BNPL Late Fee Calculator

How This Works

BNPL late fees vary significantly by provider and state. This calculator shows potential costs based on:

- New York's strict regulations (1/1/2026)

- Uncapped fees in other states

- The 33% of users who weren't aware of late fees

Enter your details to see potential costs

When you click "Buy Now, Pay Later" at checkout, it feels simple. No credit check. No interest. Just four payments. But what happens when the shoes don’t fit, the item never arrives, or you miss a payment because you didn’t realize there was a fee? That’s where things get messy. In 2025, consumer protection for BNPL services is in chaos - not because the technology is broken, but because the rules changed overnight.

What Changed in BNPL Regulation in 2025?

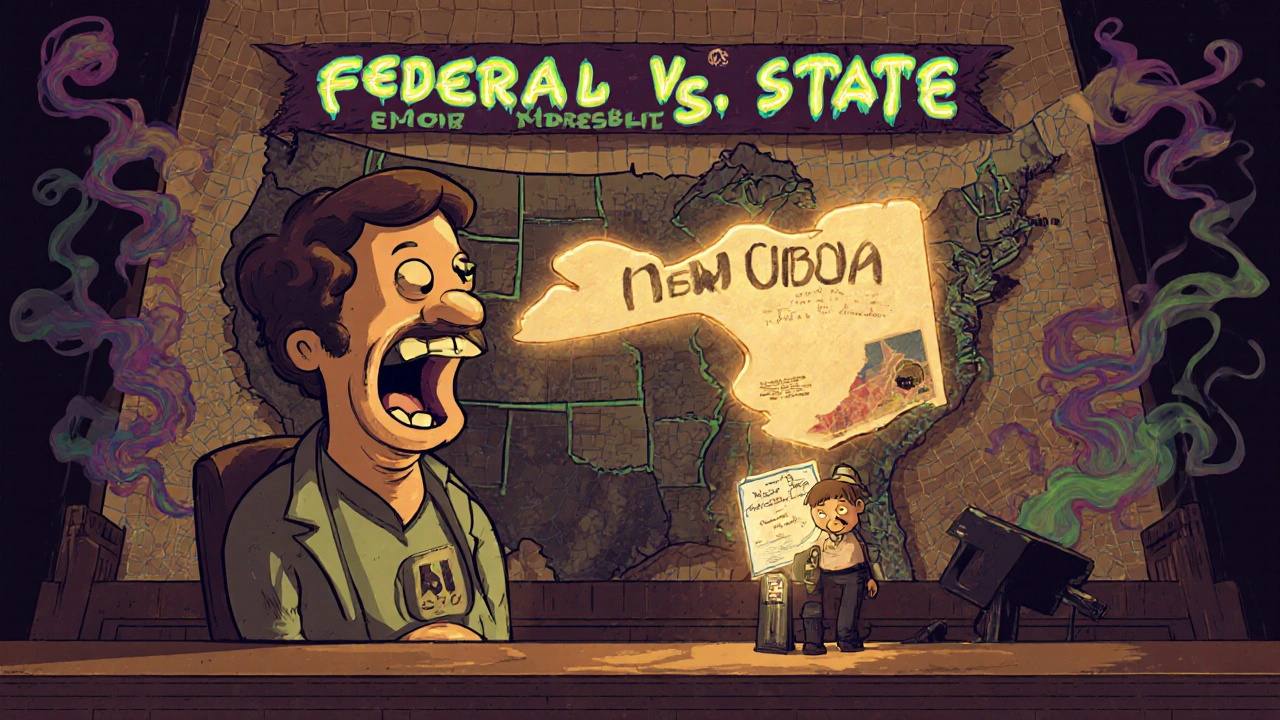

Just a year ago, the Consumer Financial Protection Bureau (CFPB) said BNPL companies had to follow the same rules as credit card issuers. That meant clear billing statements, 30-day dispute windows, and refunds within 7 days if you returned an item. It sounded like a win for shoppers. Then, on November 2, 2025, the CFPB reversed course. They announced they were dropping enforcement of those rules. No more federal oversight. No more mandatory dispute processes. No more standardized fee disclosures. The agency shifted focus to cases with "identifiable victims" - like outright fraud - and stopped treating BNPL as credit. This wasn’t a technical adjustment. It was a full retreat. And it left millions of Americans wondering: Who’s protecting me now?New York Leads the Way - But Only for New Yorkers

While the federal government stepped back, New York stepped up. On May 9, 2025, Governor Kathy Hochul signed the New York Buy-Now-Pay-Later Act - the first state law in the U.S. to treat BNPL like real credit. Starting January 1, 2026, every BNPL provider operating in New York must get a license from the state’s Department of Financial Services (NYDFS). That’s not optional. No license? No business in New York. The law requires real transparency:- Clear display of all fees - including late fees - before you check out

- Disclosure of the APR equivalent, even if there’s "no interest"

- Written acknowledgment of complaints within 5 business days

- Resolution of disputes within 60 days

- Refunds processed within 7 days of merchant confirmation

How BNPL Providers Are Handling the Mess

Big players like Affirm and Afterpay already had systems in place that matched the old CFPB rules. Affirm’s 2025 investor report showed they resolved 87% of disputes within 14 days - faster than many credit card companies. They didn’t need to scramble. Smaller providers? Not so lucky. A July 2025 Deloitte study found that full compliance with federal rules would cost $2.8 million per company annually. Many couldn’t afford it. Now, with federal rules gone, some are cutting corners. Customer service lines are longer. Dispute forms are harder to find. Some still don’t refund you until the merchant pays them - even if the merchant says you’re entitled to it. Reddit user u/ThriftyShop89 shared their story in August 2025: They returned shoes to Nordstrom. Nordstrom approved the refund. Afterpay took 21 days to process it. In the meantime, they missed a payment and got hit with a $10 late fee. No explanation. No apology. Just a charge. That’s not rare. The CFPB’s 2025 report found that 41% of BNPL users had trouble getting disputes resolved. And 33% were hit with late fees they didn’t know existed.

What You’re Not Being Told About Fees

"No interest" sounds great. But BNPL isn’t free. It’s just hidden. Most providers charge late fees - but they don’t always say how much. Some charge $5. Others charge $10. A few charge $15. And if you miss a second payment? That’s another fee. And another. Some providers cap fees at $15 per month. Others don’t cap them at all. And here’s the kicker: The APR equivalent - the real cost of borrowing - is rarely shown. New York’s law forces it. Everywhere else? It’s optional. A 2025 CFPB survey found that 68% of users were confused about what fees they might owe. That’s not confusion - that’s design. Even "no credit check" is misleading. BNPL companies still check your credit - just not the same way banks do. They use alternative data: your shopping habits, device info, even how fast you type during checkout. That data gets sold. And if you default? It can still show up on your credit report.Why Support Is So Bad (And How to Get Help)

Customer service for BNPL is notoriously slow. The CFPB found that 68% of users rated BNPL support as "fair" or "poor." Compare that to 42% for traditional credit cards. Why? Because most BNPL companies treat support as a cost center, not a priority. Their apps are built for speed - not service. If you need help, you’re often stuck in chatbots or redirected to a help center with 100 pages of legalese. Here’s what actually works:- Save every email from the merchant and BNPL provider - especially confirmation of returns.

- Submit disputes in writing, not just through the app. Email is better than a form.

- If you’re in New York, file a complaint with NYDFS. They respond.

- If you’re elsewhere, file a complaint with the CFPB anyway. Even without enforcement, complaints build public pressure.

- Call your bank. Some banks can reverse BNPL charges as unauthorized transactions if you can prove fraud or non-delivery.

What’s Coming Next

New York’s law is a blueprint. At least 17 states introduced BNPL bills in 2025. California, Illinois, and Texas are expected to pass similar laws in 2026. Each will be slightly different. California’s proposed AB 1867 would require disclosures in Spanish and other languages. Texas might cap late fees at $10. The result? A patchwork. Your rights depend on your zip code. A shopper in New York has more protection than a shopper in Georgia. But both are using the same app. Industry groups are fighting back. The Electronic Transactions Association has sued New York, claiming state law conflicts with federal authority. A decision is expected by March 2026. If they win, New York’s law could be overturned. If they lose? More states will follow.What You Should Do Right Now

1. Know your state’s rules. If you live in New York, you’re covered. If not, assume you’re not. 2. Read the fine print - even if it’s boring. Look for "late fee," "default," and "refund policy." If it’s not there, ask. 3. Don’t use BNPL for things you can’t afford to pay for in full. The 12.7% spending increase BNPL causes isn’t magic - it’s psychology. 4. Use BNPL only with trusted merchants. If the merchant won’t refund you, the BNPL company has no obligation to either. 5. Track your payments. Set calendar alerts. Miss one payment, and you might owe $10 - and damage your credit. BNPL isn’t evil. It’s just unregulated. And in a world where rules are changing faster than apps update, the only real protection you have is knowledge.Are BNPL services safe to use in 2025?

BNPL is safe if you understand the risks. The lack of federal oversight means protections vary by state. In New York, you have strong rights. Elsewhere, you’re on your own. Always read the terms, track your payments, and never use BNPL for purchases you can’t afford to pay back.

Do I have the same rights as a credit card user with BNPL?

Only if you live in New York. Under the state’s new law, BNPL providers must offer dispute rights, refund timelines, and fee disclosures similar to credit cards. In other states, you have no guaranteed rights. Many BNPL providers don’t offer chargebacks, and some don’t refund you even if the merchant does.

Can BNPL hurt my credit score?

Yes. While most BNPL providers don’t run hard credit checks to approve you, many report missed payments to credit bureaus. A single late payment can drop your score by 50-100 points. And if you default, it can stay on your report for up to seven years.

What should I do if I get charged a late fee I didn’t know about?

First, check your original agreement. If the fee wasn’t clearly disclosed before checkout, you may have grounds to dispute it. File a complaint with the BNPL provider in writing. If you’re in New York, file with NYDFS. If not, file with the CFPB. Keep records of all communication. Some providers will waive the fee if you ask politely and show you’ve been a good customer.

Is there a way to avoid BNPL fees entirely?

Yes. Pay on time. Most BNPL providers charge fees only if you miss a payment. If you set up automatic payments or calendar reminders, you can avoid fees completely. Also, look for BNPL offers that truly have no fees - not just "no interest." Some merchants offer fee-free BNPL as a promotion. Read the fine print to confirm.

Laura W

November 5, 2025 AT 07:01Okay but let’s be real - BNPL is just credit with a cute filter. They don’t do credit checks? Cool. Then why does my app know I bought 3 pairs of sneakers in 2 weeks? They’re tracking my typing speed, my device ID, my damn coffee order history. And if I miss a payment? Boom - credit report. No warning. No grace period. Just a silent slap in the face. New York’s law is the only thing keeping these companies from turning into digital loan sharks. If you’re not in NY? You’re basically signing a contract written in invisible ink.

And don’t even get me started on the ‘no interest’ lie. APR is still a thing, folks. Just buried under 12 layers of ‘terms and conditions’ you’ll never read. I once got hit with $45 in late fees across 3 different apps because I thought ‘4 payments’ meant ‘no deadlines’. Spoiler: it meant ‘pay on exact dates or pay more’.

Save your receipts. Email everything. Don’t trust the app. And if you’re in NY? File with NYDFS. They actually respond. Elsewhere? You’re on your own. But at least you know now.

Stop treating BNPL like free money. It’s not. It’s just expensive, sneaky money.

Graeme C

November 7, 2025 AT 05:03Let me be blunt: this regulatory chaos is a disgrace. The CFPB didn’t ‘step back’ - they surrendered. And now we have a patchwork quilt of consumer rights where your protection depends on whether you live in a state with a governor who gives a damn. New York’s law is not ‘progress’ - it’s a baseline. The fact that it’s even necessary proves how utterly broken the system was.

These BNPL firms are financial predators with UX designers. They weaponize convenience. They bury fees in microcopy. They make ‘no interest’ the new ‘no credit check’ - a psychological trap. And when you get screwed? Their chatbot says ‘please visit our help center’ - which is just a 300-page PDF titled ‘How to Lose Your Money Legally’.

Meanwhile, in the UK, the FCA is already moving to classify BNPL as credit. Why? Because they don’t tolerate financial sleight-of-hand. The US is falling behind. Not because of tech - because of cowardice. If you’re reading this and you’re not in New York? You’re being exploited. And the system knows it.

Astha Mishra

November 7, 2025 AT 21:42It is interesting to think, in a very deep and philosophical way, about how convenience has become the new currency of modern life - and how easily we trade our financial safety for the illusion of ease. BNPL is not just a payment method; it is a mirror reflecting our collective desire to postpone consequences, to live in the now without accounting for the future.

I come from India, where informal credit has always existed - the local shopkeeper who lets you pay next week, the auntie who lends you money for a wedding with no paperwork. But there was trust. There was community. There was accountability. Here, in the U.S., we have algorithms replacing human relationships. And algorithms do not forgive. They do not understand. They only calculate.

And yet… I still use it. Why? Because it is easy. Because the app is beautiful. Because the shoes are on sale. And so we are all complicit, in our own quiet way. The system works because we let it work. We choose not to read the fine print. We choose not to ask questions. We choose to believe ‘no interest’ means ‘no cost’.

But the cost is real. It is in our credit scores. In our sleepless nights. In the $10 fee we didn’t know we’d pay. And the only true protection is awareness - not legislation. Legislation can be overturned. But knowledge? Knowledge stays with you. Always.

So yes, New York’s law is a step. But the real change? It begins when you pause. Before you click ‘Buy Now’. You ask: Do I need this? Can I afford it? And if I can’t - why am I doing this? The answer is not in the law. It is in you.