Retirement Bucket Calculator

How the Bucket Strategy Works

This calculator helps you determine how much money to allocate to each retirement bucket based on your annual expenses and time horizon. The strategy segments your retirement funds into three buckets with different investment goals:

Your Retirement Allocation

Recommended Investments

Bucket 1: High-yield savings accounts, CDs, short-term Treasury bills (4.5%-5.25% interest)

Bucket 2: Investment-grade bonds, dividend-paying stocks, conservative mutual funds (3.5%-5.5% returns)

Bucket 3: U.S. and international stocks, REITs, growth-oriented funds (7%-10% returns)

What Is the Bucket Strategy for Retirement?

Imagine your retirement savings aren’t just one big pile of money. Instead, they’re split into three separate containers-each with a different job. That’s the bucket strategy. It’s not about picking the best investments. It’s about organizing your money so you never have to sell stocks when the market is down.

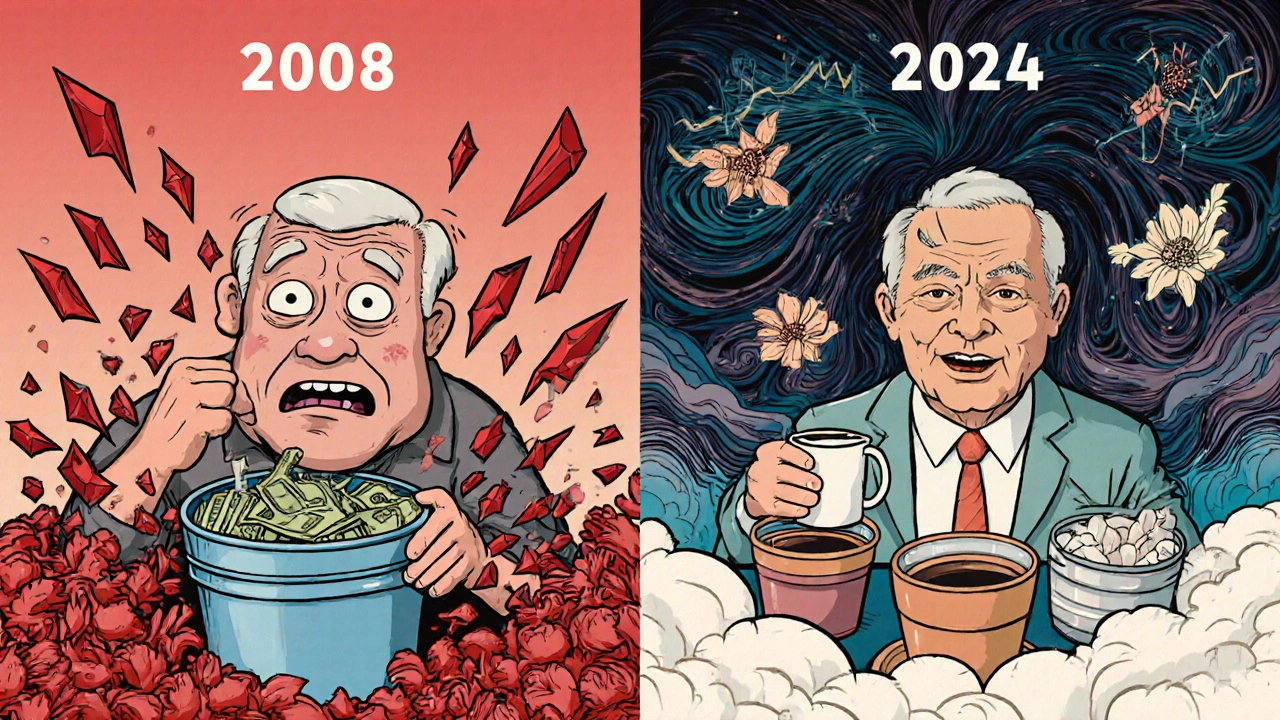

This approach was developed in the early 2000s by financial planner Harold Evensky, but it really took off after the 2008 crash. Retirees who had to sell assets at rock-bottom prices saw their portfolios shrink for good. The bucket strategy fixes that by keeping cash ready for immediate needs, so you don’t panic-sell during downturns.

Here’s how it works: you divide your retirement savings into three buckets based on when you’ll need the money. Each bucket holds different types of assets. The first bucket covers 1-4 years of living expenses and is kept safe. The second covers the next 3-10 years and balances safety with growth. The third holds your long-term growth assets-stocks, real estate, and other investments-for the next 7 to 35+ years.

Bucket 1: Your Emergency Cash Reserve (1-4 Years)

This is your safety net. You don’t touch this unless you’re paying bills. It should hold enough to cover 1-4 years of essential expenses-housing, food, healthcare, insurance. Most advisors recommend starting with 2-3 years, especially if your Social Security or pension doesn’t cover everything.

What goes in it? High-yield savings accounts, certificates of deposit (CDs), and short-term Treasury bills. As of mid-2024, these are paying between 4.5% and 5.25% interest. That’s better than inflation and way safer than stocks.

Why not keep it all in cash? Because inflation eats away at buying power. A CD ladder-where you spread your money across CDs that mature in different years-helps you lock in higher rates while keeping some liquidity. For example, put 25% in a 1-year CD, 25% in a 2-year, 25% in a 3-year, and 25% in a 4-year. When one matures, roll it into a new 4-year CD. This keeps your cash flowing without exposing you to interest rate swings.

Bucket 2: The Steady Income Layer (3-10 Years)

This bucket bridges the gap between safety and growth. It’s meant to refill Bucket 1 during market upswings and cover expenses after you’ve used up your cash reserve.

Typical holdings include investment-grade bonds, dividend-paying stocks, and conservative mutual funds. These aren’t meant to boom-they’re meant to steady the ship. Historical returns for this mix range from 3.5% to 5.5% annually, with volatility between 5% and 7%. That’s much calmer than the stock market’s typical 15%-20% swings.

For example, a portfolio of 60% intermediate-term bonds and 40% high-quality dividend stocks (like those in the S&P 500 with 2%+ yields) has historically provided reliable income without huge losses. During the 2020 market crash, retirees using this setup didn’t have to sell stocks to pay bills. They just moved money from Bucket 2 to Bucket 1.

Rebalancing happens annually. If Bucket 2 grew because the market rose, you take out what you spent from Bucket 1 and refill it. That locks in gains and keeps your risk levels in check.

Bucket 3: The Growth Engine (7-35+ Years)

This is where your money grows to outpace inflation and keep you from running out of cash later in life. It’s the longest-term part of the plan and should make up the bulk of your portfolio-usually 60% to 80%.

Holdings here are mostly equities: U.S. and international stocks, real estate investment trusts (REITs), and sometimes private equity or infrastructure funds. These assets are volatile. In bad years, they can drop 20% or more. But over 10-20 years, they’ve returned 7% to 10% annually on average.

Why keep risky assets if you’re retired? Because you might live 30 years in retirement. If you only hold cash and bonds, inflation will slowly steal your purchasing power. A 2022 study by the American College of Financial Services showed retirees using the bucket strategy had 32% higher portfolio survival rates over 30 years than those using a fixed 4% withdrawal rule.

Don’t forget to reinvest dividends and adjust for inflation. If you’re withdrawing $50,000 a year now, you’ll need about $67,000 in 10 years just to keep up with 3% inflation. Bucket 3 is what makes that possible.

How Often Should You Rebalance?

Once a year. That’s it.

Rebalancing isn’t about chasing gains. It’s about discipline. At the end of each year, check your buckets. If Bucket 1 is empty because you spent $45,000, refill it from Bucket 2. If Bucket 2 has grown because bonds or dividends paid out, move some of that excess into Bucket 1. If Bucket 3 has surged (say, stocks rose 25%), take a portion of those gains and move them into Bucket 2 to lock in the profit.

This simple rule prevents emotional decisions. You’re not selling low-you’re selling high. And you’re always keeping enough cash on hand.

Some advisors use market conditions to guide timing. Vanguard’s new “adaptive bucketing” tool, introduced in 2024, automatically adjusts Bucket 1’s size based on the CAPE ratio (a measure of stock market valuation). If stocks are expensive, it increases your cash buffer. If they’re cheap, it lets you keep more invested.

Pros and Cons of the Bucket Strategy

Let’s be real: no strategy is perfect. Here’s what works-and what doesn’t.

Why It Works

- Reduces panic selling: In 2020, retirees using buckets were 47% less likely to pull money out of stocks during the crash, according to Dimensional Fund Advisors.

- Clear mental model: People understand “this money is for next year” better than abstract portfolio values. 73% of users in SmartAsset’s 2023 survey said this made them feel more in control.

- Longer portfolio life: A 2023 meta-analysis found the bucket strategy adds 4.2 years to median portfolio longevity compared to systematic withdrawals.

Where It Falls Short

- Requires effort: You can’t set it and forget it. You need to track spending, rebalance, and adjust for inflation. Fidelity estimates it takes 15-20 extra hours a year compared to a simple withdrawal plan.

- Underperforms in bull markets: If stocks keep rising for 7+ years, a 100% equity portfolio would earn 23% more over 30 years, according to NBER data. But you’d also risk losing everything if the market crashes early.

- Hard to DIY: 41% of retirees struggle with rebalancing without help. Tools from brokerages are often basic. The best guides are from Morningstar or Bogleheads.org.

Who Should Use the Bucket Strategy?

This isn’t for everyone.

It’s ideal for retirees with $250,000 or more in savings who want control over their money and are willing to manage it. It’s especially helpful if you’re worried about market crashes, hate the idea of annuities, or want to leave something to heirs.

If you have less than $100,000 saved, the complexity might not be worth it. You’re better off with a simple withdrawal plan or an annuity.

High-net-worth retirees ($1M+) often use a modified version: 2-5-15 year buckets. The extra cushion gives more breathing room for taxes, healthcare, and long-term care costs.

And if you’re still working? Start building Bucket 1 now. Even if you’re 10 years from retirement, putting aside 1-2 years of expenses in cash-equivalents gives you a huge psychological edge when you finally retire.

Common Mistakes and How to Avoid Them

- Underfunding Bucket 1: Don’t just guess how much you’ll spend. Track your actual expenses for six months. Include taxes, insurance, and unexpected costs like car repairs or dental work.

- Ignoring inflation: Your $50,000 budget today won’t cover $50,000 in 10 years. Increase Bucket 1 by 2.5%-3% each year, matching Social Security COLA adjustments.

- Using the wrong accounts: Don’t put Bucket 1 in a Roth IRA if you’re not withdrawing yet. Use taxable accounts first. RMDs from traditional IRAs can complicate things-talk to a planner if you’re unsure.

- Rebalancing too often: Don’t move money every quarter. Once a year is enough. More frequent changes lead to emotional decisions and higher taxes.

- Using Bucket 3 as an emergency fund: If you raid your stocks for a medical bill, you break the whole system. Build a separate emergency fund outside your retirement buckets.

How to Get Started Today

- Calculate your essential annual expenses. Don’t include vacations or hobbies yet-just basics: housing, food, utilities, healthcare, insurance.

- Decide how many years to cover in Bucket 1. Start with 2-3 years if you’re unsure.

- Move that amount into high-yield savings or a CD ladder.

- Take your next 3-5 years’ worth of expenses and invest it in bonds and dividend stocks.

- Put everything else into stocks and real estate.

- Set a calendar reminder: every January 1, review your buckets and refill Bucket 1 from Bucket 2.

You don’t need a financial advisor to do this. But if you’re overwhelmed, find one who specializes in retirement income-not just investing. Ask them: “Do you use the bucket strategy with your clients?” If they say no, keep looking.

What’s Next for the Bucket Strategy?

The strategy is evolving. In 2024, Fidelity started treating Social Security as a “virtual fourth bucket”-delaying benefits to boost future income, which reduces pressure on your cash reserves. Robo-advisors like Betterment and Wealthfront now automate rebalancing. Vanguard’s adaptive buckets adjust based on market valuations.

By 2027, 65% of financial advisors plan to recommend bucket strategies as standard practice, according to the Society of Actuaries. But the core idea won’t change: protect your cash, grow your future, and never sell low.

Can I use the bucket strategy with my 401(k) or IRA?

Yes, but you need to be careful. You can’t withdraw from a 401(k) or traditional IRA without penalty before age 59½ unless you qualify for an exception. So, fund Bucket 1 from taxable accounts first. If you must use retirement accounts, prioritize withdrawals from taxable accounts, then traditional IRAs, and leave Roth IRAs for last-they grow tax-free and have no RMDs. Also, remember Required Minimum Distributions (RMDs) start at age 73. You’ll have to withdraw a set amount each year, so factor that into your Bucket 1 or 2 allocations.

What if the market crashes and my long-term bucket drops 30%?

That’s exactly what the bucket strategy is designed for. If your long-term bucket drops, you don’t touch it. You keep living off Bucket 1 and 2. You wait. Markets always recover. In 2008, the S&P 500 lost 37%. But by 2013, it had more than doubled. Retirees who sold in 2009 locked in losses. Those who held on recovered fully-and then some. The bucket strategy gives you the patience to wait.

Do I need to rebalance if my portfolio is doing well?

Yes, even if everything’s going great. Rebalancing isn’t about fixing problems-it’s about locking in gains and managing risk. If your stocks surged and now make up 90% of your portfolio instead of 70%, you’re suddenly much more exposed to a downturn. Moving some of that growth into your short-term buckets brings your risk back in line. It’s like taking profits off the table before the storm hits.

Is the bucket strategy better than an annuity?

It depends on your goals. An annuity gives you guaranteed lifetime income-you never run out of money. But you lose control. Once you buy it, you can’t access the principal. The bucket strategy keeps your money yours. You can spend it, leave it to heirs, or change your plan. If you’re worried about outliving your savings, consider a hybrid: use part of your savings to buy a Qualified Longevity Annuity Contract (QLAC) for late-life coverage, and use the bucket strategy for the rest.

How much should I have saved to make this work?

There’s no magic number, but you need enough to cover 2-4 years of expenses in cash without touching your long-term investments. Most people who use this strategy successfully have at least $250,000 saved. If you have less, focus on building a solid emergency fund and delaying Social Security. The bucket strategy shines when you have enough to be flexible-not when you’re barely scraping by.

Astha Mishra

November 7, 2025 AT 06:58The bucket strategy feels like a meditation on patience-each layer a breath, each rebalance a release. In a world obsessed with instant returns, this is radical: you don’t chase the market, you outwait it. I’ve watched friends panic-sell during dips, only to miss the rebound by months. This isn’t finance-it’s philosophy with a spreadsheet. And yet, so many reduce it to asset allocation. No. It’s about cultivating inner stillness when the numbers flash red. The CD ladder? That’s not just interest-it’s rhythm. The annual review? Ritual. You’re not managing money-you’re tending to time itself. If you can hold space for uncertainty, the market will eventually bow.

Kenny McMiller

November 7, 2025 AT 07:29Look, the bucket strategy’s just a fancy way of saying ‘don’t be dumb with your retirement.’ But let’s be real-most people don’t have the bandwidth to track CD ladders and rebalance annually. I’ve seen guys with $800k in their 401(k) who still can’t tell the difference between a TIPS and a Treasury. Vanguard’s adaptive buckets? Cool. But if you’re relying on a robo-advisor to do your emotional heavy lifting, you’re already one market crash away from a nervous breakdown. The real win here isn’t the 32% higher survival rate-it’s the fact that you stop checking your portfolio every damn hour. That’s the hidden ROI.

Dave McPherson

November 7, 2025 AT 17:00Oh wow. Another sanctimonious blog post pretending this is some revolutionary insight. The bucket strategy? That’s 2009-era advice dressed up with Bloomberg charts and a pat on the back for ‘discipline.’ Let’s not pretend this isn’t just a glorified 60/40 portfolio with extra steps. And don’t get me started on the ‘psychological edge’ nonsense-people who need a three-bucket system to not cry when the S&P drops 5% probably shouldn’t be retired anyway. Meanwhile, the 100% equity guy who held through 2008 and 2020? He’s sipping margaritas in Bali while you’re recalculating your CD maturity dates. This isn’t wisdom-it’s financial cosplay for people who think ‘rebalancing’ is a yoga pose.