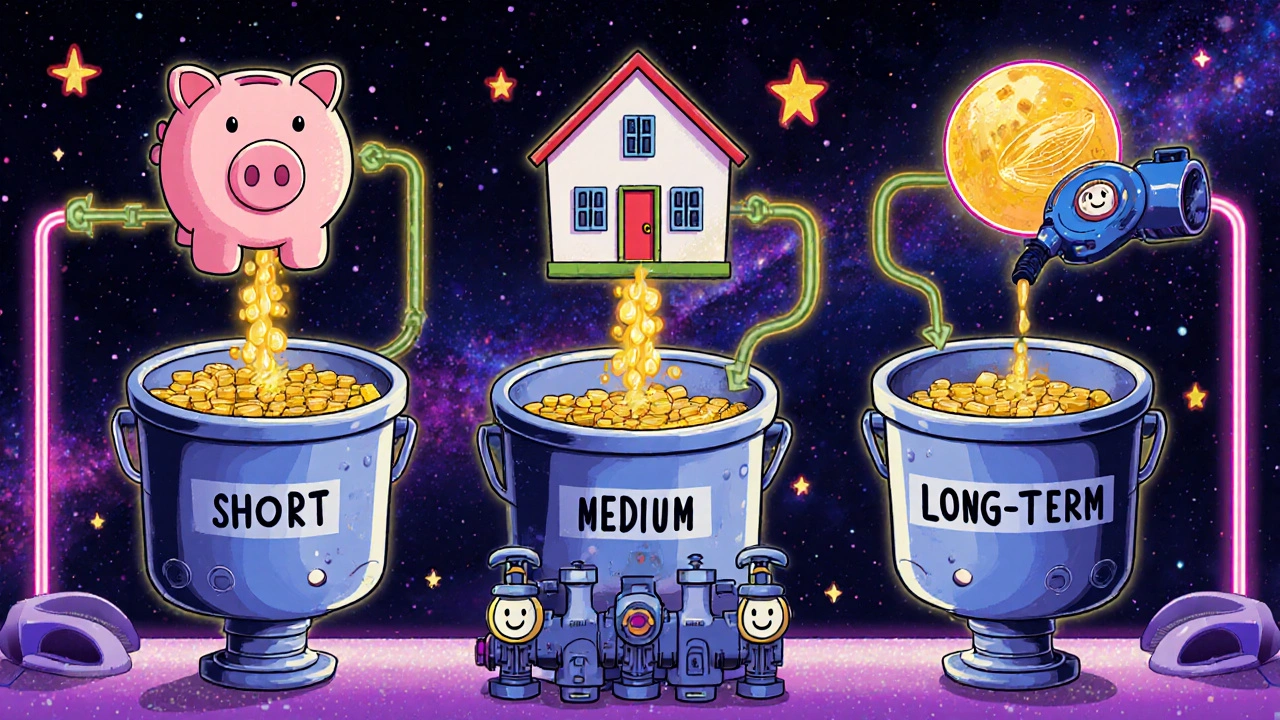

This calculator helps you allocate your investments based on your time horizons, following the 60-25-15 rule recommended in the article.

Short-term (under 3 years)

Safety and liquidity for immediate needs like emergencies or upcoming expenses. Your money should be stable and accessible.

Medium-term (3-7 years)

Steady growth for goals with clear deadlines. Balance between safety and growth.

Long-term (7+ years)

Let compounding work for you. Your money can grow with market ups and downs.

Your Allocation

Why Your Money Needs More Than One Home

Most people think investing means picking one good stock, putting money in a 401(k), and forgetting about it. But that’s like putting all your clothes in one drawer-sure, you can find a shirt, but what happens when you need socks, a jacket, and your workout gear all at once? That’s where time horizon diversification comes in. It’s not about chasing the highest return. It’s about matching your money to your life.

Think of your finances like a ladder. At the bottom, you need cash you can grab right away-maybe for a broken furnace or a surprise medical bill. Midway up, you’ve got money set aside for goals like a car down payment or a wedding in three years. At the top, you’ve got your long-term pile, the one you don’t touch for a decade or more, growing quietly while you sleep. Each rung serves a different purpose. And if you skip one, you’re not just leaving money on the table-you’re risking your whole plan.

What Counts as Short-, Mid-, and Long-Term?

Here’s the problem: everyone defines these terms differently. Some say short-term is under one year. Others say three. Long-term? Five years? Ten? It’s messy. But for practical investing, here’s what works based on real-world data and advisor practices:

- Short-term (under 3 years): Money you’ll need soon. This isn’t for growth. It’s for safety. You can’t afford to lose 10% when your kid needs braces next month.

- Medium-term (3-7 years): Goals with a clear deadline. Buying a house in five years? Paying for a certification? This is where you want steady growth without the rollercoaster.

- Long-term (7+ years): Retirement, generational wealth, or anything you won’t touch for a decade. This is where the market’s ups and downs don’t matter as much-because you have time to ride them out.

Here’s the catch: the IRS says anything held over a year is “long-term” for tax purposes. That’s not what financial planners mean. Don’t let tax jargon fool you. Your real time horizon is about your life, not the tax code.

What to Put in Each Bucket

Not all assets belong in every bucket. Putting crypto in your emergency fund? Bad idea. Keeping cash in a savings account for retirement? That’s inflation suicide.

Short-term bucket: You want safety and liquidity. That means:

- Money market funds (yielding 4.8-5.2% as of late 2025)

- U.S. Treasury bills (T-bills)

- High-yield savings accounts

- Short-term CDs (under 12 months)

These don’t grow fast-but they don’t crash either. Fidelity’s data shows money market funds kept 99.8% of their value during the 2022 market drop. That’s the whole point.

Medium-term bucket: You want growth, but with less risk than stocks. This is where bonds and dividend stocks shine:

- Investment-grade corporate bonds (Barclays Aggregate Index returned 3.7% annually from 2020-2024)

- REITs (real estate investment trusts) with steady payouts

- Dividend-paying blue-chip stocks (like Coca-Cola or Johnson & Johnson)

- Target-date funds with 5-7 year maturity dates

BlackRock found that a 60/40 stock-bond mix in this range delivered 5.8% annual returns with 40% less volatility than pure stocks. That’s the sweet spot for goals you can’t afford to miss.

Long-term bucket: This is where you let compounding do the heavy lifting. Historically, the S&P 500 returned 10.2% annually from 1926 to 2024. That’s the engine of wealth. But you need to stay in it:

- Low-cost index funds (Vanguard S&P 500 ETF, for example)

- Global equity funds

- Real estate (direct ownership or REITs)

- Private equity or venture funds (if you qualify)

J.P. Morgan found that 94% of 10-year S&P 500 holding periods ended in profit. But only 52% of one-year periods did. Time isn’t just a factor-it’s your best defense.

The 60-25-15 Rule That Works

There’s no magic number for everyone. But Morningstar’s backtesting across 20 economic cycles since 1950 found one allocation stood out: 60% long-term, 25% medium-term, 15% short-term. That mix delivered the best risk-adjusted returns-measured by the Sharpe ratio of 0.87.

What does that mean in real dollars? Let’s say you have $100,000 to invest:

- $60,000 → long-term (index funds, global stocks)

- $25,000 → medium-term (bonds, REITs)

- $15,000 → short-term (T-bills, money market)

Now, if your car dies and you need $8,000? You take it from the $15k bucket. No need to sell stocks at a loss. If your kid goes to college in four years? You use the $25k bucket. And your retirement? Still growing untouched.

Vanguard’s research shows portfolios using this approach had 23% lower volatility during the 2022 downturn and kept 87% of the long-term growth potential. That’s not luck-it’s design.

Why People Fail at This (And How to Avoid It)

Most failures aren’t about bad markets. They’re about bad habits.

Horizon creep: You planned to buy a house in three years. The market’s hot. You think, “I’ll wait a year.” Now it’s five years later, and you’ve moved that money into stocks. You’re now exposed to a 20% drop right before you need the cash. Charles Schwab found 31% of investors do this.

Emotional selling: When the market drops, people panic. But if your short-term bucket is full, you don’t have to sell your long-term holdings. Northwestern Mutual found people using time horizon buckets kept 87% of their planned contributions during the 2022 bear market. Those without buckets? Only 68%.

Wrong asset choices: Putting CDs with 3-year terms into a “medium-term” bucket is a trap. If rates jump, you’re locked in. One Reddit user lost $8,400 because his 7-year CD paid 3.8% while new ones paid 6.5%. That’s opportunity cost you can’t get back.

Ignoring taxes: Selling assets to rebalance triggers capital gains. Many robo-advisors don’t explain this. FINRA’s 2025 review found 63% of horizon-based tools fail to warn users about tax consequences.

How to Build Your Own Time Horizon Portfolio

Start simple. Follow these steps:

- Assess your cash needs. Do you have 3-6 months of living expenses in true cash? Not a bond fund. Not a Roth IRA. Actual cash equivalents. If not, build that first.

- List your goals with deadlines. What do you need money for, and when? Emergency fund? Down payment? Retirement? Write them down with dates.

- Assign each goal to a bucket. If it’s under 3 years, it’s short-term. 3-7 years? Medium. 7+? Long-term.

- Choose the right assets for each bucket. Use the examples above. Don’t guess.

- Set up automatic contributions. Even $50 a week into each bucket adds up.

- Rebalance once a year. If your long-term bucket grew to 70% because the market surged, sell 10% and move it back to medium or short-term. Do it when allocations shift by 15% or more.

Vanguard found it takes the average investor 4.7 hours to set this up. That’s less than one workday. The payoff? Years of peace of mind.

What’s Changing in 2025

This isn’t static. The tools are getting smarter.

BlackRock’s new tool, HorizonIQ, watches for life events-like a mortgage application-and automatically shifts money from long-term to medium-term. Goldman Sachs now offers 12 time buckets, not three. Need $10k for a vacation in six months? There’s a bucket for that.

Robo-advisors like Betterment and Wealthfront are leading the charge. Their users give them 4.3 out of 5 stars, mostly because they “just work.” But even these tools have flaws. Nearly 30% of negative reviews complain that the system doesn’t adjust when life changes-like a job loss or a divorce.

And regulators are catching up. The SEC’s Regulation Best Interest now requires advisors to consider time horizon in every recommendation. The DOL’s fiduciary rules demand documentation. That’s good. It means you’re less likely to get sold a risky stock as a “safe” retirement investment.

Is This Right for You?

Yes-if you have more than one financial goal. No-if you’re only saving for retirement and nothing else.

Gen Z investors hold 52% of their assets in short-term vehicles. Boomers? Only 28%. Why? Younger people have more immediate needs: rent, student loans, car repairs, travel. Older people have fewer surprises and more time. Your life stage matters.

And if you’re the type who checks your portfolio every day? Time horizon diversification is your antidote. You won’t panic when the market drops because you know the money you’re using next year isn’t even in stocks.

This isn’t about getting rich quick. It’s about not losing what you’ve built. It’s about sleeping well when the news is bad. It’s about having the money when you need it-without sacrificing your future.

Frequently Asked Questions

Can I use the same account for all time horizons?

Technically, yes-but it’s a bad idea. Mixing goals in one account makes it hard to track progress and increases the risk of emotional decisions. Use separate accounts or clearly labeled buckets within your brokerage. Fidelity, Schwab, and Vanguard all let you create custom portfolios with labels like "Emergency Fund" or "House Down Payment." Use them.

What if I need money from my long-term bucket early?

That’s a red flag. It means your short- or medium-term buckets weren’t big enough. If you’re forced to sell stocks during a downturn, you lock in losses. The goal is to avoid this entirely by planning ahead. If you’ve already done it, rebuild your short-term bucket first. Don’t touch long-term again until you’ve replaced what you took.

Do I need to rebalance every year?

Not necessarily. Rebalance only when allocations drift by 15% or more from your target. That usually happens every 11 months on average. Setting a calendar reminder for January 1st each year is enough for most people. Don’t overdo it-too much trading raises costs and taxes.

Is this strategy better than target-date funds?

Target-date funds are great for 401(k)s-they automatically adjust over time. But they’re one-size-fits-all. Time horizon diversification lets you customize. If you’re saving for a house in 4 years and retirement in 20, a target-date fund won’t separate those goals. With time horizon buckets, you control exactly how much goes where.

Can I start this with just $5,000?

Absolutely. You don’t need a lot to start. Put $1,000 in a high-yield savings account (short-term), $2,000 in a bond ETF like BND (medium-term), and $2,000 in an S&P 500 index fund (long-term). That’s a real portfolio. Add to it every paycheck. Consistency beats size.

What if interest rates keep rising?

Rising rates hurt bond prices in the short term-but they help new investments. If you’re using short-term CDs or T-bills, you’ll get higher yields as they mature. Medium-term bonds may dip, but if you hold them to maturity, you get your principal back. The key is not to panic-sell. Time horizon diversification gives you the flexibility to wait it out.

Does this work for retirees?

Yes-maybe even more. Retirees need income, safety, and growth. A three-bucket system works perfectly: short-term for 1-2 years of living expenses (cash), medium-term for 3-7 years (bonds, dividend stocks), and long-term for inflation protection (stocks). This is the core of the "bucket strategy" used by most financial planners for retirees.

Is time horizon diversification the same as dollar-cost averaging?

No. Dollar-cost averaging is how you invest-spreading purchases over time to reduce timing risk. Time horizon diversification is what you invest in-allocating assets based on when you need the money. You can do both. Invest regularly (dollar-cost averaging) into buckets based on your goals (time horizon diversification).

Next Steps

Start tonight. Open your brokerage account. Look at your goals. Ask yourself: When will I need this money? Then ask: Is it safe enough? If the answer is no, you’ve found your next step.

Don’t wait for the perfect moment. The perfect moment is now-when you’re aware of the risk. Time horizon diversification isn’t about predicting the market. It’s about preparing for your life. And that’s something you can start today-with whatever you have, wherever you are.

Kenny McMiller

November 15, 2025 AT 00:39Man, this whole time-horizon framework is basically just applied stoicism for your portfolio. You’re not trying to beat the market-you’re trying to outlast your own panic reflex. The real alpha isn’t in picking winners, it’s in architecting a system where your emotional bandwidth doesn’t get liquidated during a 15% dip. That 60-25-15 split? It’s not a recommendation, it’s a behavioral firewall. Most people think diversification is about asset classes. Nah. It’s about time. And time, unlike volatility, is the one thing you can’t borrow back.

Also, the IRS calling anything over a year ‘long-term’ is like calling a puddle an ocean because it’s wetter than a teaspoon. Tax terminology is the financial world’s version of corporate buzzword bingo. Don’t let bureaucrats redefine your life goals.

And let’s be real-your emergency fund shouldn’t be in a 3-year CD locked at 3.8% while new ones are at 6.5%. That’s not investing. That’s financial Stockholm syndrome.

Stop treating money like a game of chance. Treat it like a garden. You don’t plant oaks next to lettuce and expect both to thrive. Same principle. Different soil.

Dave McPherson

November 15, 2025 AT 13:42Ugh. Another ‘bucket strategy’ post that sounds like a finance TikTok script written by a CPA who just got out of a TEDx talk. Let me guess-you also think ‘dollar-cost averaging’ is a revolutionary concept and that Vanguard ETFs are the holy grail of wealth?

Here’s the truth: if you need a 60-25-15 rule to invest, you shouldn’t be investing at all. You’re just delaying your inevitable meltdown with fancy labels. The market doesn’t care if your ‘medium-term bucket’ is in BND or BIL. It laughs at your spreadsheets.

And don’t get me started on ‘rebalancing once a year.’ That’s like brushing your teeth once every 11 months and calling it ‘oral hygiene.’ You’re not managing risk-you’re performing financial cosplay.

Real wealth? It’s not in buckets. It’s in asymmetric bets, concentrated positions, and the courage to go all-in when everyone else is hiding under their desks. But sure, keep your T-bills and your ‘peace of mind.’ I’ll be over here compounding at 20% annually while you’re checking your ‘Emergency Fund’ balance like it’s a lottery ticket.

Julia Czinna

November 16, 2025 AT 16:22I appreciate how grounded this is. So many investment guides feel like they’re selling a fantasy, but this actually acknowledges real life-broken furnaces, surprise medical bills, kids needing braces. It’s rare to see advice that doesn’t assume you’re already wealthy or have a financial advisor on speed dial.

I’ve been using the three-bucket approach since last year, and it’s changed everything. I used to panic every time the market dipped, even though my retirement money wasn’t touched. Now I know exactly where to pull from if something comes up. No stress. No selling low.

The part about horizon creep really hit home. I did exactly that-moved money meant for a car down payment into stocks because ‘the market’s doing so well.’ Lost sleep over it. Now I’ve locked that portion in a short-term CD. Peace restored.

Also, thank you for calling out the tax trap. I didn’t realize rebalancing could trigger capital gains. That’s the kind of detail that makes all the difference.

It’s not glamorous. But it works. And sometimes, that’s enough.

Laura W

November 18, 2025 AT 12:27