Cash Sweep Rate Calculator

How This Works

Calculate the difference between your current broker's cash sweep rate and top-tier rates. See exactly how much you're losing each year due to low interest rates.

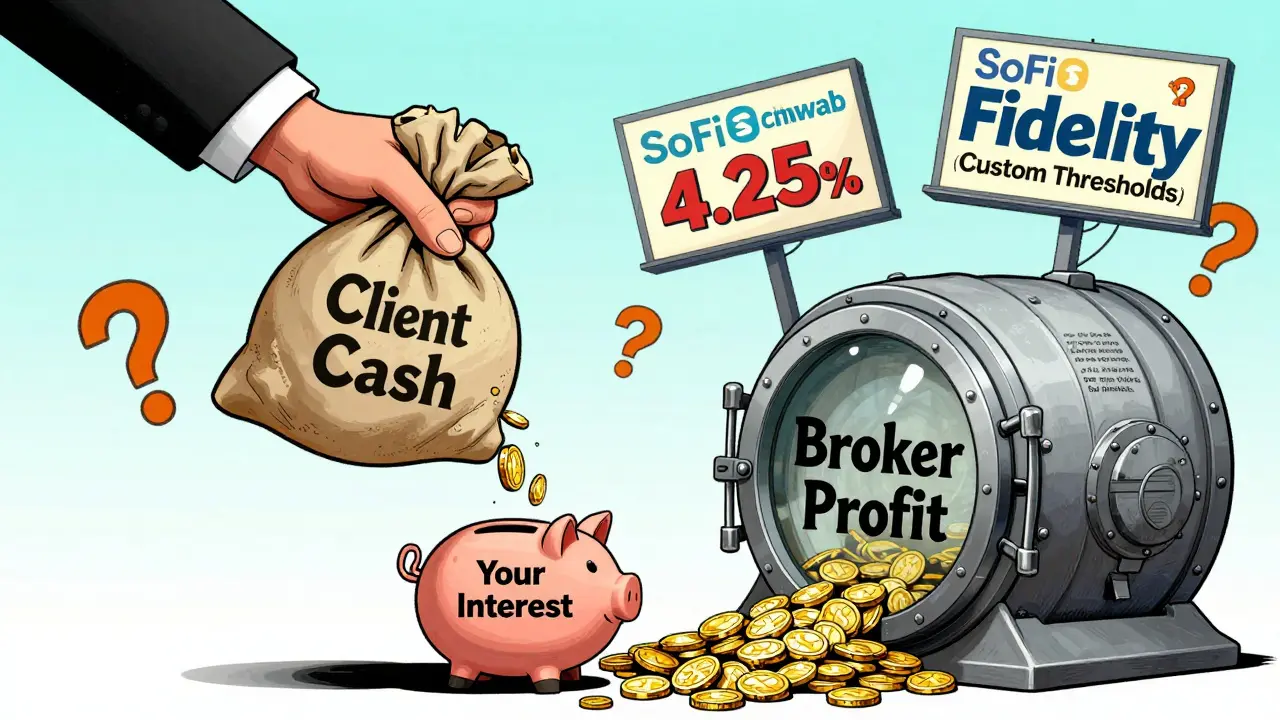

When you invest through a brokerage, your uninvested cash doesn’t just sit there earning nothing. Thanks to broker cash sweep programs, that money gets automatically moved into interest-bearing accounts - but not all programs are created equal. Some pay you 4.25% APY. Others pay 0.01%. And the difference between them could cost you hundreds - or even thousands - of dollars a year. What you might think is a simple, safe place to hold cash is actually a complex system with hidden fees, multi-bank insurance tricks, and big gaps in transparency.

How Broker Cash Sweeps Actually Work

Every time you deposit money into a brokerage account and don’t immediately invest it - whether it’s from a paycheck, a dividend payout, or selling a stock - that cash sits idle. Without a sweep program, it earns zero interest. But most brokers now automatically move that cash into one of two types of accounts: a money market fund or an FDIC-insured bank deposit account. This is called a sweep program.

The goal? Keep your cash safe, liquid, and earning something. But here’s the catch: the broker doesn’t just pass along whatever interest the bank pays. They keep a chunk of it. In 2023, when the Federal Reserve raised rates to 5.25%, some firms were keeping 90% of the interest earned. That means if your cash earned 5% at the bank, you might have only seen 0.5%. That’s not a bug - it’s a business model.

FDIC Coverage: The Real Safety Net

The FDIC only insures up to $250,000 per person, per bank. If you have $1 million in cash with a broker, and it’s all swept into one bank, only $250,000 is protected. So how do brokers claim they offer $2.5 million in coverage? They spread your cash across dozens of partner banks.

MassMutual’s Advantage Cash Sweep, for example, splits your money into $250,000 chunks and places each into a different FDIC-insured bank. That means a $2.5 million balance gets full coverage. Joint accounts can reach $5 million. It’s clever, but it’s not magic. If you withdraw more than $250,000 at once, the broker has to pull funds from multiple banks. That can take 2-3 business days. You might think your cash is as liquid as a checking account - but it’s not always that simple.

Interest Rates: The Wild West

Rate differences between brokers are insane. In December 2024, SoFi was paying 4.25% APY on its sweep program. Charles Schwab? 0.01%. That’s a 424x difference. On $50,000, that’s $2,125 vs. $5 - a $2,120 gap in just one year.

Why such a gap? Some brokers use sweep programs as profit centers. Schwab, Morgan Stanley, and Bank of America historically offered low rates while charging higher fees elsewhere. Meanwhile, newer players like SoFi and MassMutual compete on yield. SoFi even launched a Rate Match Guarantee in January 2025 - promise to match competitors’ rates plus 0.10%. That’s a direct challenge to the old guard.

But here’s what most people don’t realize: the advertised rate isn’t always what you get. Some programs adjust daily. Others change without notice. BOK Financial Securities says it can alter terms with just 30 days’ notice. If you’re not checking your account monthly, you could be earning far less than you think.

Who Benefits? Who Gets Left Behind

MassMutual, SoFi, and Fidelity are leading the pack in both yield and transparency. MassMutual offers up to $5 million in FDIC coverage. SoFi’s 4.25% rate is among the highest. Fidelity lets you set custom sweep thresholds if you have over $250,000 - so you can keep more cash in higher-yielding options.

But if you’re with Charles Schwab, Morgan Stanley, or Bank of America, you’re likely getting the worst deal. Schwab’s program has been hit with class-action lawsuits over suppressed rates. Morgan Stanley’s premium sweep requires $1 million in assets - locking out everyday investors. Bank of America’s top rate of 4.75% APY? Only for their highest-tier Preferred Rewards members.

According to a January 2025 survey of 850 financial advisors, 73% recommend clients keep their cash in a separate high-yield savings account instead of relying on brokerage sweeps. Why? Because even the best sweep programs often lag behind standalone banks like Ally or Marcus, which offer 4.5%+ with no strings attached.

The Hidden Cost: What Brokers Keep

Dr. Karen Petrou of Federal Financial Analytics called cash sweep programs a “$15 billion annual hidden fee stream” in testimony before Congress in September 2024. How? By paying banks a lower rate than what they charge clients. If a bank pays 4% to the broker, but the broker tells you it’s only paying 0.5%, the broker pockets 3.5%. Multiply that by $2.3 trillion in swept cash - and you get billions.

The SEC issued a Risk Alert in August 2024 warning brokers of “inadequate disclosures” about how much interest they retain. Some firms never even tell you the rate. Others bury it in fine print. A 27,000-signature petition on Change.org in late 2024 demanded full transparency - and it’s working. The SEC’s proposed Regulation Best Execution, published in December 2024, could force brokers to prove they’re offering “market-competitive rates.” If it passes, expect rates to jump across the board.

What You Should Do Right Now

Don’t assume your broker’s default sweep is the best option. Here’s what to do:

- Check your current rate. Log in. Look for the “Cash Sweep” or “Idle Cash” section. If it’s below 3%, you’re being underpaid.

- Compare coverage. If you have more than $250,000 in cash, confirm whether your broker uses multi-bank FDIC aggregation. If not, you’re risking uninsured funds.

- Consider switching. SoFi, MassMutual, and Fidelity offer top-tier rates and coverage. If you’re with Schwab or Morgan Stanley, moving your cash could add hundreds to your annual earnings.

- Watch for changes. Brokers can change rates with 30 days’ notice. Set a monthly reminder to check your account.

And if you’re serious about maximizing cash returns? Keep your emergency fund in a standalone high-yield savings account. Use your brokerage sweep for convenience and insurance - not yield.

What’s Next for Cash Sweeps?

The FDIC launched a pilot program on January 7, 2025, that lets you verify multi-bank coverage in real time. That’s a big deal. Right now, you have to trust your broker that your money is spread across banks. Soon, you might be able to see exactly where each $250,000 chunk landed.

MassMutual raised its rate to 4.50% APY on February 1, 2025. SoFi’s Rate Match Guarantee is forcing others to respond. Expect more brokers to raise rates - or risk losing customers.

But here’s the real question: will regulators force brokers to give you the full rate? Or will they just make the system more complicated? The answer will shape how millions of investors manage their cash for years to come.

Are broker cash sweep programs safe?

Yes - but only if your cash is properly distributed across multiple FDIC-insured banks. If your broker sweeps funds into a single bank and you have more than $250,000, the excess isn’t protected. Always confirm whether your broker uses multi-bank aggregation for full coverage.

Why do some brokers pay such low interest rates?

Many brokers use sweep programs as a revenue source. They earn interest from banks and pay only a fraction to clients. For example, if a bank pays 4% to the broker, the client might get 0.5%. The rest is kept as profit. This practice has led to multiple class-action lawsuits.

Can I opt out of a cash sweep program?

Yes. Most brokers automatically enroll you, but you can opt out within 10 business days of opening your account - as required by FINRA Rule 2111. If you don’t opt out, your cash will continue to be swept. You can usually change your sweep preference later in your account settings.

Do I pay taxes on interest earned from cash sweeps?

Yes. Any interest earned from a cash sweep program is taxable as ordinary income. Brokers will send you a 1099-INT form at the end of the year if you earn more than $10 in interest. It’s reported the same way as interest from a savings account.

Is it better to use a cash sweep or a high-yield savings account?

For most people, a standalone high-yield savings account offers better rates, clearer terms, and faster access. Cash sweeps are convenient for holding cash tied to your investments, but they rarely beat the best savings accounts. Use sweeps for liquidity and FDIC coverage - not for maximizing yield.

What happens if my broker’s partner bank fails?

Nothing - if your broker uses multi-bank sweeps. Since your cash is spread across dozens of banks, each holding under $250,000, the failure of one bank won’t affect your total coverage. The FDIC handles payouts per bank, so you’d still be fully protected as long as no single bank held more than the limit.